The Hottest Stocks That Wealthy Investors Are Betting On

Millionaire investors have the resources and experience to identify stocks with massive growth potential. By analyzing their portfolios, everyday investors can gain insight into companies poised for long-term success.

Nvidia

Nvidia (NVDA) is at the forefront of artificial intelligence, powering industries from gaming to autonomous vehicles. Its dominance in GPUs makes it one of the most sought-after stocks in the millionaire investor space.

Nvidia’s Explosive Growth

Nvidia’s stock has soared due to the increasing demand for AI chips in cloud computing and data centers. With a strong position in the semiconductor industry, it remains a high-growth pick for wealthy investors.

Apple

Apple (AAPL) has built an ecosystem of devices and services that keep customers engaged for years. Its massive cash reserves and strong brand loyalty make it a reliable investment.

Apple’s Expansion Into AI

Apple is integrating artificial intelligence into its devices to enhance user experience. Investors see this as a key driver for future growth, particularly in iPhones and MacBooks.

Microsoft

Microsoft (MSFT) dominates the enterprise software market with Office 365 and Azure. Its cloud computing business is a primary reason millionaires continue to invest.

Microsoft’s AI Ambitions

The company’s investment in OpenAI has positioned it as a leader in generative AI. Azure’s integration of AI tools is expected to drive revenue growth in the coming years.

Amazon

Amazon (AMZN) remains a top millionaire stock pick due to its online retail dominance. Prime membership and logistics infrastructure provide a competitive advantage.

Amazon Web Services Drives Profits

Amazon Web Services (AWS) is the backbone of the internet, generating most of Amazon’s profits. The growth of cloud computing ensures Amazon remains a long-term winner.

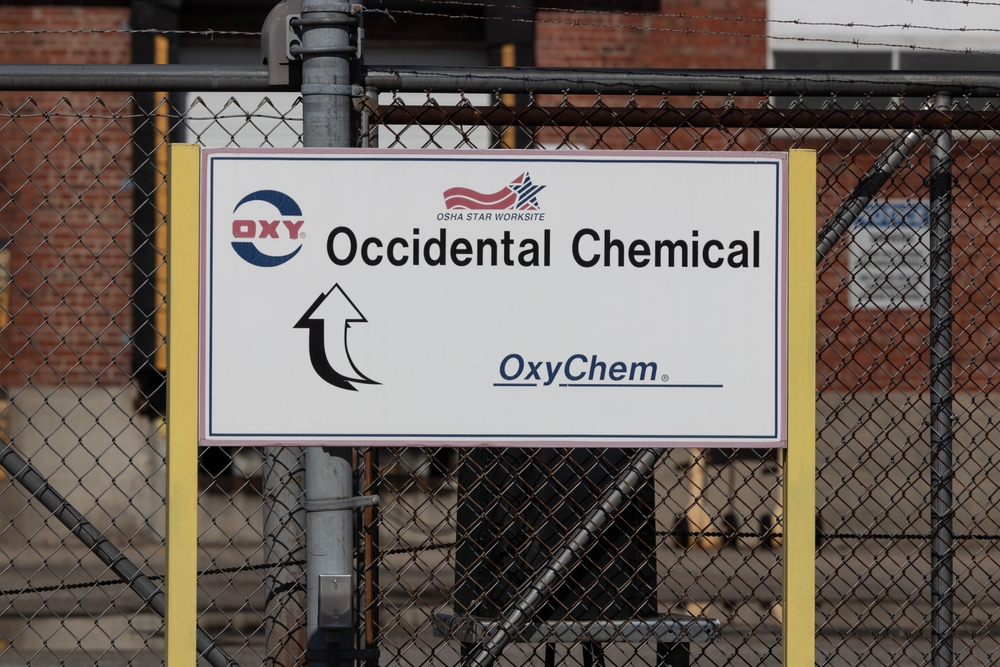

Occidental Petroleum

Occidental Petroleum (OXY) is a major player in the energy sector, specializing in oil and gas exploration. With increasing global energy demand, this stock has gained the attention of wealthy investors.

Occidental’s Warren Buffett Connection

Warren Buffett’s Berkshire Hathaway has been aggressively buying Occidental stock, signaling strong confidence in its long-term potential. Investors see this as a key indicator of the company’s value and resilience.

Chip Somodevilla, Getty Images

Chip Somodevilla, Getty Images

Meta Platforms

Meta Platforms (META) dominates digital advertising with Facebook, Instagram, and WhatsApp. It continues to innovate with AI-driven recommendations and monetization strategies.

ProducerMatthew, CC BY-SA 3.0, Wikimedia Commons

ProducerMatthew, CC BY-SA 3.0, Wikimedia Commons

Meta’s Virtual Reality Vision

Meta is betting on the Metaverse with its Reality Labs division. While risky, this long-term play could redefine online interaction and commerce.

Frame Stock Footage, Shutterstock

Frame Stock Footage, Shutterstock

Merck KGaA

Merck KGaA (MRK.DE) is one of the world’s oldest and most respected pharmaceutical and chemical companies. With a strong presence in biotech and healthcare, it continues to attract wealthy investors.

Merck KGaA’s Acquisition Strategy

Merck is actively looking to expand its pipeline through acquisitions, as seen in its recent talks to acquire US-based cancer treatment company SpringWorks. Investors view this growth strategy as a key factor in its long-term success.

Align Technology

Align Technology (ALGN) is the company behind Invisalign, the market leader in clear dental aligners. The shift away from traditional braces has made it a strong investment choice for the wealthy.

wedmoments.stock, Shutterstock

wedmoments.stock, Shutterstock

Align Technology’s Market Dominance

As more people opt for clear aligners over metal braces, Align Technology continues to capture a growing share of the orthodontic market. Millionaire investors see this trend as a long-term revenue driver.

Broadcom

Broadcom (AVGO) designs chips for networking, data centers, and smartphones. Its strong position in 5G technology makes it a favorite among high-net-worth investors.

Broadcom’s Acquisition Strategy

Broadcom grows through strategic acquisitions, recently purchasing VMware to expand its software footprint. This diversified approach attracts long-term investors.

Starbucks

Starbucks (SBUX) maintains a loyal customer base worldwide. Its expansion into new markets ensures steady revenue growth.

Starbucks’ Focus On Digital Sales

Mobile ordering and loyalty programs drive repeat business. Millionaires see this as a key factor in the company’s ability to scale.

Kaspars Grinvalds, Shutterstock

Kaspars Grinvalds, Shutterstock

PDD Holdings

PDD Holdings (PDD), the parent of Temu, is rapidly gaining market share in global e-commerce. Its aggressive pricing strategy makes it a disruptive force in online retail.

Danille Nicole Wilson, Shutterstock

Danille Nicole Wilson, Shutterstock

PDD’s International Expansion

PDD is expanding beyond China, bringing its low-cost marketplace to international customers. Investors see this as a sign of future revenue growth.

Oracle

Oracle (ORCL) is a key player in cloud computing and database management. Its focus on AI-powered applications has helped maintain its dominance.

Oracle’s Cloud Transition

Oracle has shifted from traditional software sales to cloud-based subscription models. This transition provides stable, recurring revenue that investors love.

svetlichniy_igor, Shutterstock

svetlichniy_igor, Shutterstock

Berkshire Hathaway

Warren Buffett’s Berkshire Hathaway (BRK.B) is a popular pick among millionaire investors. Its diversified holdings make it a relatively low-risk investment.

Berkshire Hathaway’s Strong Performance

Buffett’s strategy of buying undervalued businesses has led to decades of superior returns. Many investors follow his moves closely when making stock decisions.

Nike

Nike (NKE) continues to lead the sports apparel industry with strong brand recognition. Its direct-to-consumer strategy has boosted profitability.

Nike’s Sustainable Growth Strategy

Nike is investing in sustainability and digital innovation to appeal to younger consumers. Investors see this as a way to future-proof the company.

Christian Bertrand, Shutterstock

Christian Bertrand, Shutterstock

Costco

Costco (COST) benefits from a loyal customer base willing to pay membership fees. This creates steady revenue even during economic downturns.

Costco’s Expansion Plans

The company is aggressively opening new locations worldwide. Investors view this as a sign of continued long-term growth.

Own work, CC BY-SA 3.0, Wikimedia Commons

Own work, CC BY-SA 3.0, Wikimedia Commons

Visa

Visa (V) dominates the digital payments industry, processing billions of transactions daily. Its business model thrives as the world shifts away from cash.

Visa’s Cross-Border Growth

International transactions are a key area of growth for Visa. As global travel rebounds, this revenue stream continues to expand.

Mastercard

Mastercard (MA) benefits from the same trends driving Visa’s success. Its focus on security and AI-driven fraud prevention attracts high-net-worth investors.

Mastercard’s Blockchain Initiatives

Mastercard is exploring blockchain technology for secure financial transactions. This innovation could provide long-term upside potential.

Uber

Uber (UBER) dominates the ride-hailing and food delivery industries. Investors see its expansion into logistics as a major growth driver.

Uber’s Profitability Push

The company is prioritizing profitability over rapid expansion. This shift is appealing to long-term investors looking for sustainable returns.

Airbnb

Airbnb (ABNB) has revolutionized short-term rentals and continues to expand. Its ability to adapt to changing travel trends makes it a favorite stock among the wealthy.

Food Impressions, Shutterstock

Food Impressions, Shutterstock

Airbnb’s International Growth

New markets in Asia and Latin America provide untapped revenue potential. Investors believe this will drive Airbnb’s long-term valuation higher.

Netflix

Netflix (NFLX) pioneered the streaming industry and continues to dominate with its original content and international expansion. Millionaire investors see it as a long-term winner in the entertainment space.

Netflix’s Strong Subscriber Growth

Despite competition from Disney+ and other platforms, Netflix’s global subscriber count keeps growing. Its ability to adapt to market trends ensures continued profitability.

Sirius XM

Sirius XM (SIRI) is a leading satellite radio provider, offering exclusive content and subscription-based services. Its business model provides steady revenue, making it a strong pick for millionaire investors.

Sirius XM’s Competitive Edge

Unlike traditional and online radio platforms that rely heavily on ads, Sirius XM generates most of its revenue from subscriptions. This income stream makes it attractive to investors, especially during economic downturns when ad budgets shrink.

Tesla

Tesla (TSLA) revolutionized the auto industry with electric vehicles and battery innovations. Its global expansion keeps it at the forefront of millionaire portfolios.

VanderWolf Images, Shutterstock

VanderWolf Images, Shutterstock

Tesla’s Self-Driving Technology

With billions invested in full self-driving software, Tesla aims to lead the autonomous vehicle market. If successful, this could significantly increase the company’s valuation.

McDonald’s

McDonald’s (MCD) has a massive global footprint, making it a recession-proof investment. But many of us forget about its real estate holdings, which add another layer of financial security that's attractive to investors.

McDonald’s Digital Innovations

The company has invested heavily in digital ordering and delivery services. This modernization ensures it remains relevant in the fast-food industry.

Invest Like A Millionaire

Millionaires don’t just invest in any stock—they focus on companies with strong fundamentals, innovation, and long-term growth potential. By following their stock picks, everyday investors can identify promising opportunities for wealth-building.

You May Also Like:

The Best Performing Stocks Of 2025 So Far

30 Things You Shouldn't Do With Your Money, According To Warren Buffett