Surprising Things Americans Spend Their Money On

In 2024, consumer spending accounted for approximately 70% of the US economy. Americans divided their spending between non-essential goods and the essentials they needed to live their everyday lives. But some things Americans spend their money on may surprise you.

A Dramatic Increase In The Cost Of Housing

It’s worth noting that the cost of housing has increased dramatically since 2021, at 12.4%, outpacing inflation. Of course, the most expensive places in the US have only gotten more expensive, with states like California and Washington leading the way.

Will Buckner, CC BY 2.0, Wikimedia Commons

Will Buckner, CC BY 2.0, Wikimedia Commons

Out Of Town Trips Dramatically Increased Post-Pandemic

Whether it was post-pandemic fatigue or just a yearning to get out more, in 2022, “other lodging” expenditures increased the most as a percentage: 30.9% within the overall “Housing” sphere. Lodging costs for out-of-town trips increased by 38.9% in 2022.

American’s Salaries Are Growing, Too

Despite the extraordinary increases in the cost of living post-pandemic, Americans' salaries keep up. In the last two years, they have grown from an average of $87,432 to $101,805. As Americans look for new employment opportunities, with or without a college degree, they’re expecting to be paid more.

Transportation Costs Are The Next Highest Expenditure

Although transportation costs decreased by 3.5% from 2022 to 2023, this did not significantly reduce the transportation expenditures of everyday Americans. Rural Americans spent 17% of their annual income (after taxes) on transportation, while urban dwellers spent just 14.6%.

The Cost Of Gas Was America’s Highest Transportation-Related Expenditure

Unless you own an electric vehicle, the cost of gas in 2024 was likely enough to bring you to tears. You weren’t alone in that—gasoline and other fuel costs rose by 45.3%, a staggering increase that directly impacted American families.

Public Transportation Use Increased Dramatically

The use of public transportation in urban areas saw a shocking increase of over 65%, most likely because of the cost of gas, with Americans much preferring to use public transport than run down their gas tank in rush hour traffic.

Personal Insurance & Pension Contributions Went Up

Maybe Americans are being more considerate of their work-life balance or are just looking further ahead these days, because personal insurance and pension contributions saw a dramatic increase of 11.1% to both Social Security and pensions, meanwhile life and other personal insurances went up by 9.7%.

Let's Talk Food

A stunning 37% of American households experienced food insecurity in 2024, but food at home only accounted for 7.8% of Americans' annual expenses, while eating out made up 5.1%. Seemingly, this shows that Americans are eating out far less than they did post-pandemic, as the increase in prices from the grocery aisles to local restaurants has had a cooling effect.

How Much Did Food Increase In 2024?

The cost of food increased by 3.1% last year. Eggs increased 8.5% in price, mostly due to the avian influenza outbreak, while beef and veal went up by 5.4%, and sugar and sweet foods increased 3%. "Eggflation", as it was known, probably had many Americans asking how much it would cost to own chickens.

What About Healthcare?

Perhaps one of the most unsurprising costs that Americans have is healthcare. It's no secret that the for-profit healthcare system in the US leads to higher overall costs for Americans. In 2024, American healthcare premiums were $8,591 for a single individual, an increase of 6% on 2023's costs. The US Government spent over $4.87 trillion on Americans' healthcare in 2024, more than any other developed nation.

How Much Are Americans Spending On Their Education Annually?

Education is the key to a well-informed populace, as they say. Well, Americans definitely pay for their education in spades, with a four-year in-state education costing $11,260, while an out-of-state education costs $29,150. Private colleges, meanwhile, cost $41,450 per year, and increased by 4% last year.

What About Unexpected Expenses?

You might say, "But none of those expenses are unexpected: we all have to eat, drive/commute to work, rent/own a home, and have costs associated with our healthcare and education!" Fair enough, but what about those unexpected expenses? The ones that pop up when you least expect them? Let's go over some of the most common unexpected expenses Americans' face—and how you can be better prepared for them.

Car Repairs

We've all been there: You're driving to work one day and suddenly there's an irritating noise coming from your car, or it starts to shudder, or worse—the dashboard lights up like a Christmas tree. While the average cost of a car repair may only be $500-$600, as many as one in three Americans don't have that extra $500 to spare.

How Much Should I Set Aside For Car Repairs?

If you can, set aside about $600 to $700 for car repairs. If you're involved in an accident, you won't have to worry about most of the costs, but that doesn't account for any negative knock-on effects from time spent recuperating, or having to go on unpaid leave/collect employment insurance. This can come from your $1,000 emergency fund.

Healthcare Costs

Sure, health insurance will cover some of the cost of your health emergency, but maybe the insurance company decides to dispute a portion of that payment, or has recently changed its policy and no longer covers the thing you thought it would. Unexpected healthcare costs can range from hundreds to thousands of dollars out-of-pocket, despite your deductible coverages.

Healthcare Costs (Cont'd)

To reduce these overall healthcare costs, many Americans rely on their work to provide health insurance. Usually, this comes in the form of dental, prescription medication, and other health-related costs. While 72% of private industry workers did have healthcare through their job—a Gallup poll in 2021 stated that 1 in 6 Americans stay in a job they don't like because of the healthcare benefits.

How Much Should I Set Aside For Healthcare Costs?

This one is really tricky to gauge, because you'll only know your final bill once you leave the hospital. But the average American spends $14,570 per year on healthcare. Of course, setting aside $14K isn't happening for most Americans, but it's a good idea to work out what your overall expenses for healthcare are annually and then budget out how much you could put away to help with those costs.

The Vet

Of course, nobody likes to take their pets to the vet, where even simple procedures or diagnostics can run into the hundreds of dollars, let alone any other continuing care costs like special food or medications. It's even worse in an emergency, with the average emergency vet bill of $1,500—very few people have that amount of cash kicking around.

What About Pet Insurance?

Of course, having pet insurance is a huge plus when it comes to emergency vet bills (or any veterinary expenses at all), but fewer than 6% of Americans have pet insurance of any kind. Now, the cost of pet insurance will depend on the kind of pet you own, but the average in 2024 was $56/month for dogs and $29/month for cats. However, cats make up for that reduced fee by knocking off expensive items from high places.

How Much Should I Set Aside For Vet Bills?

While vet bills will (hopefully) be few and far between for your furry friend and you, it's worth setting aside at least $1,500 for any emergency vet costs you may incur. Really, you should aim to set aside about $2,000.

Unexpected Home Repairs

The roof leak, the burst water pipe, the broken window: All of these are unexpected home repairs that aren't always covered under your homeowner's insurance, so it's important to set aside some money to cover these expenses that can crop up from time to time.

How Much Should I Set Aside For Home Repairs?

Depending on what breaks and whether or not your homeowner's insurance will pay all or part of your repair, you should probably set aside between 1% and 4% of your home's overall value for repairs and maintenance. The average value of an American home in Q4 2024 was $419,000. On average, that means a repair fund of between $5,000 and $10,000.

What About Small Loans?

Small loans, such as payday loans, are one way to tackle a financial emergency—unfortunately, they're also a fantastic way to get into debt quickly. This is due to the mountain of additional fees that payday loan operators will stack on top of the original loan that was borrowed. The average borrower will spend $520 in fees from an original loan of $375.00.

What About My Emergency Fund?

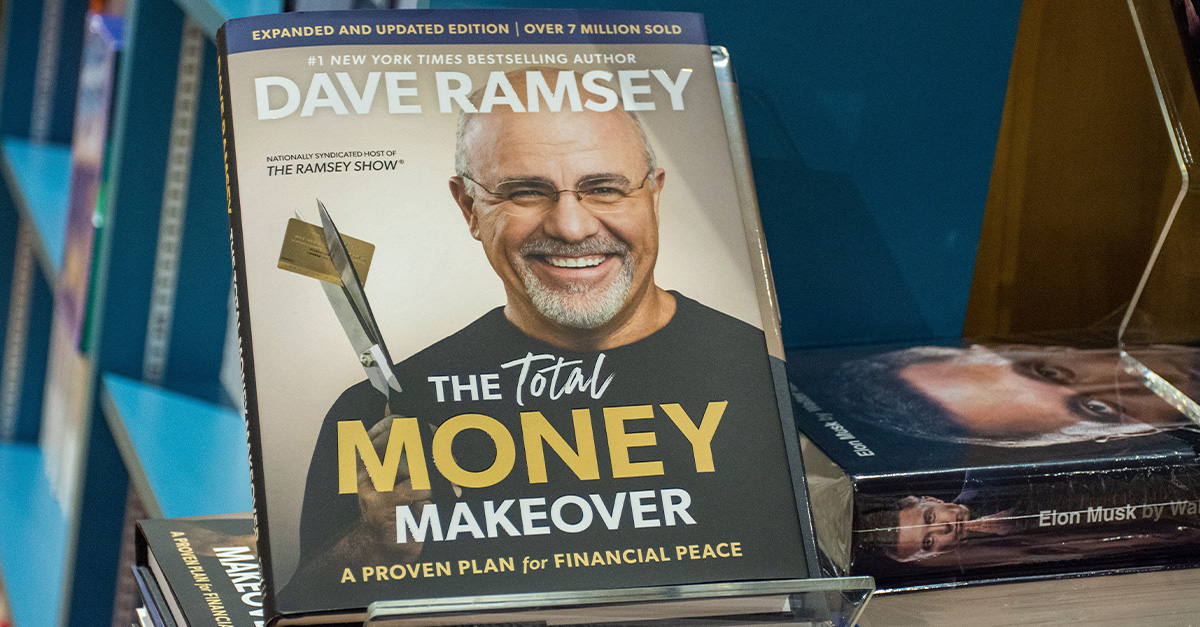

Building an emergency fund is a critical part of your financial wellbeing. Many finance experts will tout a three to six month emergency fund as "optimal". But what if you don't have the cash set aside for that length of time? Then, start off small: the minimum emergency fund recommendation is $1,000. This will cover that broken window, car repair, or some other unexpected expense.

More Than Half Of Americans Don't Have A $1,000 Emergency Fund

One of the cardinal rules offered by most financial gurus is that you should have a minimum emergency fund of $1,000. This is to cover any unexpected expense like the above-mentioned car repairs, medical bills, etc. However, recent surveys indicate that more than half of Americans aren't able to save anything every month to even begin to contribute small amounts to that emergency savings goal of $1,000.

You May Also Like:

Inside The Extraordinary Wealth Of The House Of Saud

Want To Buy A House? These Are The Cheapest And Most Expensive States—According To Data

Tips To Survive On A $2000 Budget

Vitalii Vodolazskyi, Shutterstock

Vitalii Vodolazskyi, Shutterstock

Sources: