Payday Routines That Will Set You Up For Retirement

We all hope to retire someday—for some of us, that will be at 65. For others, it might be a little later. Nevertheless, retirement is one of the most important financial goals we have. If you aim to retire sooner rather than later, you'll want to establish payday routines to help you save or invest your hard-earned cash for the long term.

Before We Get Down To Business

Before we get to the business end of payday, it's important that you establish a baseline. Here are the things you must do before building long-term wealth.

Do Up A Budget

Whether you use a budgeting app or just a simple Excel or Google Sheets spreadsheet, paying attention to where your money goes every payday is the first step in establishing a payday routine. You'll have a clear picture of where your money goes by writing everything out.

Cut Small-Dollar Transactions If Possible

That subscription that you signed up for last year and promptly forgot about? That's one of possibly many small-dollar transactions that go unnoticed from your bank account. If you can, cut back on those subscriptions immediately.

Pay Off Your Debts

If you have debts, you should work diligently toward paying them off. Rank-order your debts from smallest to largest and then pay them off one by one. Generally, it doesn't matter what kind of debt you have, deferring payment on your debts because they're a small amount won't get you any closer to financial freedom.

Once You Are Debt-Free

Once you've reached debt freedom (with the exception of your mortgage), unless you're renting, then it's time to establish a payday routine that begins to pay you in the future. Let's establish the payday routines that can help you achieve financial freedom in your retirement.

Pay Your Bills

The first step to setting yourself up for future success is to pay your bills now, to avoid going into debt with them later. Sure, you could defer your credit card bill till next month, but it's gaining interest already—so why not pay it off? Paying your bills should be the first thing you do with your paycheck.

Contribute To Your Emergency Fund

The next most-important step you can take to set yourself up for future financial success is to open a savings account that's specifically used for emergencies—your emergency fund should only be used for emergencies. Ideally, an emergency fund should contain three to six months worth of expenses.

Set Aside A Second Emergency Fund For Smaller Emergencies

While you contribute to your big goal of three to six months of expenses in an emergency fund, you might also consider building a $1,000 emergency fund for the fun emergencies that life likes to throw at you: a broken-down car, a broken window, or a sudden plumbing emergency. While $1,000 may not seem like enough, it's much easier to save than three to six months of expenses and can be put in a high-interest savings account to build interest over time, but be accessible when you need it.

Deemerwha studio, Shutterstock

Deemerwha studio, Shutterstock

Automate Your Payments

If you've not already automated your payments, now is the time to do so. By automating things like paying your mortgage, your landlord, or your credit-card/car payment/cell phone bill (assuming these things are the same amounts monthly), you take the stress of writing down the amounts owed, remembering to pay them on time and keeping a balance sheet of how much is left owing.

Automate Your Savings

Once you've automated your bill payments, you can work on automating your savings. This means setting up pre-authorized contributions to your various savings accounts, whether that's an emergency fund, kids' college fund, or your retirement accounts. By automating your savings and putting in an amount that you're comfortable with every month, you'll save yourself the anxiety that can come with making large contributions.

Set Aside Money For Your Kids' College Fund

While you might not be sure exactly how much to set aside for your kids' college fund, experts recommend setting aside between 3% and 5% of your monthly income into the fund. This can be set up as a separate bank account, known as a 529 College Savings Plan.

What Is A 529 College Savings Plan?

In case you've never heard of a 529 account before, it's a long-term investment account intended to be used for when your children go to college. As a tax-advantaged account, investments made within will grow tax-free until your child goes to college.

Set Up Or Contribute To Your Retirement Account

If you haven't been able to contribute to your retirement yet (maybe you're still a young worker), or simply haven't been able to put any money towards it in a while, now is the time. You can (and should) automate this payment from every paycheck you receive. Financial experts recommend setting aside 15% of your monthly income into your retirement account.

What Type Of Retirement Account Should I Use?

There are many types of retirement accounts, but the most popular are the 401(k) and an IRA, or Individual Retirement Account. Simply put, a 401(k) is an employer-sponsored account, where employers will match your contributions up to an annual contribution limit. Meanwhile, an Individual Retirement Account is self-directed and opened by anyone with an income.

Andrii Yalanskyi, Shutterstock

Andrii Yalanskyi, Shutterstock

How Much Should I Contribute To My Retirement Account?

Whether you have a 401(k), IRA, or both, a general rule of thumb is to set aside 15% of your income on a monthly basis (if you can afford it) to build your retirement account slowly over many decades. You can always contribute less than this, but the point is to start making contributions.

What About Investments?

Of course, contributing money to an IRA or 401(k) is great, but it might not be earning much interest while it's there. In order to make your money work for you, you should strongly consider making some investments inside either your 401(k) or your Individual Retirement Account. If you have a Roth IRA (a tax-advantaged type of IRA), it's better to open investments within this type of retirement account, because they will grow tax-free.

Sutthiphong Chandaeng, Shutterstock

Sutthiphong Chandaeng, Shutterstock

What Types Of Investments Should You Consider?

There are many different types of investments you can put in your retirement account. However, given that this is your retirement money, you definitely should avoid high-risk investment options, like initial public offerings, cryptocurrencies, or real estate investment trusts (REITs). These are very high-risk investments that could pay dividends over time, or you could lose everything.

The Best Investments For Long-Term Growth

While a certain amount of this is dependent on your age and risk tolerance, if you're a young person (say, under 35), you should strongly consider investing in growth stocks—singular companies with high growth opportunities. These are companies like Apple, Amazon, Google, NVIDIA, and more. Or, invest in exchange-traded funds, or ETFs.

What Are ETFs?

ETFs, or exchange-traded funds, are long-term investment options that cover a collection of stocks and bonds, most of which mirror the performance of the S&P 500 and/or the international markets, depending on the type of fund.

Popular American ETFs

If you're investing in the American market, there are several options for your exchange-traded fund investments: the Vanguard 500 ETF, which mirrors the performance of the S&P 500; the Vanguard Total Stock Market ETF, which mirrors the performance of American stocks; and the Vanguard Total International Stock ETF, which exposes your investments to the international American market.

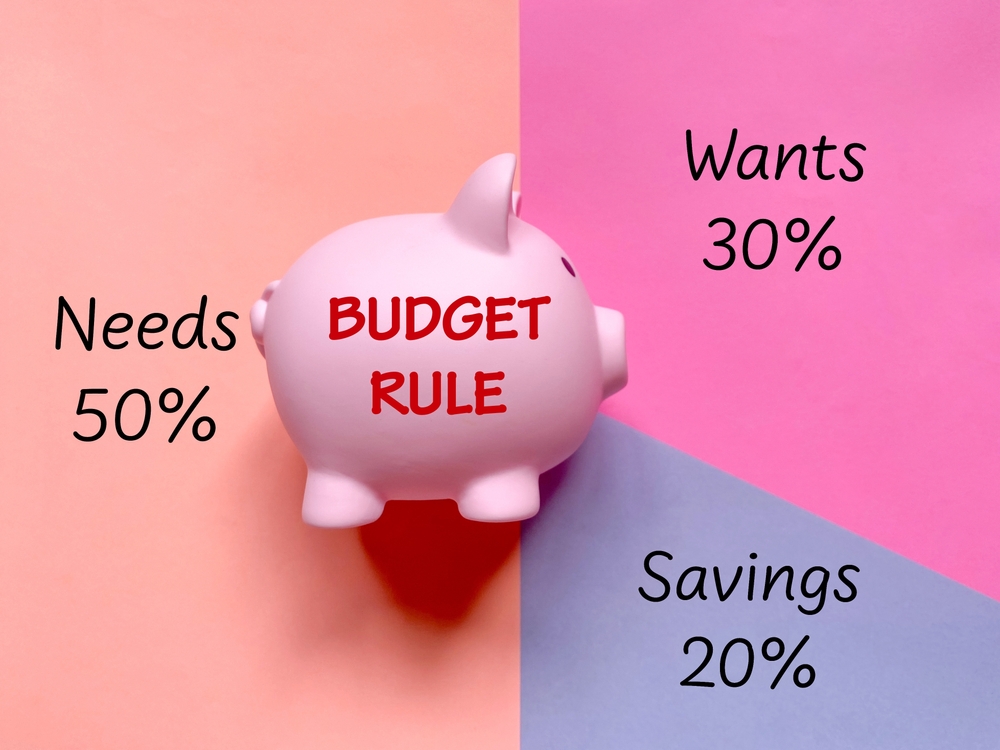

The 50-30-20 Rule

There are many different types of savings rules you can apply to every paycheck, especially if you want your outgoing expenses in a pinch. The 50-30-20 Rule is a dividing tool: 50% of your income monthly should go toward your fixed outgoing expenses, 30% toward "fun money," including dining out, entertainment and other ways you enjoy your hard-earned cash, while the remaining 20% of your paycheck goes toward your investments—5% in a 529 account, and the remaining 15% in a retirement account.

What Is Your Payday Routine?

Tell us about your payday routine. How does it differ from the above list? It's important that everyone's financial journey is different and not everyone's payday routine will be the same, but the goal in establishing a payday routine is that you create a habit of saving money for retirement and are able to relax a little, because you'll have paid off your debts.

You May Also Like:

24 Tricks Moms Used To Stretch Budgets In The 60s

How To Start A Homestead On A Budget

The Highest-Paying Jobs You Can Get Without A Degree

Volodymyr TVERDOKHLIB, Shutterstock

Volodymyr TVERDOKHLIB, Shutterstock

Sources: