Being financially free means being able to live your life the way you want without worrying about money. Such a concept may be unfathomable to some, especially for those living paycheck to paycheck, but it's definitely not impossible to achieve. All it takes is a bit of planning and a willingness to commit.

There are different ways to achieve financial freedom. For property investor Todd Baldwin, real estate is the way to go. In 2021, he made over $1.5 million from sales and rentals, revealing the key to his success was staying focused: "I didn't party, I didn't go on vacation. I didn't even really see my friends. But by the time I was 25, I had a net worth of $1.2 million." Baldwin added that he left his 9-to-5 job to invest in properties full time and that he could retire tomorrow and never have to work a day in his life. "Take a small chunk of years and blitz. That's the way I did it."

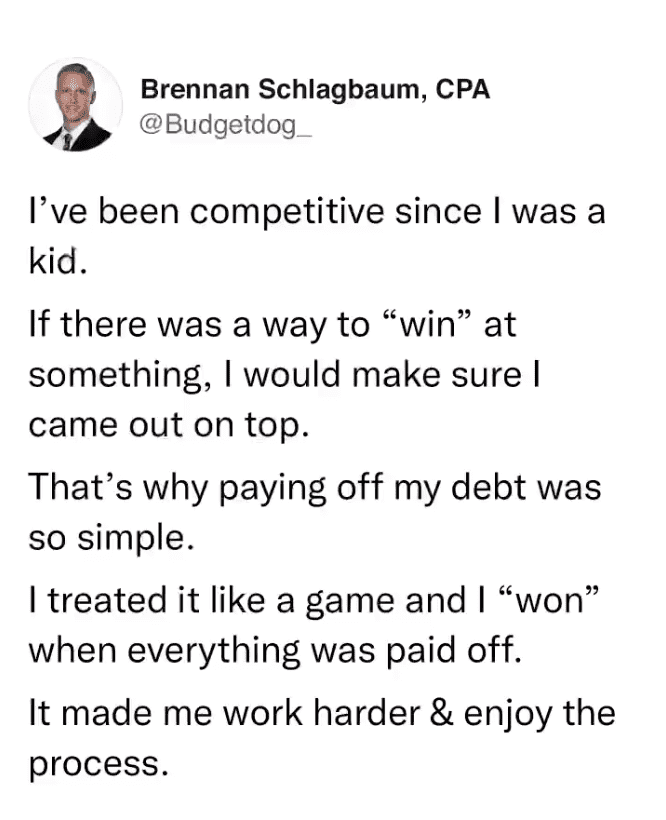

Brennan Schlagbaum, a finance coach, took a different route. He started his company Budgetdog on the side for additional income, but it ended up raking in more dollars than his CPA job. Once the revenue became stable enough, he quit his CPA job to focus on his business full-time. Now, he's his own boss, making upwards of $28,000 a month. Perhaps the most impressive part about Budgetdog is that it started off as an Instagram account where he'd give advice to people from a dog's perspective. Schlagbaum's journey proves that small ideas can yield big returns if you give them a chance to flourish.

Yet another success story comes from Ali and Josh Lupo, who achieved financial freedom by cutting down their work hours. Ali, in particular, went from working five days a week to two, explaining that full-time work became too physically and emotionally taxing during the height of the Covid pandemic. Before making that decision, she crunched the numbers with her husband Josh and they both determined that they could still manage to retire by 40 if she switched to part-time. Now, they are using their spare time to build their own brand, The FI Couple. The Lupos proves that sometimes less really is more.

The moral of these stories is that there isn't only one way to make a living. 9-to-5 jobs are great for stability but there are so many other options out there to explore. It can be intimidating to dive into unfamiliar waters but with some courage and an open mind, you might just find yourself a million-dollar solution to your financial plight.