Have You Read The Best Finance Books Of All Time?

Where do you get your financial advice? Is it from a professional financial advisor? Or do you listen to money-centric podcasts? Perhaps watch the financial sections of the daily news to track stocks? But what about books? How many of you read about finance? If you're looking for financial advice—regardless of what area you're interested in—these are some of the best finance books ever written.

The Simple Path To Wealth

Born out of a letter written to his daughter about financial success, JL Collin's book, The Simple Path To Wealth, was released in 2016 and has sold millions of copies. Known as the "Godfather of Financial Independence", Collins' book centers on the power of investments, a high rate of savings (up to 50%, if possible), and maintaining a decent amount of spending money. It receives a 4.7-star Amazon rating and a 4.46 rating on Goodreads.

The Psychology Of Money

This interesting take on money is explored through an unusual lens of 19 short stories about how people think about money—not in terms of figures and dollars and cents, but rather at the checkout or on their bank account screens. Morgan Housel's book, The Psychology of Money, became a best-seller and received a 4.7 Amazon rating and a 4.4 rating on Goodreads.

Atomic Habits

James Clear's Atomic Habits is all about your financial habits and how to create, build, and bake-in the best habits to help you save more money. Clear's ability to break down complex topics into simplistic terms that allow readers to better connect with his writing is never more present than in Atomic Habits. The book received an Amazon rating of 4.8 stars and ranked at 4.38 on Goodreads.

James Clear, CC BY-SA 4.0, Wikimedia Commons

James Clear, CC BY-SA 4.0, Wikimedia Commons

The Go-Giver

Bob Burg and John David Mann's The Go Giver is a book about business and philanthropy that outlines five rules for success: Value, Compensation, Influence, Authenticity, and Receptivity. The rules are laid out as part of Joe's (the fictional character at the center of The Go-Giver) learning journey. Ranking at 4.8 on Amazon and a 4.34 on Goodreads, The Go-Giver is excellent for business-minded folks.

The Bogleheads' Guide To Investing

If you're looking for investment advice, a great option is to read The Bogleheads' Guide To Investing. It's a bit brash and straightforward with its advice—it does come from the investment experience of John C Bogle, founder of the Vanguard Group and popularizer of index funds. Scoring a 4.7 on Amazon and a 4.29 on Goodreads, The Bogleheads' Guide To Investing is geared toward the investment-conscious American.

BillCramer, CC BY-SA 4.0, Wikimedia Commons

BillCramer, CC BY-SA 4.0, Wikimedia Commons

Trading In The Zone

Geared towards day traders and stock investors, Trading In The Zone by Mark Douglas is all about overcoming your ingrained habits regarding risk and reward and making the market work for you. It received a 4.7 rating on Amazon and a 4.2 rating on Goodreads.

The Richest Man In Babylon

In a fascinating style, The Richest Man In Babylon by George Clason disguises advice on personal wealth, finance management, and being thrifty in 4,000-year-old Babylonian parables on wealth. Once you get past the fact that you're reading a Babylonian parable, it's actually excellent advice. Ranking at 4.8 on Amazon and 4.26 on Goodreads, The Richest Man In Babylon was also a best-seller.

Quit Like A Millionaire

If you hate your job and want to quit someday, then Quit Like A Millionaire by Kristy Shen and Bruce Leung may be just the book you need to read. With tips on saving money without decreasing your quality of life, Shen and Leung offer practical advice that may lead you to quitting your job without a care in the world. Quit Like A Millionaire ranked at 4.7 on Amazon and 4.26 on Goodreads.

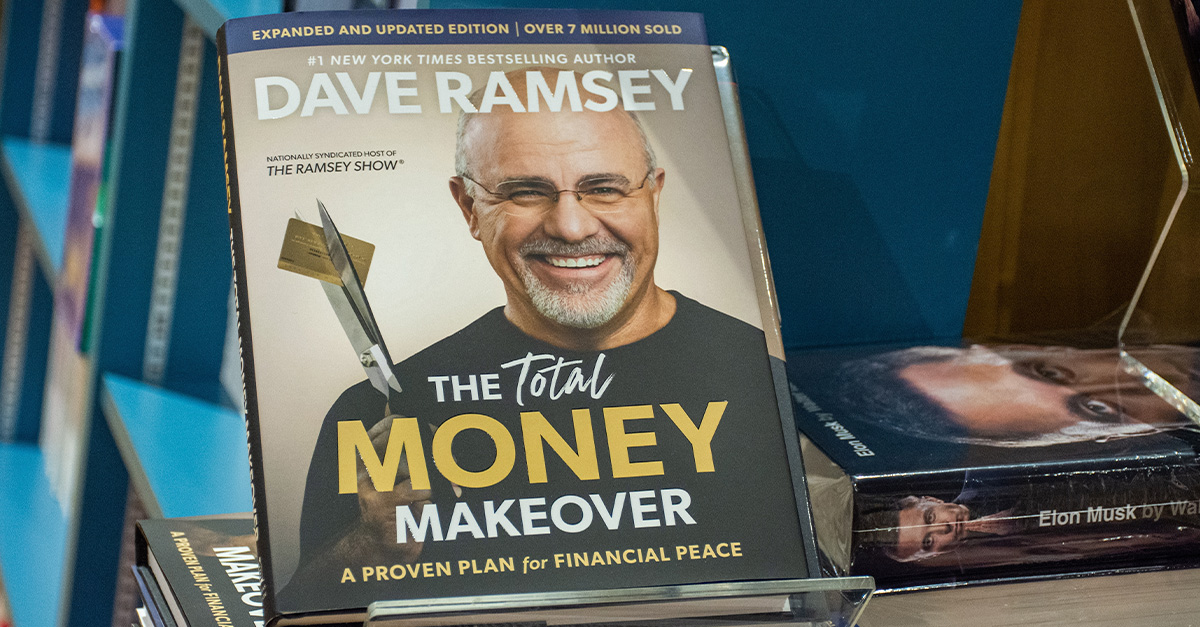

Total Money Makeover: A Proven Path For Financial Fitness

The second book from Dave Ramsey after Financial Peace, which outlined saving and investing principles, Total Money Makeover is Ramsey's guide to putting those into practice. Total Money Makeover performs excellently on Amazon, getting a 4.7 rating, while achieving a 4.24 rating on Goodreads.

Gage Skidmore, CC BY-SA 2.0, Wikimedia Commons

Gage Skidmore, CC BY-SA 2.0, Wikimedia Commons

The Intelligent Investor

Benjamin Graham's The Intelligent Investor was first published in 1949 and is considered one of the greatest finance books of all time. It shaped 20th century investors' minds and taught them to develop long-term investment strategies. Cited as one of the great books on finance by Warren Buffett, The Intelligent Investor received a 4.7 Amazon rating and a 4.24 rating on Goodreads.

Think Like A Breadwinner

Jennifer Barrett's Think Like A Breadwinner is a manifesto on building wealth aimed at working women. She expertly dismantles the narrative that women don't and shouldn't take their financial lives into their own hands, Think Like A Breadwinner was very well-received on Amazon, scoring a 4.9 rating, while achieving a 4.2 rating on Goodreads.

How To Win Friends And Influence People

First published way back in 1936, Dale Carnegie's How To Win Friends And Influence People is all about using your personality and language to get the work you want, improve the job you have, and to put yourself in situations to meet the right people. How To Win Friends And Influence People is a classic in financial literature and scores a 4.7 rating on Amazon and a 4.21 on Goodreads.

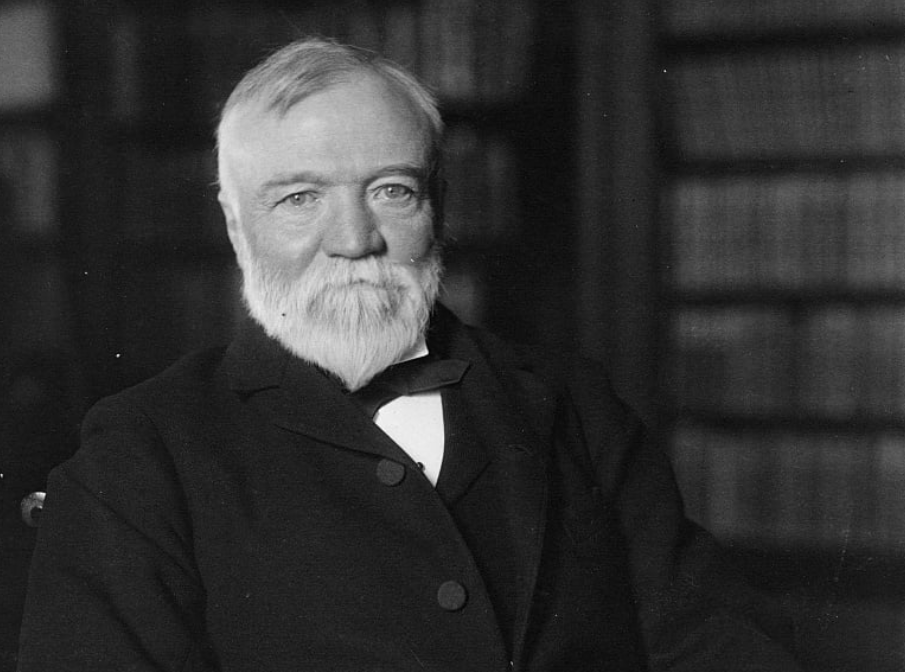

Think And Grow Rich

Inspired by the life of Andrew Carnegie, the Scottish-American industrialist and steel industry magnate, Think And Grow Rich was first published in 1937 by Napoleon Hill. For the book, Hill interviewed 504 people and invested 20 years of his life putting together some of the best advice from the best financial minds in America in the early 20th century. Think And Grow Rich receives a 4.7 rating on Amazon, and a 4.18 rating on Goodreads.

Thinking Fast And Slow

Daniel Kahenman's first book released for the general public, Thinking Fast And Slow was the culmination of Kahneman's studies in behavioral psychology, happiness, and behavioral economics that inspired the likes of Malcolm Gladwell. Defining "System One" (Fast) and "System Two" (Slow) thinkers in a financial context is a fantastic way of looking at your own finances. Thinking Fast And Slow received 4.6 stars on Amazon and a 4.17 rating on Goodreads.

Just Keep Buying

This excellent book from Nick Magguilli is all about spending, saving, and investing—but instead of throwing numbers around and using words you don't understand, Just Keep Buying offers practical advice that's digestible at any level of financial literacy. Just Keep Buying receives a 4.5 star rating on Amazon, while scoring 4.18 on Goodreads.

I Will Teach You To Be Rich

While you might not think that you can achieve financial independence and wellness in six weeks, Ramit Sethi's book I Will Teach You To Be Rich begs to differ. Offering a crash course in how to live well, without worrying so much over dollars and cents, Sethi's book offers tips on automated payment options, credit card literacy and much more. I Will Teach You To Be Rich ranks at 4.7 on Amazon and scores 4.13 on Goodreads.

Jeremy Vohwinkle, CC BY 2.0, Wikimedia Commons

Jeremy Vohwinkle, CC BY 2.0, Wikimedia Commons

A Random Walk Down Wall Street

If investing is in your financial purview, you'll need to read A Random Walk Down Wall Street by Burton Malkiel. For the serious investor, this how-to guide breaks down almost all of your investment options possible, including things Bitcoin. A Random Walk Down Wall Street scores a 4.7 on Amazon and a 4.12 on Goodreads.

Carlos Delgado, CC BY-SA 3.0, Wikimedia Commons

Carlos Delgado, CC BY-SA 3.0, Wikimedia Commons

Common Stocks And Uncommon Profits

Written by investor-extraordinaire Phillip Fisher, who pioneered the Scuttlebutt Investing Method—a method that uses information gathering as a way to decide whether or not to invest in a business—Common Stocks And Uncommon Profits is all about investment decisions and risk management. It earned a 4.6 rating on Amazon and scored a 4.13 on Goodreads.

Rich Dad, Poor Dad

Rich Dad, Poor Dad by Robert Kiyosaki is an excellent book for parents who're looking to teach their kids about financial literacy, financial planning, and more. If you are looking to outfit your youngster with good financial advice, but aren't sure where to start—Rich Dad, Poor Dad may be just the book for you. Based on Kiyosaki's story of growing up with both types of financial influences, it's sure to connect with you, no matter your financial situation. Rich Dad, Poor Dad achieves a 4.7-star rating on Amazon, but ranks at 4.11 on Goodreads.

Finance For The People

Finance For The People is as much an exercise in financial self-reflection as it is a lesson about money management. Offering thoughtful tidbits on how you can change your relationship with money, and tips on how to be more mindful of your spending, Finance For The People is an every-person's finance book. It scored a 4.6 rating on Amazon, and ranks at 4.07 on Goodreads.

The Energy Of Money

The Energy Of Money: A Spiritual Guide To Financial And Personal Fulfilment is Dr Maria Nemeth's exploration of wealth and finance through a metaphysical and spiritual lens. Exploring philosophies surrounding wealth, it's a neat read for anyone who wants to explore money differently. It earned a 4.6 rating on Amazon and a 4.06 rating on Goodreads.

The Millionaire Next Door: The Surprising Secrets Of America's Wealthy

A millionaire may live next door to you and you'd never know it. At least that's the premise behind The Millionaire Next Door by Thomas Stanley and William Danko. This research-based novel tells of a hidden American millionaire group, dotted throughout the middle class, who's focus on savings and investments—rather than expensive luxuries—came as a surprise to the pair when they wrote this 1996 book. It received an Amazon rating of 4.7 stars and performed well on Goodreads with a rating of 4.05.

Raising Financially Fit Kids

Another excellent book for parents, Raising Financially Fit Kids is all about the importance of teaching your children financial literacy and financial planning. A family-centric approach is taken across five development stages in this half-parenting, half-financial advice book. Raising Financially Fit Kids was a hit among parents, scoring 4.6 stars on Amazon, while rated at 4.01 on Goodreads.

7 Money Habits For Living The Life You Want

Rachel Cruze's father is the aforementioned Dave Ramsey—that might be where she gets her money habits from. In 7 Money Habits For Living The Life You Want, Cruze breaks down how our most destructive habit—comparing ourselves to others—stops us from reaching our financial goals. She then illustrates new habits we can adopt to aid in living a better, more secure financial future. Like her father's book, Cruze's ranks highly on Amazon, at 4.7 stars, but receives just under 4 stars on Goodreads.

Debt-Free Degree: Getting Your Kid Through College Without Debt

Being encumbered with student loan debt is something we've grown accustomed to as a society. It's almost a rite of passage. In Debt Free Degree, written by financial podcaster, author, and guru Anthony O'Neal provides a step-by-step guide to helping your kids leave college with little-to-no student loan debt, without giving them much by-way of financial assistance. Debt-Free Degree ranks at 4.7 stars on Amazon and achieved a 3.96 rating on Goodreads.

Your Money Or Your Life

Adopting a philosophy of building money habits and mindfulness, rather than budgeting yourself to oblivion, Your Money Or Your Life by Vicki Robin and Joseph Dominiguez takes you through nine steps to achieve the life you want, without having to make unnecessary sacrifices in your quality of life. Your Money Or Your Life receives a 4.5 rating on Amazon and a 4.1 rating on Goodreads.

Financial Freedom: A Proven Path To All The Money You'll Ever Need

Written by the "Millennial Millionaire" Grant Sabatier, Financial Freedom is all about the power of hustling your way to a million dollars. Written from his own life experience, Sabatier was a broke 24-year-old who became a millionaire in five years. He explores the power of side hustles and investments to make passive income. Financial Freedom: A Proven Path To All The Money You'll Ever Need ranks at 4.6 stars on Amazon and received a 3.96 rating on Goodreads.

Ruggiero Scardigno, Shutterstock

Ruggiero Scardigno, Shutterstock

The Automatic Millionaire

The Automatic Millionaire by finance guru David Bach breaks down financial principles like paying yourself first and avoiding unnecessary debts in an entertaining fashion. In 2017, Bach re-released the book to tackle modern technology and its effects on automation in our financial lives. The Automatic Millionaire ranks at 4.6 stars on Amazon and achieves a 3.94 rating on Goodreads.

FinishRich Media, CC BY-SA 3.0, Wikimedia Commons

FinishRich Media, CC BY-SA 3.0, Wikimedia Commons

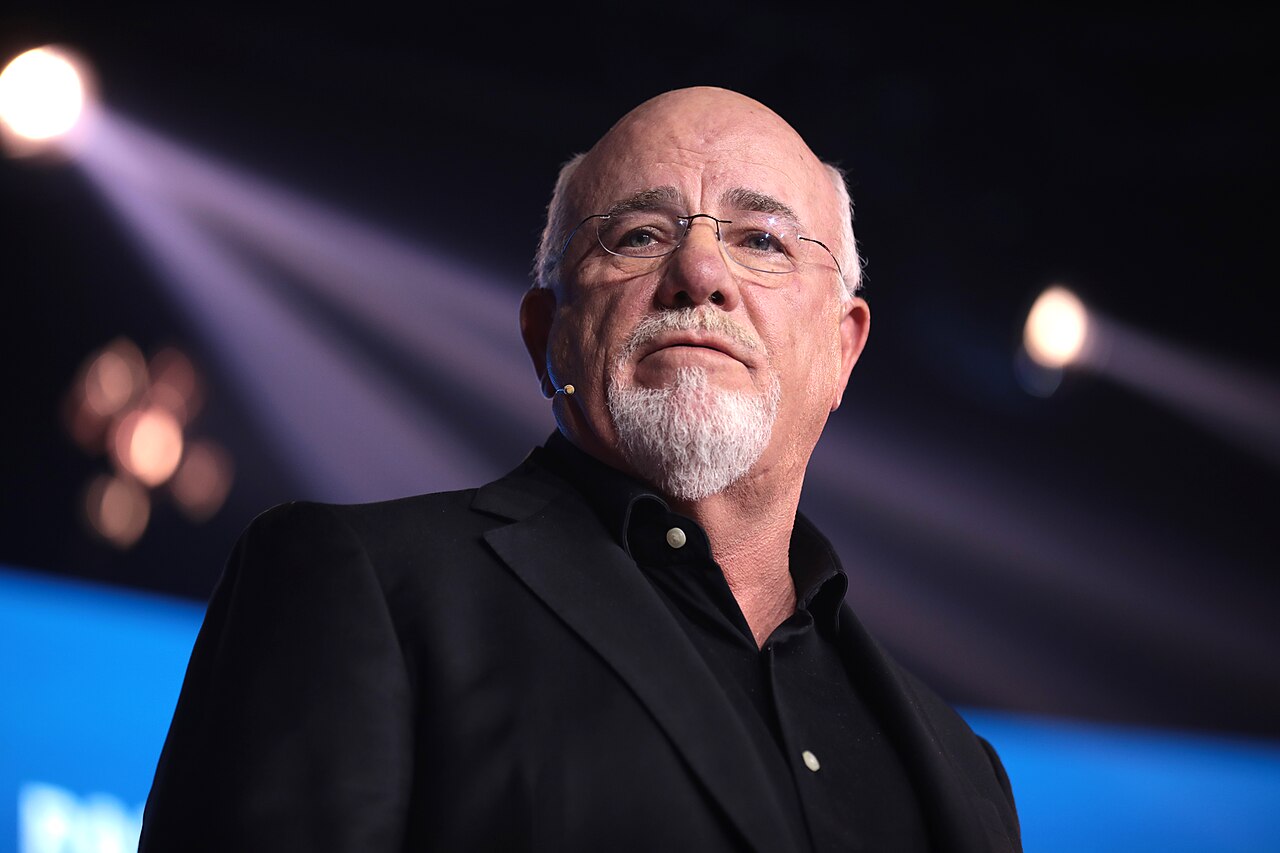

Baby Steps Millionaires

Another excellent book from Dave Ramsey, national radio host and financial expert, who went from a millionaire to flat-broke and then back again in the space of a decade throughout his twenties. Detailing how 'baby steps' can make you a millionaire, Ramsey shares his steps to getting back to the big time in this guide. Baby Steps Millionaires ranks at 4.5 stars on Amazon and received a 3.92 rating on Goodreads.

Broke Millennial

Picked by the Washington Post's Book Club is Erin Lowry's Broke Millennial, a deeper dive into the traditional money-saving methods: budgeting, investments, savings accounts, and so on. This includes tackling student loan debt and financial advice for millennial couples. Broke Millennial received a 4.6 star rating on Amazon and ranked 3.91 on Goodreads.

Die With Zero: Getting All You Can From Money And Life

Bill Perkins' Die With Zero is a unique take on financial health and well-being. Preaching an attitude of "You can't take it with you", Perkins' philosophy focuses on breaking the habit of over-saving and under-living with practical advice on how to optimize your life and not worry so much about money. Die With Zero receives a 4.5 rating on Amazon and is ranked 3.86 on Goodreads.

Why Didn't They Teach Me This In School?

Short and sweet—that's Cary Seigel's message in Why Didn't They Teach Me This In School? Breaking down a huge subject into 99 digestible small tips, Seigel imparts these pearls of financial wisdom in an effective and humorous manner to cover subjects not taught in school, even at an MBA level. Why Didn't They Teach Me This In School received a 4.5 rating on Amazon and ranked 3.82 on Goodreads.

Clever Girl Finance

This lighthearted and accessible personal finance book should be on every woman's reading list. Clever Girl Finance by Bola Sokunbi draws on her own rags-to-riches story to empower young women to save, ditch debt, and make good credit decisions. Clever Girl Finance is a new-age book for the entrepreneurial woman. It receives a 4.5 rating on Amazon and a 3.8 rating on Goodreads.

Vitalii Vodolazskyi, Shutterstock

Vitalii Vodolazskyi, Shutterstock

Dollars And Sense

A world-renowned economist (Dan Ariely) and a financial comedian and writer (Jeff Kreisler) got together to write Dollars And Sense—a fantastic blend of humor and sound financial advice that breaks down our spending habits and explores the psychology behind why we make poor financial decisions. By broadening your understanding of why we have these habits, we can hopefully break them, thanks to Dollars And Sense. It received a 4.5 rating on Amazon and Goodreads gave it a 3.8.

Yael Zur, CC BY-SA 4.0, Wikimedia Commons

Yael Zur, CC BY-SA 4.0, Wikimedia Commons

The Dumb Things Smart People Do With Their Money

The Dumb Things Smart People Do With Their Money introduces the reader to the subject of good financial decision-making by telling them everything that other smart people have done wrong. Outlined in 13 costly mistakes by Jill Schlesinger(CBS News money expert and radio host), Schlesinger hopes you'll be the smart person that avoids making the same mistakes. Ranking at 4.5 on Amazon and 3.77 on Goodreads, the book is full of salient advice aimed at smart people like you.

The One-Page Financial Plan

Okay, so, the One-Page Financial Plan isn't actually a single-page, but is an exploration of how to create an effective financial plan for your short;- and long-term financial goals. Written by New York Times finance columnist Carl Richards, The One Page Financial Plan is a perfect quick read for anyone just starting out. It received a 4.5 rating on Amazon and ranked at 3.74 on Goodreads.

The Guide To Passive Income: Building Generational Wealth

The key to building generational wealth is passive income, at least according to Andrew Lanoie. The Guide To Passive Income: Building Generational Wealth is one of the best financial books on earning income on the side that you don't notice until you're rich. Covering 11 revenue streams that could be the key to leaving the 9-to-5 rat race behind, Lanoie's book receives a 4.5 rating on Amazon and a 3.73 on Goodreads.

The Essays Of Warren Buffett: Lessons For Corporate America

Warren Buffett is one of the best-known financial minds in the world. A savvy investor, self-made billionaire, CEO of Berkshire-Hathaway, and all-round financial good-egg, Buffett penned The Essays Of Warren Buffett in 2001 and released a second version in 2008. Filled with lessons from the great man's life in finance, drawing on his personal experiences, these essays are some of the best financial reading you could hope for. Scoring a 4.31 on Goodreads and receiving a 4.7 star rating on Amazon, everyone else seems to think so too.