Retirement Milestones: How Much to Save and When

Retirement can be a scary thought. Finance, in general, is reported among the top significant sources of stress for Americans.

For many people, retirement is a more worrisome thought than end of life. Like most fears, much of it is driven by uncertainty. Research has found that many people simply don’t know how much they’ll receive come retirement, and thus, how much they need to save.

This article helps break down the savings process into smaller chunks so that saving for retirement is less of a daunting process for the average American.

Setting Retirement Goals

The average amount of retirement savings you should have varies by your age and income. It isn’t exact as it is difficult to determine how much you’ll earn at each stage. But, having these goals can help keep you in check as you go.

As always, these financial goals are suggestions and can be tweaked to support your own personal plan. Andrey_Popov, Shutterstock

Andrey_Popov, Shutterstock

Average Retirement Savings by Age

According to the Federal Reserve, “Average retirement savings in 2019 ranged from $30,170 for those under 35 to $426,070 for those aged 65 to 74”

However, we all know that looking at the “average savings” of others isn’t the most helpful considering income varies across the country.

The median—the middle number of any given set of data—is a more practical number when looking at data like this. Referring to the median helps reduce the influence of those with “unusually large retirement savings”.

So, to put it into perspective, the median retirement savings for people under 35 is $13,000, the median for people aged 65 to 74 is $164,000.

Age Guidelines: By Age 30

There are many thoughts on how to save for retirement, this is Fidelity’s recommendations, which bases savings on your income, rather than on a foxed numerical goal.

By age 30, you should have the equivalent of your current annual salary saved. If you earn $50,000, you should have $50,000 saved for retirement at this age. Andrey_Popov, Shutterstock

Andrey_Popov, Shutterstock

Age Guidelines: By Age 40

According to Fidelity, by age 40, you should have three times your annual salary saved. If you now earn $60,000, you're on track if you have $180,000 saved for retirement by 40. Andrey_Popov, Shutterstock

Andrey_Popov, Shutterstock

Age Guidelines: Age 45-55

Following Fidelity’s recommendations:

By age 45: Have four times your annual salary saved.

By age 50: Have six times your annual salary saved.

By age 55: Have seven times your annual salary saved. Romolo Tavani, Shutterstock

Romolo Tavani, Shutterstock

Age Guidelines: Age 60-67

And finally, by age 60, Fidelity estimates that you should have eight times your annual salary saved, and by age 67 you should have 10 times your annual salary saved.

This sounds like a lot. So how are these numbers determined, and how can we possibly make this happen? fizkes, Shutterstock

fizkes, Shutterstock

Retirement Savings Calculations

Fidelity calculates that it is “best to save enough to cover 45% of your gross preretirement income per year, since the rest of your income in retirement will likely come from Social Security.”

However, many things can affect this goal, such as the age you plan to retire and the kind of lifestyle you want upon retirement.

Also, not everyone will reach these goals. Life happens, and your ability to save will vary depending on your lifestyle. This guideline is simply that—a guide to help keep you in check.

So, how can we expect to meet these goals? Monthira, Shutterstock

Monthira, Shutterstock

How to Save for Retirement

Fidelity's guidelines assume that “an individual has saved 15% of their annual income every year since age 25 and that they invest more than 50% of their retirement savings in stocks.”

Saving as early as possible is the best way to take advantage of compound interest.

There are many types of accounts where you can save and invest for retirement, such as: a 401(k) or 403(b), a traditional IRA, a Roth IRA, a Brokerage Account, and Social Security.

Let’s explore the options in further depth. Sutthiphong Chandaeng, Shutterstock

Sutthiphong Chandaeng, Shutterstock

401(k) or 403(b)

A 401(k) is a retirement account sponsored by an employer that allows you to contribute directly from your paycheck. If you work at a nonprofit or a public school, for example, it's called a 403(b).

A 401(k) will require you to pay income tax when you withdraw in retirement since contributions are made before they are taxed. But a Roth 401(k) includes contributions that have already been taxed, so you can withdraw money in retirement tax-free.

Many companies with offer to match employee contributions to a 401(k). Some small business offer their own version called a SIMPLE 401(k) plan, and self employed people can open a Solo 401(k).

You can start withdrawing money, penalty-free, with a 401(k) at the age of 59 (or under 55 under certain circumstances). Drozd Irina, Shutterstock

Drozd Irina, Shutterstock

Traditional IRA

People who may not have access to a 401(k), or people who would like to save a bit extra for retirement can open an Individual Retirement Account (IRA). These accounts also come in traditional or Roth versions, and the qualifications differ between plan types.

Traditional IRAs are taxed upon withdrawal.

For freelancers, self-employed and sole proprietors a Simplified Employee Pensions (SEP IRA) is available.

For small business, there is a SIMPLE IRA available. Vitalii Vodolazskyi, Shutterstock

Vitalii Vodolazskyi, Shutterstock

Roth IRA

Similar to a Roth 401(k), Roth IRAs are funded with post-tax income. You can diversify your savings plan by opening a traditional 401(k) and a Roth IRA. An accountant can help choose which type of IRA is best for your personal situation. FabrikaSimf, Shutterstock

FabrikaSimf, Shutterstock

Brokerage Account

In addition to a 401(k) or IRA, you can invest in a brokerage account. A non-retirement brokerage account can allow you to skip certain restrictions regarding how much you can contribute and when you can withdraw your money in retirement. Daenin, Shutterstock

Daenin, Shutterstock

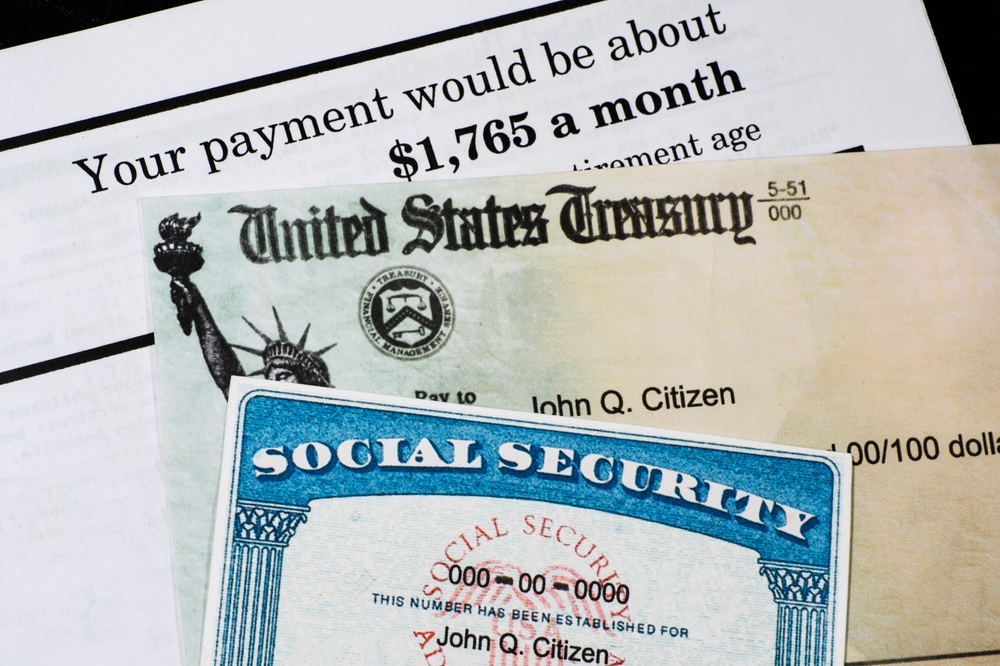

Social Security

Social Security alone will not be enough to maintain a decent lifestyle after retirement, but it can still help contribute.

You can use online calculators to estimate how much you may be entitled to based on your projected retirement date. Rix Pix Photography, Shutterstock

Rix Pix Photography, Shutterstock

Final Thoughts

The bottom line is: the most important element of saving for retirement is planning ahead—and as early as possible.

Surely, your circumstances will change of the years and your plan will need adjustment. But if you save extra, downsize your home or find yourself with an inheritance, you can recover the savings and reach your goal of 10 times your final salary saved at age 67.