How To Save & Then Use Your First $100,000

Saving $100,000 can seem insurmountable, particularly if you're starting out in your financial life or are rebuilding your finances after a crushing life event. Here's the thing: saving $100,000 doesn't have to be this unclimbable mountain. We'll walk you through how to save your first $100,000 and then what you should do next.

Examine Your Monthly Budget

One of the first steps you should take is to examine your monthly budget. If you don't have a monthly budget yet, it's time to start making one. Don't put it off any longer and start building a budget that's geared towards saving $100,000. You don't have to give yourself a timeframe for it, unless you're saving for a big purchase.

Figure Out Why You Want To Save $100K

Sure, having $100,000 in the bank is great, but there has to be a reason why you're saving up $100,000. Are you using it as a down payment for a big home? Are you using it as your retirement fund? Are you going to blow it all on hats? Okay, probably not that last one, but once you've figured out what you're doing with it, you'll be able to figure out the best vehicle to use to save that amount of money.

Make A Zero-Based Budget

Zero-based budgeting assigns every dollar that you make a task within your monthly budget. Unlike traditional budgeting, where you take away your fixed expenses and what you're left with is your "fun" money for the month, zero-based budgeting forces you to give every dollar a purpose. By assigning every dollar a purpose, you'll be left with $0 at the end of every month, helping you to make decisions about your money and get you closer to $100K.

Creating $100,000 Habits

Part of saving $100,000 is creating money habits that will get you there faster. These $100,000 habits include diligently budgeting and cutting non-essentials like impulse purchases online. As part of your zero-based budget, figure out what in your life you spend money on but could live without for the next 6-12 months. Then cut it. Pump these savings into your $100K fund.

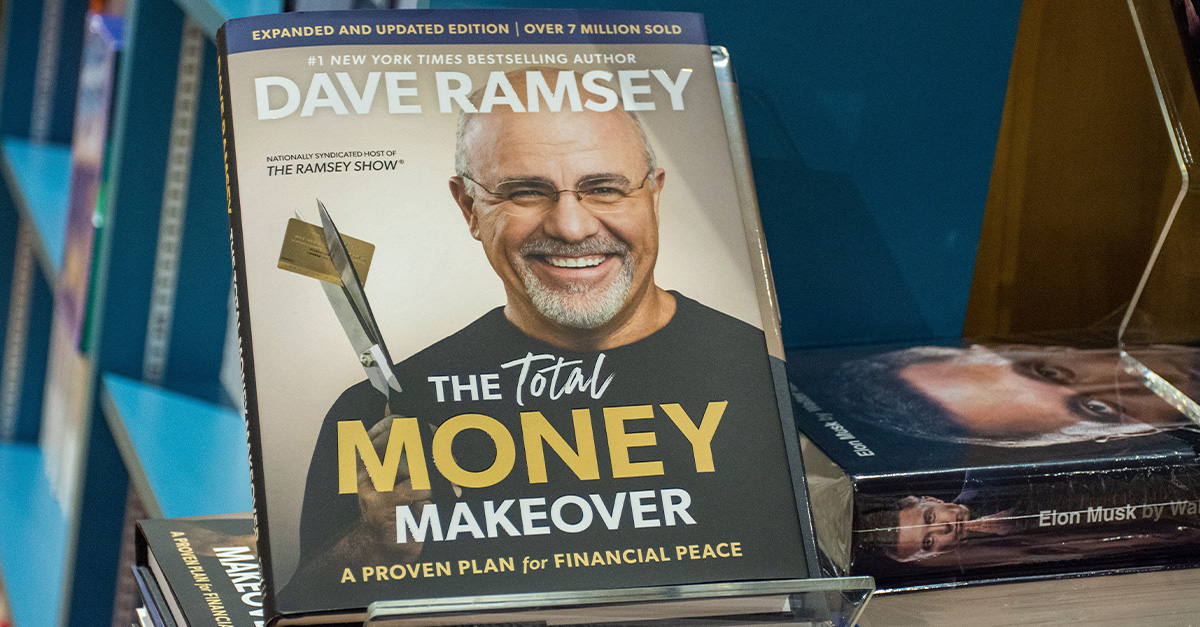

Eliminate Your Debts

Most people in the world are not debt-free. Eliminating your debts will allow you to maximize your savings potential. You can use either the "Debt Snowball" method—which involves paying off your debts in the order of lowest to highest, or the "Avalanche" method—which pays off the debts with the highest interest rates first.

Funnel Your Debt Payment Savings Into Your $100K Fund

As you pay off debts, you'll notice that you have more money every month (because it's not going toward those pesky debt payments!), so funnel this money into your $100,000 fund. But, what vehicle should you use to save that $100,000, you ask? Start off with a traditional savings account.

Open A Savings Account For The Money

Most of us use our checking accounts and maybe one savings account for just about everything. But it's important that we give our $100,000 account its own special savings account, particularly if you have a longer than five-year timeline to save this $100,000, which opens you up to other investment options.

Decide What Vehicle You're Going To Use To Get To $100K

When it comes to saving $100,000, you have many options available to you. Opening a savings account for the money may simply become a placeholder for your initial deposit, depending on what you do next. Decide which investment strategy you want to use to get to $100,000.

Decide On Your Initial Deposit

Maybe you've saved up your first $1,000 and want to use this to jump-start your $100K account. If you've got more money than that, then decide how much you want to put in. This is really up to you, but some accounts will require a minimum amount to be put in the account, usually $500.

Is Your $100,000 A Short-Term Goal?

By "short-term", we mean, less than five years. If so, you're going to want to be very aggressive with your savings plan. This means pumping every last dollar you've got into your savings plan to the $100,000 goal. Of course, how much you'll need to save in less than five years depends on your initial investment. Here are some investment vehicles that best serve short-term savings purposes.

Move Money Around Between High-Interest Savings Accounts

High-interest savings accounts, sometimes called high-yield savings accounts, are great options for short-term interest gained for a period of 3-6 months. These high-yield savings accounts offer new clients a high interest rate, particularly if you move your paycheck or other direct deposits into their accounts. While not matching the stock market at 8%, these can be as high as 5%. It does take some time and effort to sign up for each new interest rate as they're offered by the different banks, but it's an option worth exploring.

Certificates Of Deposit

Certificates of deposit, or CDs, are another short-term investment vehicle to help you grow your money to reach that magic number of $100K. CDs often operate on a sliding scale, based on the number of months or years you lock money away for. That's the kicker: deposits into CD accounts are often non-redeemable, meaning you won't have access to the money for the period of time that you agree to lock it away for. However, it does earn a fixed interest rate for that term—minimizing losses.

Short-Term Corporate Bond Funds

Corporate bonds are a type of bond offered by a corporation to their investors when they want to make a large purchase, or expand the business in some way. Investors lend money to the company to achieve this objective, from which they receive a dividend payment of the interest on the amount they've lent, usually between 5.5% and 6.5%, plus repayment of the principal. Because of the higher interest rate than CDs, a short-term corporate bond arrangement may be a good option.

Money Market Account

Money market accounts are another option for short-term savings, offering an interest rate that is generally above that of a high-interest savings, with no minimum balance and withdrawal limits. It's an excellent option for short-term savings, but not great for those who don't have as much money to start with on their way to building $100K.

Cash Management Account

Cash management accounts are an excellent option for short- or medium-term savings goals, offering a one-stop shop for all your banking needs. They also provide higher interest than high-interest savings accounts, but because the brokerage's robo-advisor manages your money, there are sometimes fees associated with them. Cash management accounts' interest rates also rise and fall with the markets.

Medium- To Long-Term Investment Options To Get To $100K

Next we'll discuss what your options are if you're just starting out investing and want to get to $100,000 in the medium- to long-term, say a five- to 20-year period. Whether your initial investment is $1,000 or $10,000, taking the long view of finance is often the best way to reach that $100,000 finish line.

Take A Look At Company-Matched Retirement Accounts

If your company offers an employer-matched retirement account, like a 401(k) or Roth IRA, then it's important that you start making contributions as soon as possible. These are matched by your employer and could mean a huge boost to your retirement plans, particularly if you have decades left till you plan on retiring.

Invest In The Stock Market

The stock market, more specifically the S&P 500, generally returns about 8% per year. Investing in the stock market is one of the favorite long-term investment vehicles of America's most famous investor: Warren Buffett. There are many options once you decide to invest your money in the stock market, but you have to be comfortable with letting your money sit there over years, possibly decades, and watching it fluctuate. Let's go over some stock market based investment options.

Alex from the Rock, Adobe Stock

Alex from the Rock, Adobe Stock

Exchange-Traded Funds

Exchange-traded funds, or ETFs, are essentially baskets of different stocks. There are thousands of ETFs on the stock market, covering different areas of the globe, different industries, and different levels of risk. ETFs are a great option for the long-term investor who seeks to buy and hold their investments for many years, riding the waves.

Mutual Funds

Mutual funds are another basket-investment option that hold bonds and stocks, either all-bonds, all-stocks, or a mixture of both. Mutual funds often come with a manager, who decides which stocks and bonds to choose within the fund. Mutual funds provide an excellent in-between for those who don't want to invest in individual stocks. The trade-off is that mutual funds come with high fees paid to the fund manager.

Bonds

Bonds are another excellent long-term option for that $100,000 portfolio. Particularly, longer-term corporate bonds, as we covered above, or Treasury Bonds. Treasury Bonds are meant to be bought and held over decades and are guaranteed by the United States Government, making them a near-risk-free investment. The trade-off is that Treasury Bonds don't have as high interest rate yields as corporate bonds.

Invest In Real Estate

If you want to get to $100,000, but only have, say $10,000 to invest, you could decide to invest in real estate—even if all you do is strategically buy raw land. The value of that land will increase over time. Of course, if you have more money to invest in real estate, you could buy a bigger parcel of land, or use it as a downpayment to buy property.

What About REITs?

If you can't afford to buy property, you could invest in REITs, or Real Estate Investment Trusts. These are funds that own income-producing properties, or own a mortgage on a property. REITs are huge corporations that sell shares in their corporations to investors (sometimes coming with a handsome dividend). REITs are made up of mortgages, retail, residential, office, and healthcare properties.

Using Your Dividends To Reinvest

If your investments are generating a handsome dividend for yourself every month/quarter/half-year, you could easily reinvest those dividends into your portfolio, increasing your returns over time and expediting your way to $100,000.

The Right Type Of Retirement Account For Long-Term Investments

Suppose that you're using $100,000 as a benchmark for your retirement fund, but you're just starting out saving for retirement and you're unsure about which type of retirement account is best for you. We can help.

401(K)s

Your 401(k) is the most basic retirement account: any investments and growth within your 401k is tax-deferred until you withdraw from the account when you retire, which you must do by the time you turn 73. 401(k)s are most commonly offered by most employers, look for that employer-match we mentioned above!

Traditional IRAs

Traditional IRAs, or Individual Retirement Accounts, allow you to contribute pre-tax contributions to the account, which could reduce your current tax burden, though any withdrawals you make in retirement are taxable. Traditional IRAs are most common for those needing or wanting an immediate tax break.

Roth IRAs

Meanwhile, a Roth IRA is a type of Individual Retirement Account where all contributions are made with money that's already been taxed, so any withdrawals made from your Roth IRA are tax-free. Long-term investors seeking to break that $100,000 barrier may consider having a Roth IRA account over a Traditional IRA.

How Fast Can You Save $100,000?

This is a subjective question, as it all depends on how aggressive you are with your saving. But, assuming you're able to put away $1,000/month into a savings account, without earning high interest, you'll be at the $100,000 line in about 7-8 years. On average, people save up their first $100,000 in about 7.84 years.

Ways To Contribute More Toward Your Goal

There are a few ways you can contribute more toward your savings goal of $100,000. Let's explore some ways to reach $100,000 in less time than that average of almost eight years.

Find A Side Hustle

If your 9-to-5 keeps you busy, but you're not quite able to save enough every month to reach your $100,000 milestone in the timeline you've given yourself, then try to find a side hustle and bank that extra money into your $100K account. This could be anything from mowing lawns to selling artwork at a local farmers market.

Reinvest Your Tax Refund

If you're getting tax refunds during your saving years, you can reinvest that nice little chunk of money from Uncle Sam and bolster your savings account. You could even reinvest it into your Roth IRA account and get an even bigger tax break the following year!

What To Do With $100,000 Once You've Got It

Congratulations on saving $100,000! You rock! Now that you've got a hundred G's to your name, let's explore your options of what to do with that money to turn it into even more money.

Buy A Home

Once you've reached your $100,000 goal, you'll most likely be able to afford a sizable down payment on a home, or purchase a smaller investment property for renting out. While $100,000 is excessive for a down payment, it could also act as a partial emergency fund or repair fund for the home once you've secured a mortgage.

Take The Trip Of A Lifetime

Perhaps you're in your latter years and this $100,000 nest egg is supposed to fund your retirement. If that's the case, $100,000 is more than enough to allow you to travel and see the world in your twilight years. Dollars go much further in other countries than the United States, so use your $100,000 to see as much of the world as possible!

Reinvest It

If you've managed to save, save, save and have come up with $100,000 in a short period of time, you've got more time to reinvest that $100K in the market. Use any of the above-mentioned methods based on your timeframe! If you're under 50, investing $100,000 for the next 15-20 years could leave you with a significant retirement fund.

Tell Us How You're Saving Your First $100K & What For

How are you planning to save your first $100K? Let us know in the comments below. Also, tell us what you're saving for: Retirement? A home? A round-the-world trip? Let us know what you're using your first $100,000 for.

You May Also Like:

Common Workplace Mistakes That Quietly Ruin Your Career

10 Money Habits Of People Who Retire Before 40