40 Ways To Lower Your Living Expenses In 2025

We've all been feeling the pinch of inflation in 2024—everything has increased, from gasoline to clothing, food, and much more. Looking ahead into 2025, many of you may want to decrease your living expenses without necessarily having to take drastic financial measures or make massive lifestyle changes. Here are 40 ways to lower your living expenses next year.

Begin Reading Digital Books

Reading a digital book sounds like blasphemy to some people, but they do cost a fraction of an actual paperback. Start off your 2025 living expense reduction by buying an e-Reader (or asking for one for Christmas) and then begin reading digital copies of books.

No More Landlines

Obviously, this won't apply to everyone—for instance, if you don't live in an area where you receive cell reception, then you'll need to keep your landline. But if you have a cell phone and have good reception, there's no need for the extra cost of a landline. Ditch it.

Stay Away From Name-Brand Items

When doing your weekly grocery shopping, stay away from name-brand items. There's almost certainly a very similar (and cheaper) alternative to the name-brand stuff without a noticeable loss of quality. They also cost 40% less on average, according to data.

Thrift Shop For Clothing

Unless we're talking underwear and socks, there's almost no reason to buy brand new—when you can likely find the same brands at your local thrift shop for a fraction of the price. Some clothing will even still have the tags on!

Check Your Subscriptions

Most of us have so many subscriptions that we don't even know where to start. Between our Netflix, and Sportsnet, and Amazon Prime, and on and on the list goes. Make decisions about which subscriptions you actively use—and get rid of what you don't. Even if it's only $10/month—that's an extra $120 per year.

Thin Down Your Cable Channel Package

In a similar vein to subscriptions, you may be paying exorbitant amounts of money for a cable channel package that you don't use half of. Write down what you watch regularly on your cable package and see if your provider offers a cheaper package that includes those channels, or see if you could pay for a subscription that covers all the channels you need.

Pick Matinee Showtimes At Your Local Theater

If going to your local theater is something you really enjoy, choose a matinee showtime—one that is in the afternoon. These are usually less expensive than peak evening performances of your movie of choice. See if your local movie theater also does "cheap nights" and go to these instead of other performance times.

Borrow, Rather Than Buy

If you know that you're going to need an item for a short period of time, consider seeing if one of your friends, or even those on your local Facebook group, has the item you need (like a particular power tool) and borrow it for a week, or as long as is necessary. Even paying a comparatively small rental fee is a great option, rather than paying hundreds for a tool you'll use once.

Shop Wholesale & Buy In Bulk

Sure, Costco and other wholesale-style stores may seem like they're expensive when you get the final bill, but because you're buying in bulk, you're saving a lot of money in the long run. Most people say they've saved as much as $1,000 a year by shopping at Costco.

Drink More Water

As well as just being healthier for you, water is also free. Choose H2O when out at a restaurant with friends or family. Those restaurant Pepsi drinks can be as high as $3.50/glass.

Drive Less. Walk Or Bike More

Depending on where you live, this may be impractical—but if it is practical for you, then 2025 might be a good year to walk or cycle to more places than you drive to. If you can cycle or walk to get the groceries, then do so. If you can cycle or walk to a friend's house for dinner, then do so. Not only is it good exercise, you'll dramatically reduce your gas/car wear-and-tear costs.

See If Your Utility Provider Offers Budget Billing

Sometimes, certain utility providers can offer equalized billing payments—if you have good credit history with them, you may be able to receive an equalized billing amount based on your previous good payment history, where your bill is equalized across all 12 months of the year. This is a great way to save money overall on utility bills.

Watch Your Local Grocery Flyers

While we often throw away or burn our local flyer deliveries, they can be a gold mine for sales and savings. Pay more attention to them and see if you can snag a good deal or two.

Make Your Coffee At Home

One of the largest expenses that we almost never notice or think about is our daily coffee. Research suggests that Americans spend $21.32 per day on coffee at coffee shops, while making it at home may cost you between $11 and $30 per month.

Bring A Lunch To Work

Unless you're one of the lucky people that get to work from home, chances are that your daily lunch out is probably between $10 and $20 per day, even if you're just getting a sandwich, a treat, and a drink. That's either $50 or $100 per week on lunches. By bringing a homemade lunch to work, you may spend $5 on lunch in total.

Meal Plan To Stick To Your Grocery Budget

If you haven't created a budget for 2025—do that right now. If you have, then think about incorporating different meals into your weekly meal plan to maximize how far your food goes and minimize waste.

Run A Full Load Of Laundry

Whenever you do laundry, it's always advisable to run a full load. Even if you're one of those people that separates out their whites and colors—running separate smaller loads is a great way to burn through water and electricity like they're going out of fashion.

Make Use Of Natural Light

There's almost no need to have lights on at home during the day. Let the light of the sun in through your windows and don't turn any lights on until nighttime. This will save you money, and sunlight will give you all the benefits of vitamin D and increase dopamine in your body.

Get Yourself A Quality Thermos

Spend about $30 or $40 and get yourself a good quality thermos, particularly if you're an all-day drinker of hot beverages. Buying a quality thermos that'll last you all day is a great way to not spend that extra $4 daily on mid-afternoon coffee or tea. Also, coffee shops may give you a discount if you insist on getting that morning caffeine hit from an establishment.

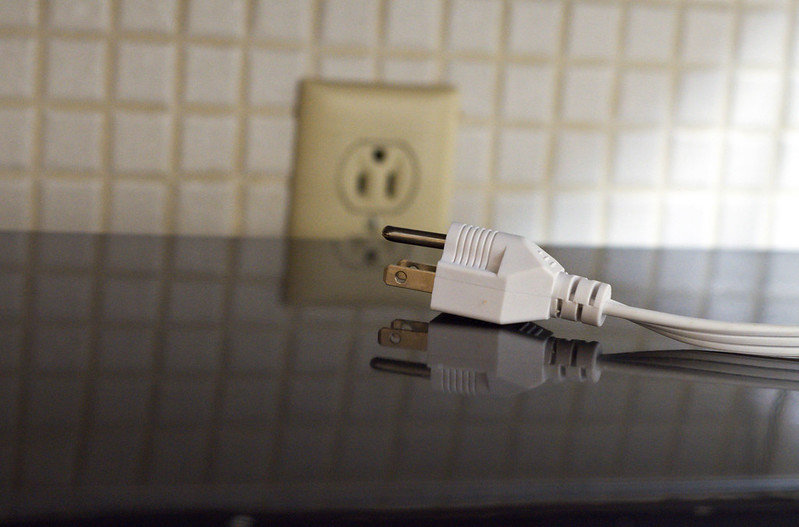

Ensure That Lights Are Off And Devices Unplugged When Not In Use

Even though your devices may be turned off, if they're plugged in, they're still drawing a tiny amount of electricity from the grid. Although incremental, it all adds up. Likewise, leaving lights on will not only kill the lightbulb faster, it will also increase your electricity costs. On average, lights make up 25 to 30% of a home electric bill every month.

Repair Your Clothing If Possible

If it's possible to repair clothing instead of throwing it away, try and do that. Or, if you're looking to buy the exact same item as a replacement for the damaged piece, see what it would cost to get it professionally repaired by your local seamstress or leatherworker.

Install Heat Pumps In Your Home

While the cost of these may seem exorbitant upfront—between $3,000 and $5,000 to install—the average utility savings on these units is roughly $400 per month, meaning they'll pay for themselves after the first year of use. Get at least one installed in your home—they're more energy-efficient and cheaper than traditional heating methods.

Use Drying Racks Instead Of Dryers

With most homes having reliable heating sources like heat pumps these days, there's almost no reason to use a dryer to dry your clothes. Simply set up a drying rack in front of your heat pump and let the hot air do its job. Clothes dryers are good if you're having to do multiple loads of laundry per week, but if not, it may be best to go the rack method.

Buy Refurbished Electronics

If you find yourself wanting a new phone or laptop, check to see if retailers offer a refurbished option. They might not have it for the current model year, but given that the technology changes are rarely ground-breaking, you may get a great deal on a refurbished model from the previous year that's just as good as your current phone or laptop, if not better.

Explore House- Or Pet-Sitting To See A New Location

If you want to take a vacation, a great option to save accommodation costs is to explore pet-sitting or house-sitting websites or posts on Facebook to see if you can stay at a person's home for free and look after their pets—all while getting a nice vacation out of it and giving others peace of mind.

Explore Public Transit Before Purchasing A Vehicle

It's certainly true that public transit or transportation without a vehicle (in general) can be difficult in North America. Depending on where you live, you may have no choice but to own a car. However, if you do live somewhere with a public transportation system, see if you can use it to get around, rather than buying your own car and all the additional expenses that come along with it.

Clean Out Your Pantry Every Two Weeks

If you have a food cupboard that doesn't get a second look, make 2025 the year that you go through and use it up. You may find ingredients you thought you didn't have and can squeeze another week's worth of meals out of what's in there. Make a plan to go through and use up your pantry items every couple of weeks. You'd be amazed at what you can make with the small amounts of leftover basics.

Take Shorter Showers

This doesn't mean leaving yourself unclean, but rather, being quicker about the cleaning process. Half-hour showers are awesome when you're not paying for the heating or water—but can mean an exorbitant bill at the end of the month if you take long showers. We don't blame you, we're just saying it's expensive.

Potlucks Over Dinners Out

While a dinner out with your friends can be a wonderful opportunity to socialize, they can also be very expensive endeavors. Plan to have a potluck with your friends instead of going to an expensive restaurant—this might even give you a chance to make your friends the guinea pigs for a new recipe.

Reuse And Recycle

Rather than throwing old items out (including old furniture), there's likely a new use for them. Scour Pinterest for inspiration and turn the old into something new again! Turn an oyster shell into a trinket dish (once cleaned out and sanitized), for example.

Switch To LED Bulbs

LED light bulbs are now basically the light bulb standard across the US—for good reason. They're far more energy efficient than their predecessors, and the Department of Energy estimates that you can save up to $225 per year just by using LED bulbs over traditional light bulbs.

Use Online Resources To Learn New Skills

While good, reputable tradespeople are worth their weight in gold, you don't have to get a tradesperson in to fix certain things in your home. There are many online options, including millions of free YouTube tutorials, that can teach how to do things like change your oil, or fix your lawnmower, or millions of other simple tasks. Save the money and learn how to do it yourself.

Sign Up For Cashback

Cashback is now being offered by Rakuten and a host of other companies for purchases made online. You sign up for cashback via the company website, then whenever you make an online purchase, you usually receive between 1% and 5% cashback. You'll either get a monthly cheque, or a PayPal deposit. It's a great way to get a few dollars back and can come in handy for bigger purchases.

Use A Grocery Store That Provides Member Rewards

Several grocery store chains provide member rewards like special pricing or points that can be used in exchange for cash payments. You may have to spend a certain amount to get them, but these points can be used once a year for Christmas dinner fixings, for example, and nearly pay for the whole thing.

Engage In Low-Cost Hobbies

Some hobbies can be very expensive to maintain. Things like photography as a hobby can very quickly morph into thousands of dollars of expenses. Engaging in low-cost hobbies like a weekly billiard league, gardening, or board game nights and more is a great way to socialize and keep your brain engaged.

Plant A Garden

Speaking of gardening... Planting a garden is an excellent way to save on food costs. While you'll need to spend a little money upfront on the supplies and the money to create the garden space or build garden beds, it'll soon take you just 10 minutes to water the garden and that's all you'll have to do. You can plan your garden to be a year-round thing, or just in the summer. The average garden can reap $600 worth of food per year and costs just $70 to begin.

Find Low-Cost Forms Of Exercise

Sure, the gym can be a great place to get your workouts in. But gym memberships can also be very expensive—between $40 and $70 per month. You could save on that cost by working out at home, buying your own weights and a weight bench, and walking or running outside. In the colder months, you could also get a treadmill for the cost of an annual membership at the gym.

Compare Insurance Providers

See what your insurance costs are for 2024, then resolve to spend the Christmas holidays or early part of the New Year looking for a new provider, especially if your rates are going up in 2025. Call around and see what you can get for a quote from different providers. You might be surprised how much you'll save.

Barter Services With Friends And Neighbors

Bartering is a lost art form of sorts. If you're in need of a service, whether that's your lawn mowing or someone to babysit your kid(s) for an hour or two, think of a service that you could offer to your friends or neighbors in exchange for their help. While you can certainly pay to have these services done for you, it may well be that a bartering arrangement with friends and neighbors can save (or significantly reduce) that expense.

Don't Spend On Non-Essentials

This is a good policy to implement year-round, but even if you just shorten your "no-spend on non-essentials" policy for just a month, you may see some eye-watering savings that you weren't expecting. It will also give you a greater appreciation for what is a necessity.

A Cost Of Living Crisis

Most people in the United States are definitely experiencing a cost of living crisis. A stunning 77.6% of Americans' income goes towards their cost of living—that is the basic necessities of sustaining a reasonable quality of life, without extravagant purchases. While the cost of living crisis might not be resolved by the above measures, we hope they'll help you reduce your overheads where you can.