Climate change is one of the most pressing issues affecting our world today, yet there seems to be a lack of urgency among the general public to fully address it. Despite recent data that suggests the Earth is on the brink of another mass extinction event, a large proportion of the global population still chooses to maintain the status quo.

Harmful environmental practices continue to persist from the top down—at the industry level, all the way down to the individual level—and unshakeable systems such as capitalism, consumerism, and science denialism are not helping matters, either. At this point in time, a shift in thinking and behavior is necessary in order to prevent catastrophic outcomes.

The science is clear

The latest report by the Intergovernmental Panel On Climate Change (IPCC) reveals a stark prognosis for our planet. The science is clear: "Unless there are immediate, rapid, and large-scale reductions in greenhouse gas emissions, limiting warming to close to 1.5°C or even 2°C will be beyond reach."

Previous climate models that were used to assess the impact of the doubling of greenhouse gases from pre-industrial levels were too varied in their results to confidently rely on. But now, the reports are showing much less variance—in fact, researchers are almost certain that an increase of greenhouse gases to 520 parts per million will result in three degrees of warming. To put that into perspective, the IPCC reports the current atmospheric CO2 at 410 ppm. Such an increase would push the Earth to a point of no return.

Save money for fighting climate change

Solving climate change will require no less than an international collaborative effort. While the spotlight is mainly focused on governments, corporations, the finance sector, and other major entities, every single person can still contribute to the good fight. Such is a belief held by Carbon Neutral Club, a Canadian climate tech company that aims to make climate action accessible to anyone.

Its tagline, "Save money for fighting climate change," explains everything you need to know how the company works—participants can estimate their personal carbon footprints and offset them through memberships that fund wind, solar, and reforestation projects. In return, they receive big discounts on over 50 sustainable brands like Frank and Oak, KOTN, and Village Juicery, giving them access to year-round savings.

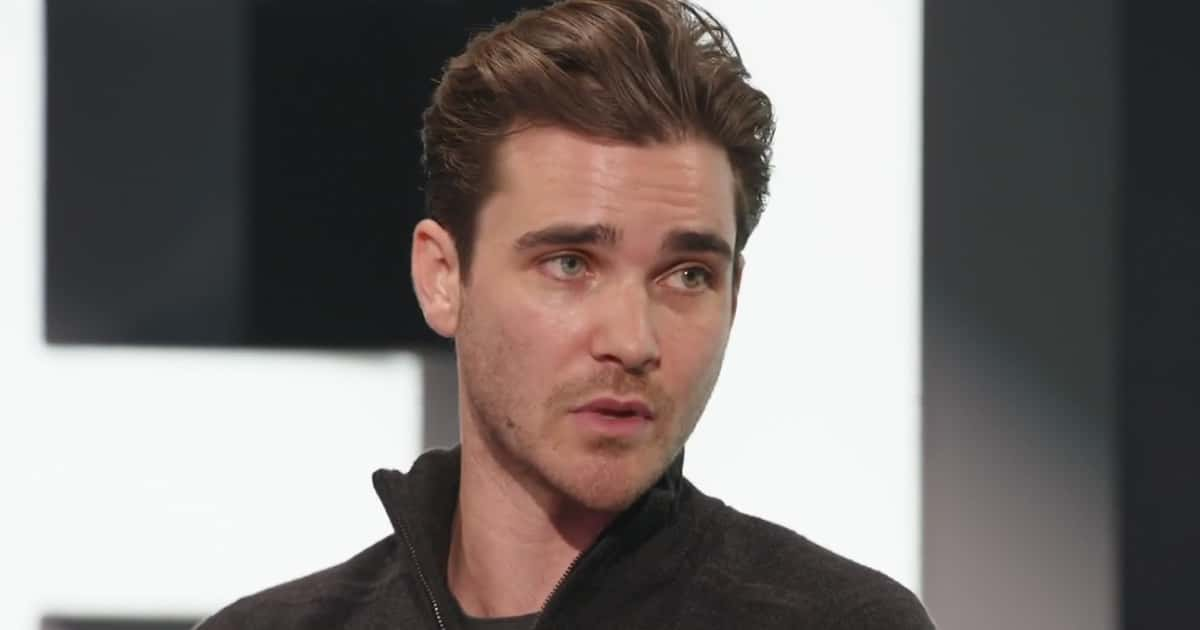

Co-Founder Jack Bruner spoke at the ELEVATE: Think 2030 conference on Wednesday to discuss how Carbon Neutral Club is promoting sustainability through its disruptive technologies. Bruner believes that many people are reluctant to adopt environmentally conscious behaviors due to a lack of awareness and accessibility. He mentions that they receive several emails daily from new members who never knew that a sustainable lifestyle was so within reach and that there are tools available to help them reduce their personal impact. His hope is that Carbon Neutral Club can make that way of life the obvious choice.

"One of the big challenges we're trying to solve for is how do we make sustainable lifestyle financially beneficial to somebody. There is something that exists [called] green premium, and it's very real—asking consumers to spend more on a sustainable product is a tough ask."

Bruner adds that survey data often shows people would prefer to buy a sustainable product over a non-sustainable product, but that preference doesn't always translate into a change in behavior.

"What we're trying to break down is how can we make it an obvious decision, and remove that green premium and put the sustainable product on the same playing field from a dollar-to-cents perspective. We have many members who are saving more money each month than they are paying their membership fees to offset their [carbon] footprints...and that's an amazing thing."

"The more we can create a financial incentive, and companies can help to create an environment where it doesn't cost you more money to live sustainably (and in fact, maybe you can make some money in doing it), that's a special thing. And I think once we can get there, it will unlock a wave of action."

COVID-19 and sustainability

Back in March 2020 when the world went into lockdown, the Earth began to show signs of recovery. India's skies cleared up so much that the peaks of the Himalayas were visible for the first time in decades. Israel's third-largest city Haifa experienced an increase in wild boar sightings roaming the deserted streets. Even Bosphorus, the Strait of Istanbul, started seeing more dolphins swimming closer to shore.

Clearly, the COVID-19 pandemic and climate change are connected to one another. When asked about how the crisis has affected the current perception of sustainability, Bruner says it has actually pushed it to the forefront of public concern:

"Above all else, I think COVID has made me reprioritize my life [and] what matters. At the end of the day, what matters is your health, your family, and your future. You really can't disconnect the climate crisis from any of these three things; they are deeply connected. When we talk about climate change, what we're talking about is the future livability of our planet; the security of our future generations."

Reuters

Reuters

Bruner thinks more and more people are waking up to that and behavioral changes are starting to happen at scale; particularly in the millennial and Gen Z demographics.

"This audience is rethinking what they buy, who they buy from, who they choose to work for, who they choose to vote for, all through this lens of sustainability in a way that hasn't happened before."