See How These Famous Investors Made Their Millions

Chances are you've heard of Warren Buffett. The "Oracle of Omaha" is a legend in the investing business, but what about other investors who don't just buy and hold in the S&P 500? Let's explore the investing strategies of famous investors and see how they made their millions.

Mark Cuban

Mark Cuban, the famed owner of the Dallas Mavericks basketball team and creator of Shark Tank, has long been investing in profitable businesses, after founding a software company in the early 20s. His stock picks include Amazon, Meta, Alphabet, Uber, Tesla, Nike, Gamestop, Philip Morris International, and Robinhood Markets. He has a net worth of approximately $5.7 billion.

Gage Skidmore, CC BY-SA 2.0, Wikimedia Commons

Gage Skidmore, CC BY-SA 2.0, Wikimedia Commons

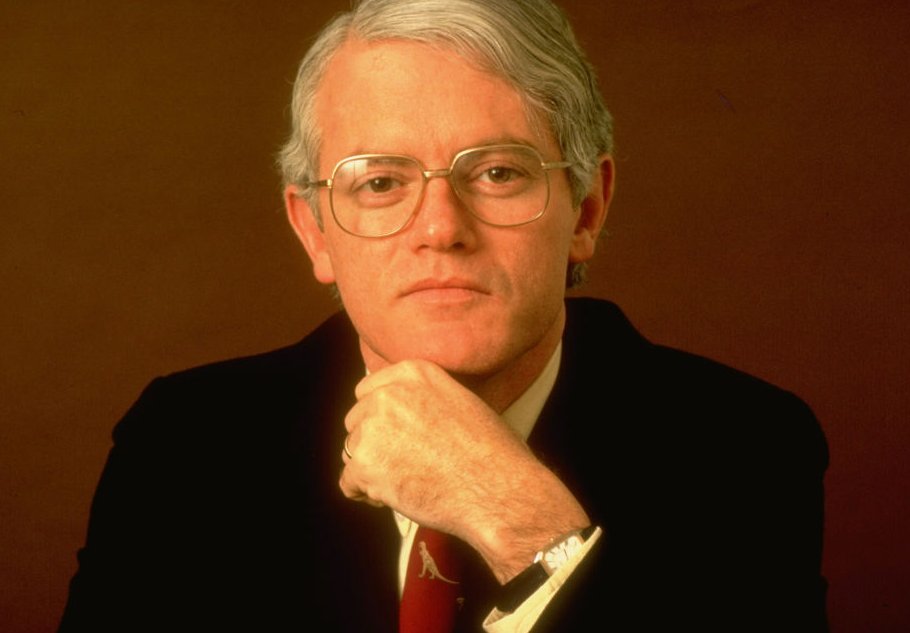

John D Arnold

Here's a name you may not have heard of: John D Arnold. He's a billionaire who made his money in the early 2000s after the collapse of Enron. He created a $750 million company in its wake, beginning the Centaurus Advisors hedge fund in 2007, retiring from the company with a $3.3 billion net worth by 2012.

Bloomberg Wealth: John Arnold, David Rubenstein

Bloomberg Wealth: John Arnold, David Rubenstein

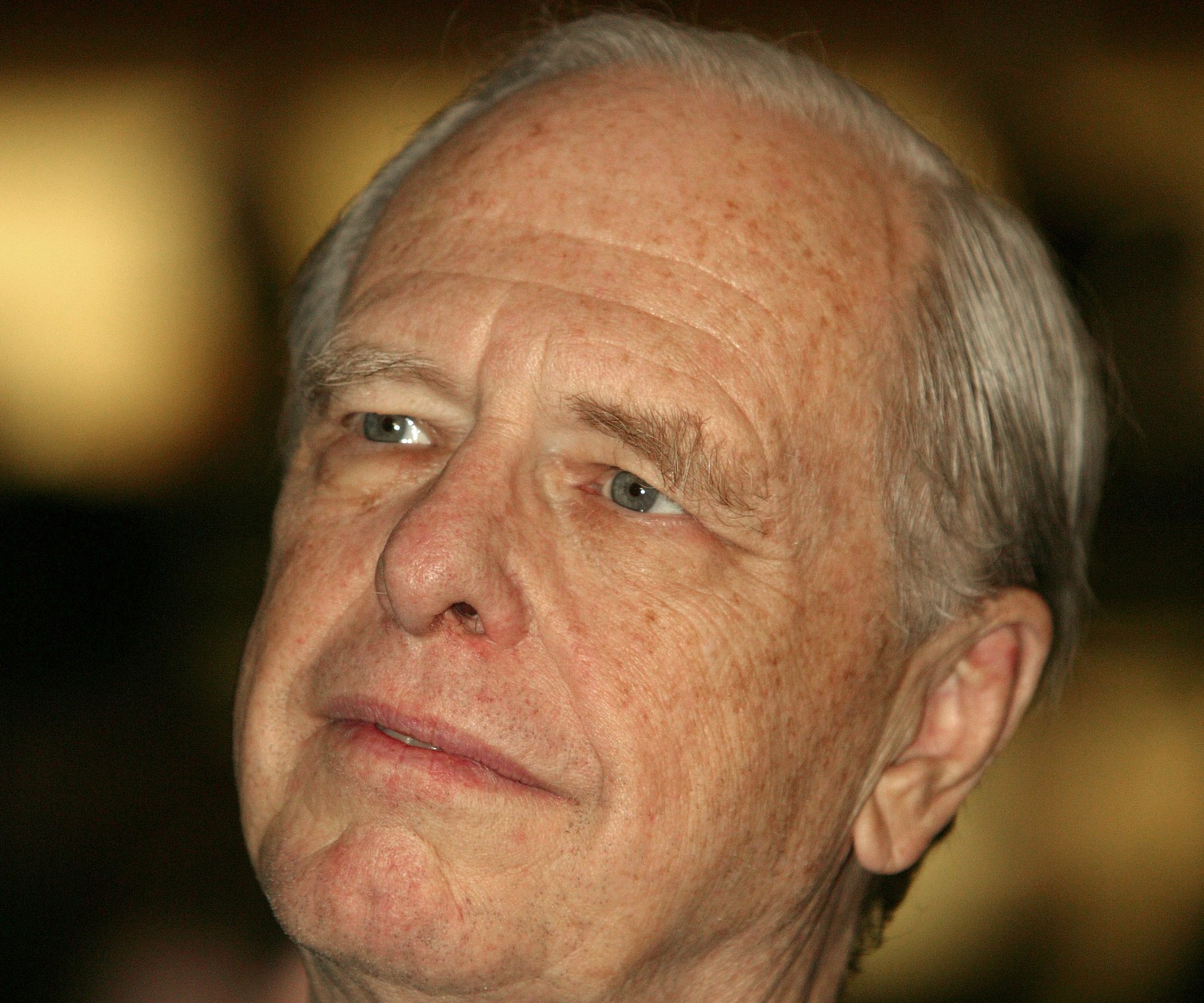

Stanley Druckenmiller

Part lead portfolio manager for George Soros, part Duquesne Capital founder in 1981, Stanley Druckenmiller led Soros' Quantum Fund to a $1 billion gain by shorting the British Pound in 1992. Druckenmiller's direction led Duquesne to gain $260 million during the stock market crash of 2008. His net worth? $6.2 billion. Among his top stock picks are Natera Inc, Coherent Corp, Woodward Inc, and TEVA Pharmaceuticals.

Chase Coleman III

Worth a stunning $5.7 billion, Chase Coleman III founded Tiger Global Management with help from Julian Robertson, one of the most successful hedge fund managers of the 1980s. Meta and Microsoft made up his top investments of last year, although Tiger Global had a value of nearly $12 billion.

ajay_suresh, CC BY 2.0, Wikimedia Commons

ajay_suresh, CC BY 2.0, Wikimedia Commons

Daniel Loeb

Founder of the New York-based hedge fund Third Point, Daniel Loeb was an investing star even in college (where he was classmates with Barack Obama), but he ended up losing $120,000 on a bad investment. He turned that fortune around quickly, founding Third Point in 1995. Today, he's valued at $3.3 billion and his stock picks are PG&E, Amazon, the Danaher Corporation, and Meta.

Dan Loeb Says Hedge Funds Are Getting Killed: Bottom Line, CNBC

Dan Loeb Says Hedge Funds Are Getting Killed: Bottom Line, CNBC

Bill Ackman

Bill Ackman is a hedge fund manager for Pershing Square Capital Management, generating a 17.1% return between 2003 and 2021. Ackman tends to purchase large stakes in publicly-traded companies, then works on reorganizing or restructuring them to perform better. His top stock picks are in Alphabet, Uber, and Brookfield Corp. Ackman's net worth is a staggering $3.7 billion.

John Paulson

John Paulson is another hedge fund manager who's investment strategy is all about broad diversification, as he owns several stocks from each sector. Unfortunately, Paulson is one of those who benefited most from the subprime mortgage crisis of 2008, netting a cool $4 billion from investing in credit default swaps. His net worth presently sits at $3.5 billion.

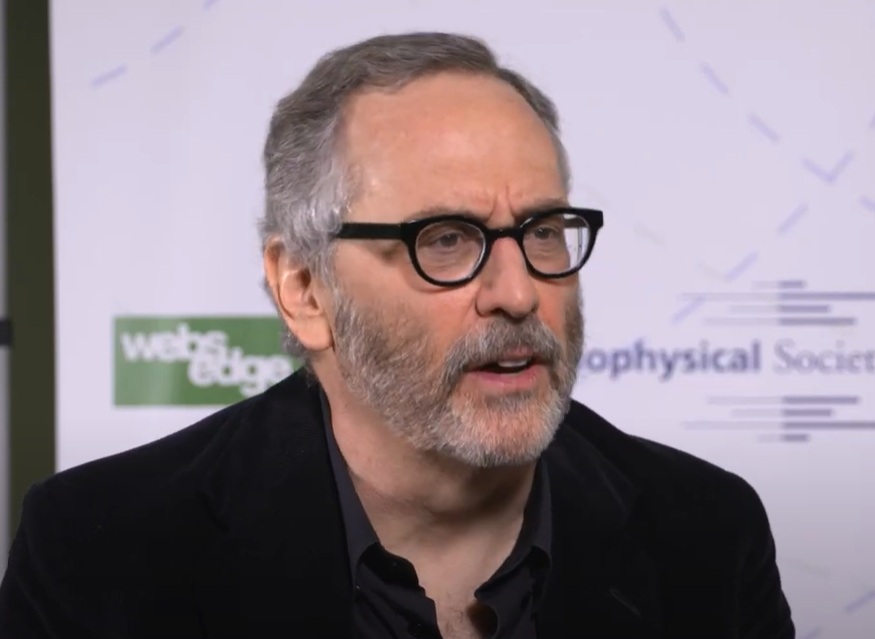

David Shaw

David Shaw is one of the most innovative names in the stock market industry. He's the founder of DE Shaw, a hedge fund that utilizes proprietary computing software to uncover inefficiencies in financial markets, then takes advantage of them. Shaw's now got a backseat role at DE Shaw, but he's made his billions already and is worth $8.3 billion.

2016 National Lecturer with David E. Shaw, PhD, WebsEdge Science

2016 National Lecturer with David E. Shaw, PhD, WebsEdge Science

Charlie Munger

Warren Buffett's right-hand man, Charlie Munger, was the Vice Chairman of Berkshire-Hathaway, but began his career by working in the grocery store owned by Buffett's grandfather, Ernest Buffett. Despite his passing in 2023, Munger's stock portfolio continues to do well for his company, the Daily Journal Corporation. He had investments in BYD and Alibaba, along with many domestic banks, like Bank of America, Wells Fargo, and US Bancorp.

Nick Webb, CC BY 2.0, Wikimedia Commons

Nick Webb, CC BY 2.0, Wikimedia Commons

Philip Fisher

One of America's most famous investors from the mid-20th century, Philip Fisher was a strong proponent of growth investing. That is, investing in companies that show promising above-average returns. He published a well-loved book on the topic in 1958. Although his stock portfolio isn't public, we can speculate that he made great decisions and invested in the companies of the future in the post-war United States.

Thomas Rowe Price Jr

Thomas Rowe Price Jr is the investor that gave rise to Philip Fisher. Known as the "father of growth investing," Thomas Rowe Price Jr began the T Rowe Price Group in 1937, which was revolutionary in that it charged a fee for assets under management, rather than charging a commission, which was standard practice at the time. Price Jr invested in IBM and Xerox, although his net worth went unreported until his death in 1983.

Wallstreethotrod, Wikimedia Commons

Wallstreethotrod, Wikimedia Commons

Paul Singer

Another hedge fund manager who uses their financial capital to push for changes in a company. Paul Singer's Presidency and co-CEO position at Elliott Management allows him to push for changes over his various stock picks, namely in Triple Flag Precious Metals Corp, Marathon Petroleum, and Howmet Aerospace. His overall net worth? $6.1 billion.

World Economic Forum, CC BY-SA 2.0, Wikimedia Commons

World Economic Forum, CC BY-SA 2.0, Wikimedia Commons

Seth Klarman

Seth Klarman is another billionaire hedge fund manager, president of Baupost Group and writer of a book called Margin of Safety, which currently sells for about $1,500. Klarman is another subscriber to the value investing strategy, following in the footsteps of Ben Graham. He has holdings in Restaurants Brands International, Sunrise Communications AG, and Ferguson Enterprises Inc. His net worth is $1.3 billion.

Maryland GovPics, CC BY 2.0, Wikimedia Commons

Maryland GovPics, CC BY 2.0, Wikimedia Commons

Joel Greenblatt

Another value investor on our list of America's top 40 is Joel Greenblatt. Founder of Gotham Asset Management and Value Investors Club, a social media website where investors can discuss their portfolios, Greenblatt's portfolio holds shares in Nvidia, the S&P 500, Apple, Gotham, and iShares Exchange-Traded Funds (ETFs). His net worth is about $1 billion.

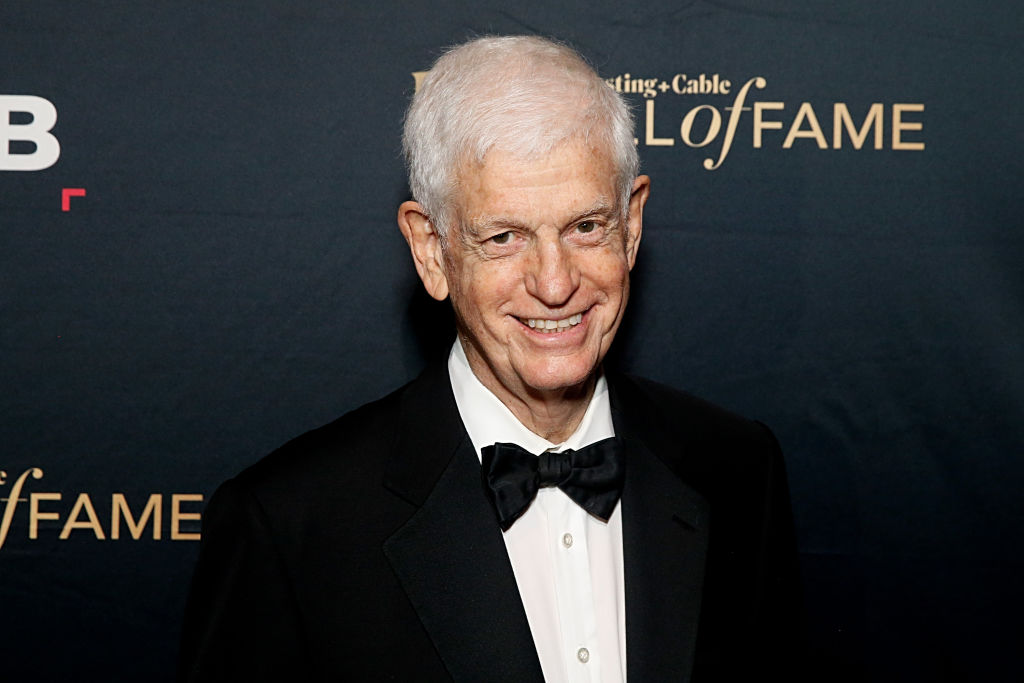

Edward Johnson III

Fidelity Investments is one of America's top investment firms, founded by Edward Johnson III and his father. Edward Johnson III began his professional career in his father's investment firm as an analyst and helped grow his fortune. Truly a family affair, before Johnson passed away, he handed control of Fidelity over to his daughter Abigail, along with a sizable portion of his $8.2 billion net worth.

Harold Clark Simmons

A pioneering investor, Harold Clark Simmons invented the concept of a "leveraged buyout," or acquiring a company using debt, by placing the company's assets as collateral for the loan. This sometimes predatory practice did make Harold Simmons very rich, to the tune of almost $9 billion.

Billie Grace Ward, Wikimedia Commons

Billie Grace Ward, Wikimedia Commons

Ronald Perelman

Investment diversification is the name of Ronald Perelman's investment game. Owner of MacAndrews & Forbes, a private diversified holding company, Perelman has a net worth of $1.7 billion and his stock portfolio includes beauty companies like Revlon and vTv Therapeutics.

David Shankbone, CC BY 3.0, Wikimedia Commons

David Shankbone, CC BY 3.0, Wikimedia Commons

Leon Cooperman

Cooperman is a true rags-to-riches story. After graduating from university with an MBA (which he paid for by working at Xerox as a quality control engineer), he began working for Goldman Sachs and became a portfolio strategist. Omega Advisors was his own investment firm from 1991 to 2016. His stock portfolio includes the Las Vegas Sands Corporation, Elevance Health and KBR Inc, a company operating in the STEM field. His net worth is approximately $2.8 billion.

Kenneth Fisher

Remember Philip Fisher, who we covered earlier? Ken Fisher is his son. Keeping with the family business, he founded Fisher Asset Management in 1979 and his top three stock picks are Apple, Amazon, and Microsoft. Fisher The Younger's net worth is approximately $7.1 billion.

Erin A. Kirk-Cuomo, Wikimedia Commons

Erin A. Kirk-Cuomo, Wikimedia Commons

David Abrams

Lithia Motors, one of America's largest used car dealerships, received a sizable investment from Abrams Capital, owned by David Abrams, one of the top 22 wealthiest people in the country. With a net worth of roughly $3.4 billion, Abrams is a value investor and obviously made a smart play by investing in a used car dealership like Lithia.

Ian Poellet, CC BY-SA 3.0, Wikimedia Commons

Ian Poellet, CC BY-SA 3.0, Wikimedia Commons

Mario Gabelli

Mario Gabelli is one of Wall Street's most celebrated investors: winning the Morningstar Fund's Investment Manager of the Year in 1997 and the Institutional Investor's Manager of Year in 2010, Gabelli's GAMCO Investments makes billions every year, including netting Mr Gabelli a personal net worth of $1.7 billion. His personal top three holdings are Herc Holdings Inc, a heavy equipment rental business; GATX Corporation, a transportation company dealing with rail transporting; and Mueller Industries, which specializes in producing industrial piping.

John Bogle

John Bogle was the founder of the Vanguard Group, one of the world's top investment funds. Known as the father of index funds, John Bogle investment portfolio was once worth $4.2 trillion, but his actual net worth is unknown.

BillCramer, CC BY-SA 4.0, Wikimedia Commons

BillCramer, CC BY-SA 4.0, Wikimedia Commons

David Tepper

Founder of Appaloosa Management LP in 1993, Tepper is a sports fan and owns a number of sports teams, including Charlotte FC of the MLS and the Carolina Panthers of the NFL. Worth $20 billion, Tepper's portfolio includes Nvidia, Meta, and Microsoft.

Appaloosa Management, CC BY-SA 3.0, Wikimedia Commons

Appaloosa Management, CC BY-SA 3.0, Wikimedia Commons

Jim Simons

A mathematician at heart, Jim Simons pioneered quantitative investing, an investment strategy with an awful lot of math involved, but clearly it yielded results for Simons. His net worth is now $30.7 billion, while his hedge fund, Renaissance Technologies, manages $69 billion worth of assets.

BillCramer, CC BY-SA 4.0, Wikimedia Commons

BillCramer, CC BY-SA 4.0, Wikimedia Commons

John Neff

Coming up as an investor in the 1950s, John Neff was head of Vanguard's Windsor Fund (their mutual funds division), using a value investment strategy, Neff grew Vanguard's Windsor Fund from $750 million to $13.6 billion in 31 years. Although no figures are available for his personal net worth, he was clearly a highly-skilled investor.

BillCramer, CC BY-SA 4.0, Wikimedia Commons

BillCramer, CC BY-SA 4.0, Wikimedia Commons

Bill Miller

Miller Value Partners is another investment firm on Wall Street, founded by Bill Miller. With a portfolio worth over $150 million, Miller is best-known in the finance world for beating the S&P 500's annual returns for 15 years in a row. His net worth is approximately $1.8 billion and he has stock holdings that contain Amazon and Bitcoin.

Bill Millers best and worst investment decisions, Fox Business

Bill Millers best and worst investment decisions, Fox Business

Bruce Kovner

From 1983 to 2011, Bruce Kovner's investment firm, Caxton Associates, earned an annual return of 21% per year. This extraordinary return netted him an incredible net worth of $7.7 billion.

Michael Loccisano, Getty Images

Michael Loccisano, Getty Images

Edward Lampert

Edward Lampert follows Warren Buffett's investment strategy of making targeted bets on companies that he thinks will do well, and then holding those investments for several years. Lampert's investments have included Sears Holdings and AutoNation. His current net worth is approximately $2 billion.

Michael Burry

Michael Burry shorted the stock market because he saw the subprime mortgage crisis coming. This gamble made him a $100 million man. Now worth $1.2 billion, Burry's holdings include stocks like Expedia Inc, Charter Communications Inc, and Generac Holdings. He also made his investors $700 million during the subprime mortgage crisis and following the financial crisis of 2007-2009.

Paul Tudor Jones

He began as a day trader, trading cotton futures on the New York Stock Exchange, but soared to popularity in 1987 after Black Monday, when Tudor Investments experienced a 200% gain. Now worth an astonishing $8.1 billion, Paul Jones' biggest stock picks are Horizon Therapeutics, Microsoft, and the SPDR S&P 500 ETF.

National Archives at College Park - Still Pictures, Wikimedia Commons

National Archives at College Park - Still Pictures, Wikimedia Commons

Ken Griffin

While studying at Harvard University in the 1980s, Ken Griffin dabbled in trading convertible bonds, beginning a career in investments in 1986 by trading stock options out of his dorm room, Griffin then started Citadel Investment Group. His main stock picks today are in McDonalds, Microsoft, and T-Mobile. His net worth is approximately $35.6 billion.

Paul Elledge, CC BY-SA 4.0, Wikimedia Commons

Paul Elledge, CC BY-SA 4.0, Wikimedia Commons

Israel Englander

Owning a number of ETF funds in his investment portfolio, Israel "Izzy" Englander is the founder and CEO of Millennium Management, a fund he began in 1989 with $35 million. Israel Englander's net worth is now $11.8 billion, and he has three ETFs as his top stock picks.

Patrick McMullan, Getty Images

Patrick McMullan, Getty Images

Peter Lynch

Another excellent investment strategy comes from Peter Lynch, VP of Fidelity Investments. His growth strategy focuses on investing in low-performing companies with growth potential. His book One Up On Wall Street has sold over 2 million copies since it was published in 1989. His net worth is approximately $352 million.

Benjamin Graham

The father of value investing, Ben Graham taught Warren Buffett almost everything that the Oracle Of Omaha now knows about investments. His book, The Intelligent Investor, is among the best finance books you'll ever read and his worth was approximately $3 million, which he left to heirs when he passed away in 1976.

Unknown Author, Wikimedia Commons

Unknown Author, Wikimedia Commons

Andreas Halverson

Another hedge fund manager making a fortune is Andreas Halverson. The CEO of Viking Global, a fund managing over $41 billion of assets, Halverson was born in Norway but obtained his post-secondary education in the US. His top stock picks include Visa, Danaher Corp, and APi Group. His net worth is approximately $5.9 billion.

Ray Dalio

The founder of Bridgewater Associates, Ray Dalio bought his first stock pick at the age of 12, which tripled in value soon afterwards. Bridgewater Associates was once the largest hedge fund in the world and Dalio was named as one of the most influential people in the world by TIME magazine in 2012. His net worth is an extraordinary $15.4 billion.

Web Summit, CC BY 2.0, Wikimedia Commons

Web Summit, CC BY 2.0, Wikimedia Commons

Carl Icahn

Another activist investor on our list, Carl Icahn is responsible for saving Chrysler from bankruptcy. Icahn's investment strategy is to buy struggling companies and make them profitable by implementing a few policy changes. It seemed to have worked for him, making him rich to the tune of $6.9 billion.

AviateHistory, Wikimedia Commons

AviateHistory, Wikimedia Commons

Steve Cohen

Steve Cohen owns the New York Mets and has shares in Nvidia and Microsoft, including dabbling in AI companies in the early part of 2023, when they were all the rage. Cohen's net worth is approximately $19.8 billion.

Unknown Author, Wikimedia Commons

Unknown Author, Wikimedia Commons

Phillippe Laffont

Founding Coatue Management in 1999, Phillipe Laffont is a student of Julian Robertson (mentioned earlier) and a huge proponent of investing in tech, with big shares in Microsoft, Meta, and Nvidia. His net worth? Only $6.1 billion.

Coatue’s Laffont on AI Darlings and Opportunities in Today’s Markets, Bloomberg Live

Coatue’s Laffont on AI Darlings and Opportunities in Today’s Markets, Bloomberg Live

George Soros

Meet the founder of the Soros Fund Management, the man who shorted the British Pound and broke the Bank of England, with an average annual return of 30.5% between 1969 and 2000. Soros is one of the most well-known figures on Wall Street and has stock picks in Horizon Therapeutics and Alphabet. His personal net worth? $6.7 billion.

World Economic Forum, CC BY-SA 2.0, Wikimedia Commons

World Economic Forum, CC BY-SA 2.0, Wikimedia Commons

Warren Buffett

And now—of course—perhaps the most famous investor of all time: the "Oracle of Omaha," Warren Buffett. He's a man who's revolutionized investing in the United States and around the world, and has done it all while maintaining a sense of humility and grace. Worth $123.1 billion, Buffett is the CEO of Berkshire Hathaway and has his hand in too many cookie jars to count.

You May Also Like:

How To Invest Just $1000 And Multiply It

The Wealthiest People In The US