Biggest Recessions The US Has Faced

Recessions can really rock an economy, causing immense job loss in all income levels. There have been as many as 48 recessions in United States history, with some of them being real doozies.

While most recessions are said to only last about a year, there have been some that have dragged on for over three—causing devastating consequences for the American people.

Here are some of the worst recessions the United States has ever experienced, and what caused them.

The Panic Of 1785

1785-1788

The panic of 1785 is the earliest known recession in the US. It ended the business boom that followed the American Revolution. It’s blamed on overexpansion and debts, a post war deflation, and competition in the manufacturing sector from Britain, as well as a lack of adequate credit and a sound currency.

The panic among business and propertied groups led to the demand for a stronger federal government

Unknown Artist, Wikimedia Commons

Unknown Artist, Wikimedia Commons

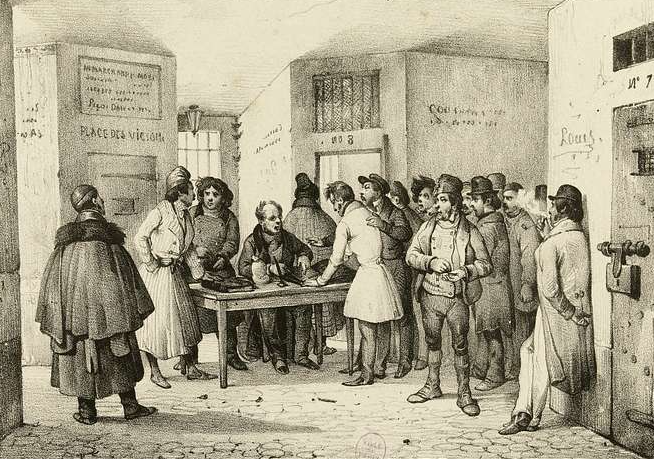

The Copper Panic Of 1789

1789-1793

While the American economy was still recovering from the Panic of 1785, the Copper Panic happened. Due to a debasement and counterfeiting, a loss of confidence in copper coins led to a commercial freeze up that halted the economy of several northern states.

It lasted four years and was only alleviated with the introduction of new, paper money.

Billjones94, CC0, Wikimedia Commons

Billjones94, CC0, Wikimedia Commons

The Panic Of 1796

1796-1799

The American economy had a short break before hitting another recession in 1796. This time, deflation from the Bank of England crossed into North America and severely disrupted commercial and real estate markets—causing major financial panic.

This event is similar to the Great Recession that happened later between 2008 and 2009. Financial problems got worse and worse, affecting nearly everyone from investors to shopkeepers to laborers.

The 1802 Recession

1802-1804

A boom of wartime activity led to a decline after the Peace of Amiens ended the war between the United Kingdom and France. Commodity prices fell dramatically and trade was disrupted by pirates, leading to the First Barbary War.

Jules-Claude Ziegler, Wikimedia Commons

Jules-Claude Ziegler, Wikimedia Commons

The 1815 Depression

1815-1821

This American recession was a lengthy one. It started in 1815, shortly after the war ended, when the value of bank notes rapidly depreciated.

The panic was followed by several years of a mild depression, and then a major financial crisis—the Panic of 1819. This crisis led to widespread foreclosures, bank failures, increasing unemployment rates, a collapse in real estate prices, and a slump in agriculture and manufacturing.

National Numismatic Collection, Wikimedia Commons

National Numismatic Collection, Wikimedia Commons

The 1822 Recession

1822-1823

After a mild recovery from the depression, commodity prices hit a peak in March 1822 and then began to fall, causing many businesses to fail and a spike in unemployment.

This lasted about a year, and then America had a brief moment of rest.

Thomas Rowlandson, CC0, Wikimedia Commons

Thomas Rowlandson, CC0, Wikimedia Commons

The 1825 Recession

1825-1826

At this point, the United States was seeing a recession every few years. And it didn’t stop here. Only two years after the last one, the Panic of 1825 hit. It was a stock crash following a bubble of speculative investments in Latin America that led to a decline in business activity.

Several other minor recessions occurred in the following years, lasting about a year at a time, and resulting from credit expansions and trade declines.

The 1836 Recession

1836-1838

Jumping to 1836, a sharp downturn in the American economy was caused by bank failures, lack of confidence in the paper currency, tightening of English Credit, crop failures, and Jacksonian policy.

American banks stopped payment in gold and silver coins, which then led to over 600 banks failing during this time.

The cotton market completely collapsed, resulting in immense job loss and causing a further financial crisis.

The 1839 Recession

1839-1843

This was one of the longest and deepest depressions of the 19th century. It was a period of pronounced deflation and massive defaults on debt.

The Cleveland Trust Company Index showed the economy spent a whopping 68 months below its trend, and only nine months above it. It also declined 34.3% during this depression.

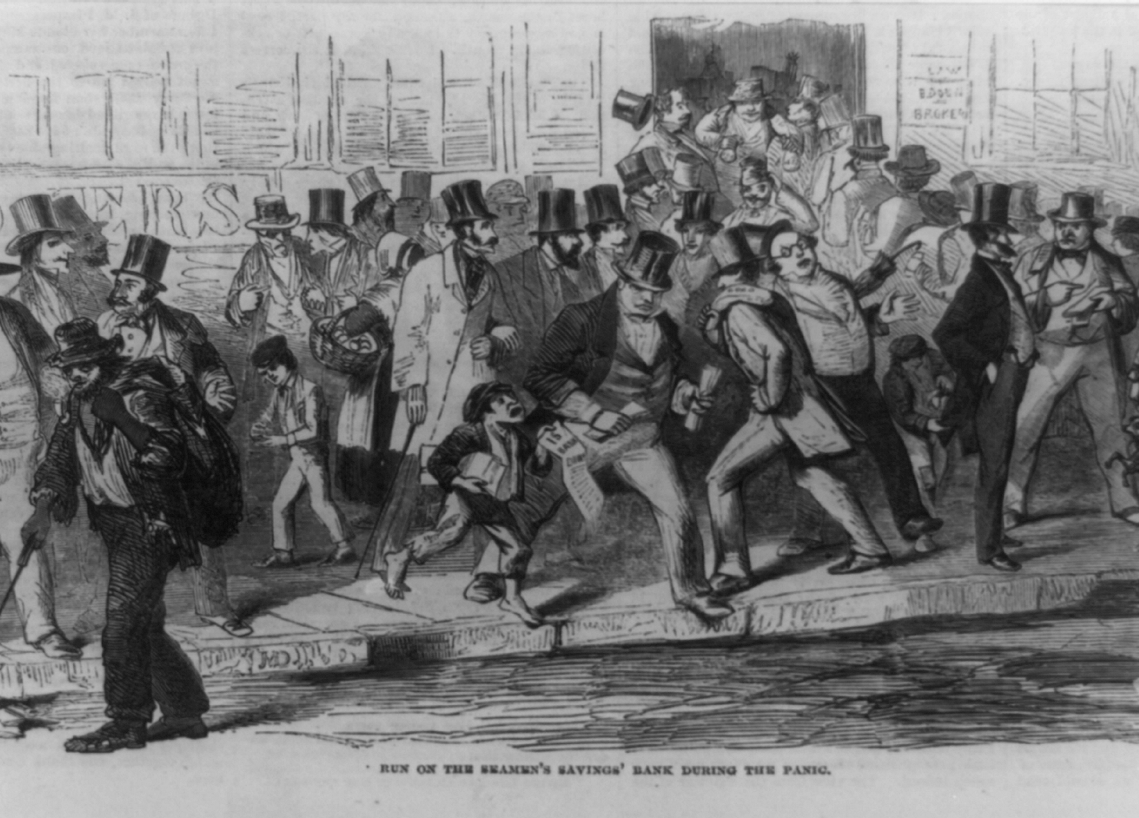

The Panic Of 1857

1857-1858

The Panic of 1857 is notable thanks to the invention of the telegraph, which spread news of the crisis quickly across the country.

The failure of the Ohio Life Insurance and Trust Company is to blame. It burst a European speculative bubble in United States' railroads and caused a loss of confidence in American banks.

Carey, Charles Henry, Wikimedia Commons

Carey, Charles Henry, Wikimedia Commons

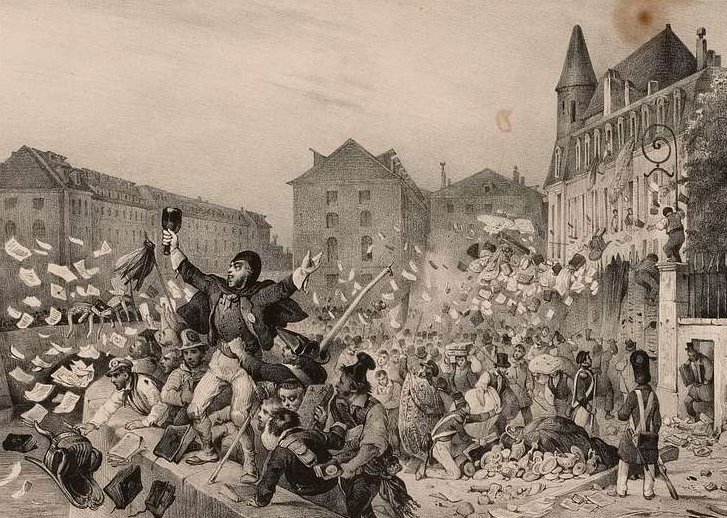

The Panic Of 1857

1857-1858

Over 5,000 businesses failed within the first year, and a massive spike in unemployment led to protests by frustrated and desperate Americans.

This recession is also said to be one of the causes of the American Civil War, which would begin in 1861.

Matt Morgan, Wikimedia Commons

Matt Morgan, Wikimedia Commons

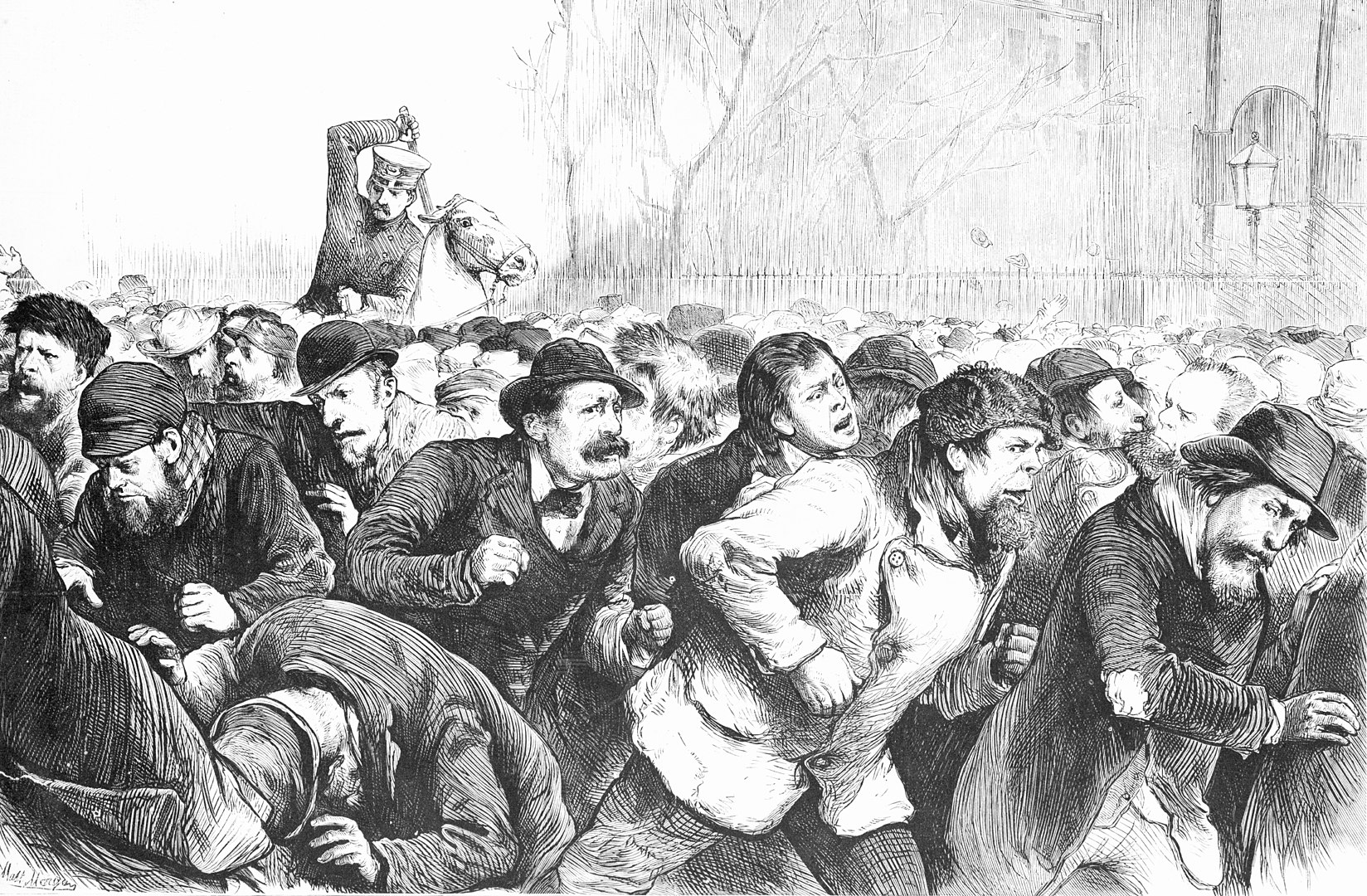

The Long Depression

1873-1879

Often referred to as the “Long Depression,” the Depression of 1873-1878 started with a stock market crash in Europe. Investors started selling their American projects—which included bonds that funded railroads.

Unknown Artist, Wikimedia Commons

Unknown Artist, Wikimedia Commons

The Long Depression

1873-1879

Without the necessary funding, the largest bank in the US, Jay Cooke and Company—which was also heavily invested in railroad construction—closed its doors. Other banks and businesses followed, and soon, 18,000 US businesses went completely bankrupt.

But that’s not all.

NIAID, CC BY 2.0, Wikimedia Commons

NIAID, CC BY 2.0, Wikimedia Commons

The Long Depression

1873-1879

Aside from thousands of businesses, 89 railroads, and at least 100 banks going bankrupt, the Coinage Act of 1873 decided to demonetize silver as legal tender in the US.

This resulted in many working-class folks having fewer ways to pay their debts. This led to labor turmoil, which then resulted in numerous employment strikes, and The Great Railroad Strike of 1877.

Vladimir Makovsky, Wikimedia Commons

Vladimir Makovsky, Wikimedia Commons

The Long Depression

1873-1879

While it technically only lasted five years, the effects were felt for much longer, and The Long Depression is sometimes held to be the entire period from October 1873 to December 1896.

Unknown Artist, Wikimedia Commons

Unknown Artist, Wikimedia Commons

The Panic Of 1893

1893-1897

The period of 1893–1897 is seen as a generally depressed cycle that had a short spurt of growth in the middle. The first panic began in 1893 and lasted about a year and a half. It was caused by the failure of the Reading Railroad, and a stock market and banking collapse which included disputes over gold and silver.

The financial crisis grew over the five years, causing widespread panic from an almost continuous cycle of job loss.

Recession Of 1907

1907-1908

Shortly after the San Francisco earthquake—which took a toll on insurance companies—another recession hit. It was also influenced by the Bankers Panic of 1907 which caused a huge stock market drop.

Banks and businesses failed, and the American people lost confidence in the financial industry.

Soerfm, CC BY-SA 3.0, Wikimedia Commons

Soerfm, CC BY-SA 3.0, Wikimedia Commons

The Depression Of 1920

1920-1921

The 1921 recession began a mere 10 months after the post-World War I recession—which thankfully only lasted seven months, but still took a toll on the unemployment rate.

The recession was short, but extremely painful. Actually, the year 1920 was the single most deflationary year in American history.

Thankfully, the economy had a strong recovery after this one.

Associated Press, Wikimedia Commons

Associated Press, Wikimedia Commons

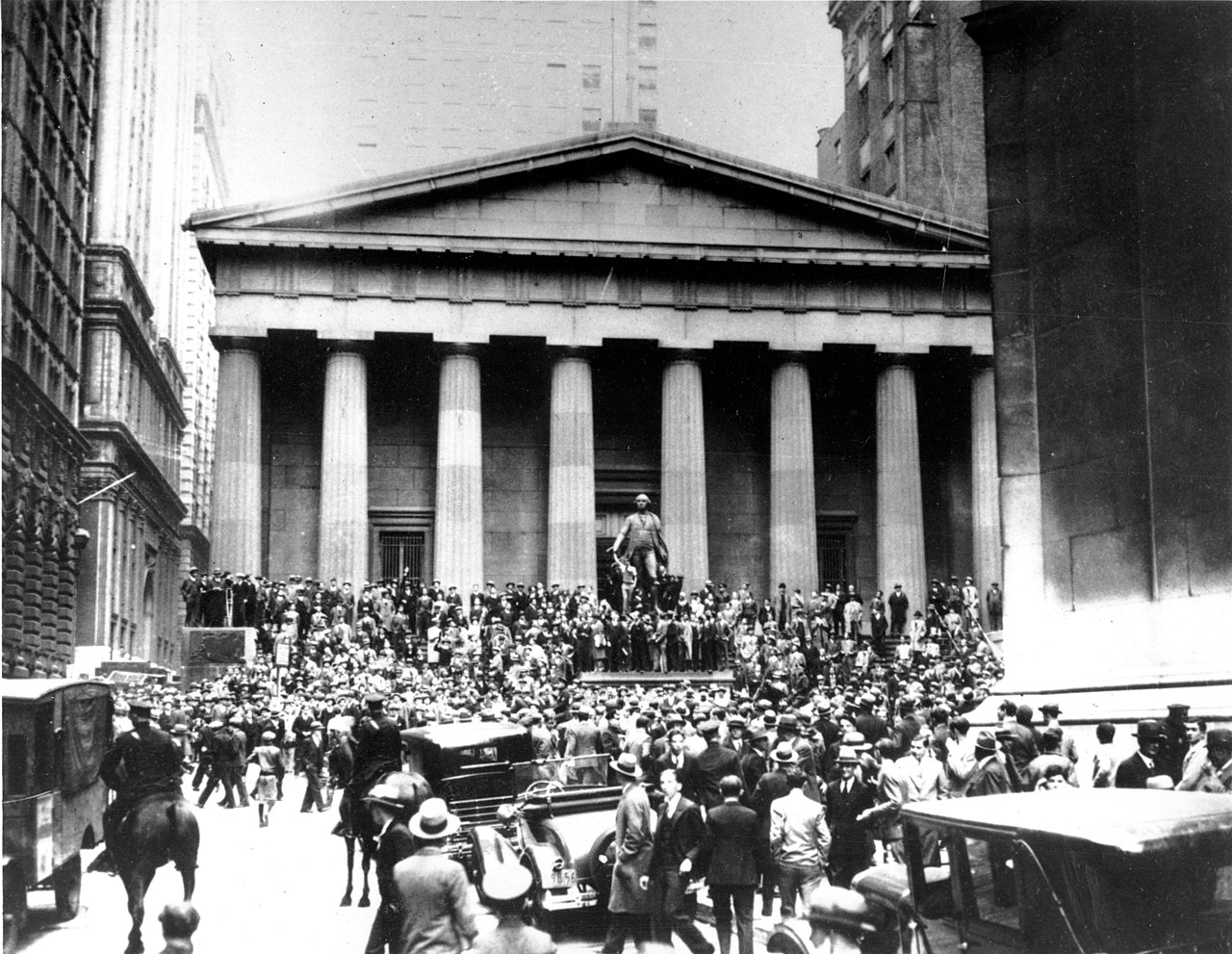

The Great Depression

1929-1937

Most recessions last a few months, with a few lasting a couple years. But the Great Depression lasted a very long time, and the effects were brutal. In fact, it’s regarded as the most devastating economic crisis in US history.

There were many causes of the Great Depression, including reckless speculation, volatile economic conditions in Europe, and overvaluation that ended in a stock market crash.

Associated Press, Wikimedia Commons

Associated Press, Wikimedia Commons

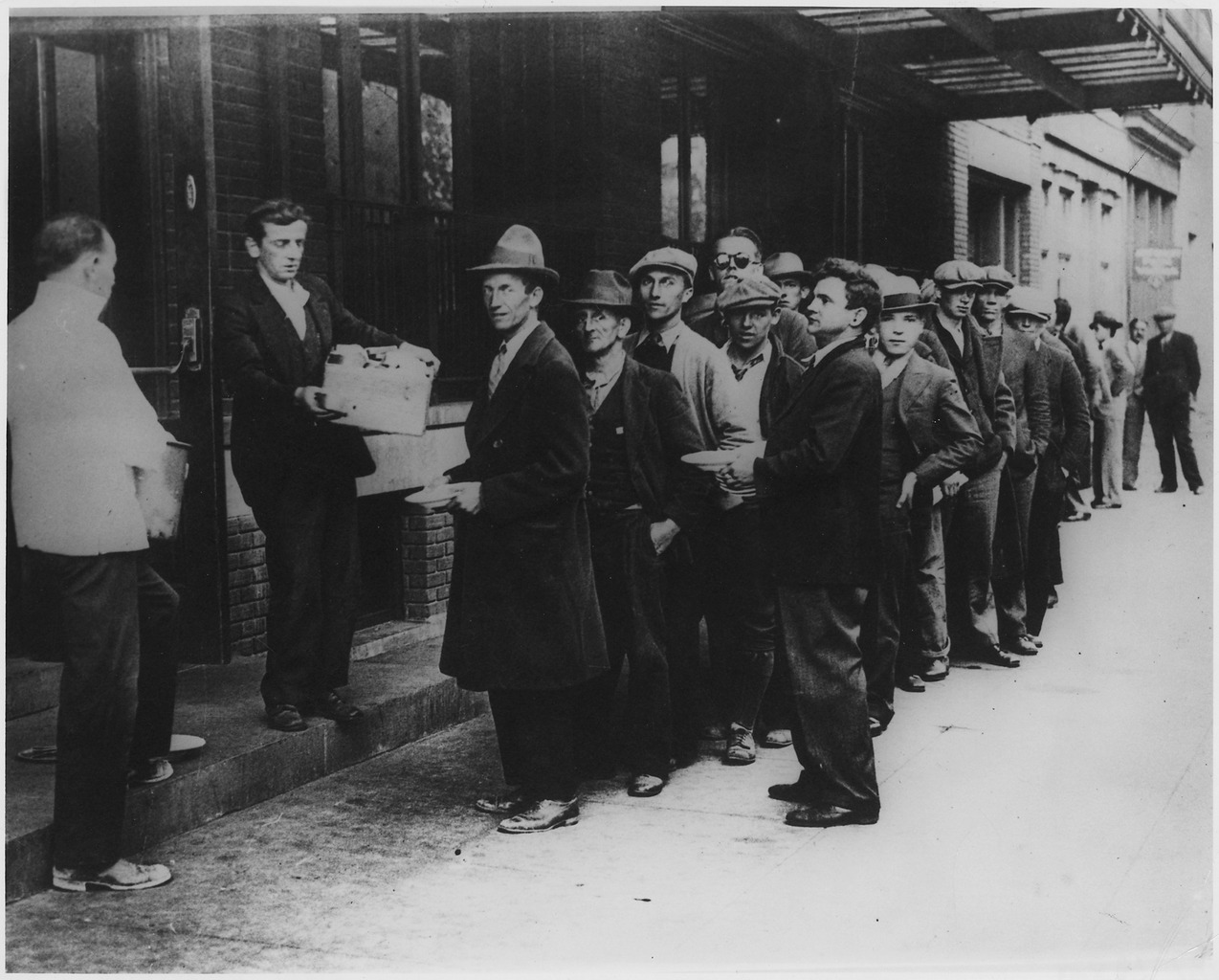

The Great Depression

1929-1937

As a result, countless businesses shut down and many people lost their jobs. By 1933, thousands of banks had closed their doors.

In the Great Depression, GDP fell by 27% and the unemployment rate reached a whopping 24.9%—the highest since 1982.

Associated Press, Wikimedia Commons

Associated Press, Wikimedia Commons

The Great Depression

1929-1937

The Depression then turned into a recession in 1937, which is still considered among the worst recessions of the 20th century. It lasted just over a year.

Monetary policy and expansion led to the ultimate recovery later in 1940.

Associated Press, Wikimedia Commons

Associated Press, Wikimedia Commons

The Recession Of 1945

1945

This recession only lasted about eight months. It was the result of demobilization and a shift to a peacetime economy after World War II ended.

It was a noteworthy time due to the enormous 12.7% drop in the GDP.

Jack Boucher, Wikimedia Commons

Jack Boucher, Wikimedia Commons

The Recession Of 1949

1948-1949

The 1948 recession lasted just shy of one year, and thankfully it was forecasted to be much worse than it actually was. It is believed to have been somewhat caused following a period of monetary tightening in response to rampant inflation.

Although it is generally considered a minor downturn, the unemployment rate did reach 7.9%.

John Vachon, Wikimedia Commons

John Vachon, Wikimedia Commons

The Recession Of 1953

1953-1954

Another similar recession followed in 1953 that lasted only 10 months and was said to be caused by a combination of events—including a post-Korean War economic contraction, as well as the tightening of monetary policy.

Unemployment peaked at 6.1%. Several other mild recessions took place throughout the next few decades for similar reasons.

Library of New South Wales, Wikimedia Commons

Library of New South Wales, Wikimedia Commons

The Recessions Of 1980-1982

1980-1982

The early 1980s are said to have had two fairly short recessions. The first, beginning in January 1980, only lasted six months, and the second lasted a bit longer from July 1981 to November 1982.

Unemployment rates remained high during and between both recessions.

National Archives, Wikimedia Commons

National Archives, Wikimedia Commons

The Recessions Of 1980-1982

1980-1982

The second recession is known as a double-dip recession, and is largely blamed on monetary policy as high inflation rates put pressure on the economy.

Unemployment reached an unbelievable 10.8% by December 1982—the highest level of any modern recession (at the time).

Dorothea Lange., Wikimedia Commons

Dorothea Lange., Wikimedia Commons

The Recession Of 1990

1990-1991

The “Reagan Boom” came to a crashing end in the beginning of the 1990s as stock markets all around the world crashed, and the US savings and loan industry collapsed. Then, Iraq invaded Kuwait in 1990, which drove up the price of oil.

The recession lasted for about a year, but it took a while for the economy to recover.

The 2001 Recession

2001

The 1990s were the longest period of economic growth in American history up to this point. This time, the collapse of the speculative dot-com bubble is to blame. That, along with a fall in business outlays and investments, and then of course the horrific events that took place on September 11th.

All of that brought an entire decade of growth to an end—however, it thankfully only lasted about eight months.

Unknown Artist, Wikimedia Commons

Unknown Artist, Wikimedia Commons

The Great Recession

2007-2009

The Great Recession—also known as the financial crisis of 2008-2009—is notable for its severity as well as its length. During this time, the US GDP fell 4.3% from its highest level at the end of 2007 to its lowest point in mid-2009. Meanwhile, the unemployment rate continued to rise, making it to 10% by October 2009.

American citizens felt this one hard.

David Shankbone, CC BY 3.0, Wikimedia Commons

David Shankbone, CC BY 3.0, Wikimedia Commons

The Great Recession

2007-2009

During this recession, the average home price fell about 30%, and the S&P 500 fell 57%. Not only that, the net worth of US households and nonprofit organizations also took a hit, dropping from approximately $69 trillion in 2007 to $55 trillion in 2009.

So, what caused this devastating event to occur?

Unknown Author, CC BY-SA 3.0, Wikimedia Commons

Unknown Author, CC BY-SA 3.0, Wikimedia Commons

The Great Recession

2007-2009

The Great Recession was possibly caused by regulatory changes to how banks were allowed to invest customers’ money. But it was also triggered by the subprime mortgage crisis, which was felt on an international level.

A global economic downturn resulted in an unprecedented number of stimulus packages being introduced around the world. In the US, a $700 billion bank bailout and $787-billion stimulus package helped revive the economy.

The COVID-19 Recession

2020

The US managed to go a good decade after the last recession that rocked the economy hard. And then the dreadful pandemic hit, and turmoil struck again.

This recession wasn’t just a national event, it was global. It began in February 2020 in most countries, and while most sources claim the recession only lasted months, many countries and millions of people felt the effects for much, much longer than that.

Kwh1050, CC BY-SA 4.0, Wikimedia Commons

Kwh1050, CC BY-SA 4.0, Wikimedia Commons

The COVID-19 Recession

2020

The COVID-19 pandemic caused worldwide lockdowns which instantly shut down businesses and put restrictions on citizens. The lockdowns drove the global economy into crisis, and within seven months, every advanced economy around the world had fallen into recession.

Prosperosity, CC BY-SA 4.0, Wikimedia Commons

Prosperosity, CC BY-SA 4.0, Wikimedia Commons

The COVID-19 Recession

2020

Because businesses were forcibly shut down, the government had to start dishing out stimulus checks once again in order to keep American citizens fed. Though, sadly, many people still didn’t have enough and people began losing their homes.

At the same time, more than half the globe was incredibly sick.

Frankie Fouganthin, CC BY-SA 4.0, Wikimedia Commons

Frankie Fouganthin, CC BY-SA 4.0, Wikimedia Commons

The COVID-19 Recession

2020

In April 2020, the United Nations (UN) predicted that global unemployment would wipe out 6.7% of working hours globally in the second quarter of 2020—equivalent to 195 million full-time workers.

In the US alone, more than 24 million people lost jobs within the first three weeks of lockdowns. The unemployment rate peaked at an unprecedented level—not seen since data collection started in 1948—in April 2020 at an incredible 14.8%.

The economic impact of the virus is still being determined, but the recession was apparently the shortest on record...even though four years later, some people are still picking up the pieces.

Carlos Delgado, CC BY-SA 3.0, Wikimedia Commons

Carlos Delgado, CC BY-SA 3.0, Wikimedia Commons