15 Money-Saving Habits That You Can Implement Today

Whether you're saving for a big trip or trying to buy a house, there's no reason why your money-saving habits can't be started today. Not as a New Year's Resolution that you'll not keep for more than a week, but realistic saving habits that you can implement right now to help you meet your financial goals.

If you have big financial goals, it helps to break them down into more bite-sized, manageable savings goals to start with. That down payment on your dream home may seem impossible until you break it down into monthly savings goals. Or saving for the new car may seem impossible until you start putting money away and hey, presto! In 12 months, you may have enough to buy it. Let's go over 15 money-saving habits that you can implement today.

Ensure Your Savings Are Automated

The last thing you want is to have to think about saving money because then you'll start thinking about all the other things you need to pay for and nothing will ever be saved. Open a savings account of some sort and then ensure that your deposits into that account are automated from your paycheck. Set the amount to be as little as you think you can afford, even $20 goes a long way over time. Automating this process will mean less hassle and less chance of the money being used for something else.

Titipong Chumsung, Shutterstock

Titipong Chumsung, Shutterstock

Save A Little To Save A Lot

Most people who are not independently wealthy have had to start saving from somewhere. The most important aspect of saving is that you start. Even if you're only throwing $5, $10, or $20 in a savings account (or piggy bank) every paycheck, you'll eventually reach your financial goals.

Use Automatic Payments

Missing a payment can land you in huge trouble with whomever you've not paid. Instead of remembering to pay your bank, landlord, or electricity company, set up recurring payments for a specific date each month. Not only will this increase your credit score over time, but you'll also never miss a payment date.

Set Up An Emergency Fund

Most of us are living from one paycheck to the next and unsure of where our 'rainy day' fund is going to come from. Setting up a third bank account alongside your savings and checking accounts to use as an emergency fund is always a good idea. You can even set up automatic payments into this one too, so that every paycheck, you set a little aside for life's unexpected expenses.

Vitalii Vodolazskyi, Shutterstock

Vitalii Vodolazskyi, Shutterstock

Check Your Account Balances Daily

It's a good idea to check your account balances in the mornings, or at least once a day. This will help you keep track of how much money you have to spend each day (particularly if you're living frugally) and stop you from overspending whimsically. Additionally, it will help you track payments and detect any suspicious transactions well before they become bigger deals than a single unauthorized payment.

Organize Your Receipts As You Receive Them

It's time to Marie-Kondo your receipts: "Don't put it down, put it away," as she said. Get yourself a receipt folder or booklet of some sort and organize your receipts from any purchases you make that may be tax deductible, particularly if you're a small business owner. By keeping your receipts organized, you'll lessen the headache come tax time.

Create A Monthly Budget

You can begin today, but it always helps to create a monthly budget of your incoming pay and outgoing expenses, even if you create one retroactively to last month to give you an idea of where your money is going. By creating a monthly budget, you'll have a long-term view of where your money goes and whether it's being spent in service of, or to the detriment of your long-term financial goals.

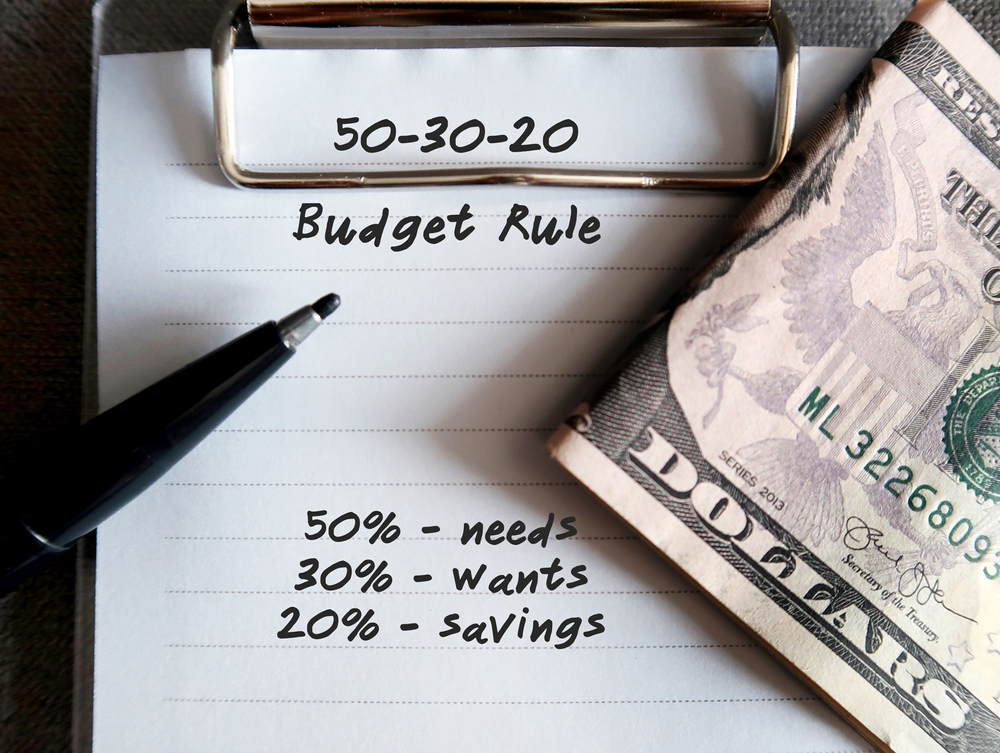

Learn About The 50/30/20 Rule

Take your paycheck and look at the amount you have currently. Whether it comes in once a month, weekly, bi-weekly, whatever. Now, do the following math on paper: set aside 50% of your paycheck for your needs. These are things like rent, food, water, electricity, transportation, etc. Then, set aside 30% of your total paycheck for things you want. For example, you might want to attend that concert in the summer. Or you might want a new pair of hiking boots. Finally, set aside 20% of your paycheck for "Future You"—this can be buying your first home a new car, or a long-awaited vacation.

Please note that this isn't hard and fast—life happens. It's okay not to set aside exactly this amount every month into savings or for wants, just try and develop it habitually over the long term.

Create A Money Journal

This is an interesting technique that enables you to dispel money lies that you've been told or have been telling yourself, and be honest with yourself about how you've spent money in the past and what financial mistakes you've made that you'd not revisit. Ask yourself whether there are financial moves you can make to help you become more financially secure (for example, investing in a different type of savings account).

Give Yourself A Gift With Extra Funds

If you get a raise at work or receive a small inheritance, or some extra birthday money, it is well worth giving yourself a little (or big) gift that's just for you. Buy that camera lens you've been looking at, or treat yourself to a nice, lavish meal. Or, go to your favorite restaurant with your partner: make it a date night.

Speak To A Financial Advisor

Even if you only go and see your financial advisor once a year, it may be more than worth the cost of a visit to get some professional advice on your finances and how to make your money go further and work for you. If you don't have a financial advisor yet, set up an appointment with one—the first one might even be free, but you'll learn a lot about what your money situation is and how you can make it better.

Applaud Your Small Victories

When you're trying to save, it's important to give yourself credit where it's due! Hey, you saved your first $100! You didn't spend any money on Amazon impulse buys this month! Don't forget to pat yourself on the back for your small financial wins—this will only encourage you to think "onwards and upwards!"

One "No-Spend" Weekend A Month

If you're able, set yourself a goal of not spending any money for one weekend a month (to start). There are plenty of things that you can do (even with your significant other or family) that are low-cost. A trip to a local beach or park, for example. Sure, there's minimal gas expense to get there, but you can pack a picnic and make a day out of it!

ORION PRODUCTION, Shutterstock

ORION PRODUCTION, Shutterstock

Buy In Bulk

If possible, when buying groceries, buy things in bulk and make meals that last. Simple ones include spaghetti, chili, or stews that can be frozen and reheated easily, and are easy to put together with items that you buy in bulk. If your grocery budget allows, visit a store like Costco to shop for your groceries, rather than making multiple smaller trips to your local grocer. Buying (and making) food in bulk is a great way to reduce your repetitive costs over the long haul.

Vladyslav Starozhylov, Shutterstock

Vladyslav Starozhylov, Shutterstock

Buy That Coffee

Life should be about enjoyment and if that means that you buy a latte or treat yourself to a meal every so often, then that's what you should do. Yes, it's going to make a small dent in your savings goals, but if you have the extra money to treat yourself to something, then you should. Life is not all about money.