Many people are discouraged to start investing because they think they'll need a lot of money to do so. New graduates, part-time workers, and individuals who are generally tight on money might feel like they can't handle an investment with the money they have. But the reality is, investing even small amounts can pay off big time.

Even just setting aside $50 per month is a great way to start. The key to investing is not necessarily the size of the funds you are able to contribute, but rather the money-saving habits you choose to commit to. It might require slight changes in your lifestyle, but it's definitely nothing that you won't be able to handle. Here are 5 ways to start investing with little money.

Flex Jobs

Flex Jobs

Don't forget to check the comment section below the article for more interesting stories!

#1 The Piggy Bank Approach

Slow and steady wins the race, even when it comes to investing. The first thing you should do is save a bit of money up so that you at least have something to work with. Put aside $10 a week in your piggy bank, for example, and in a year you'll already have over half a grand saved up. Get into the habit of taking some portion of your pay and setting it aside so that it won't feel like a burden moving forward.

Next, open an online savings account with a bank that offers a decent Annual Percentage Yield. For some banks, there is no minimum deposit required or monthly maintenance fees, which means you would earn on all balances. When your money has grown large enough, you can always take it out and put it towards a larger investment.

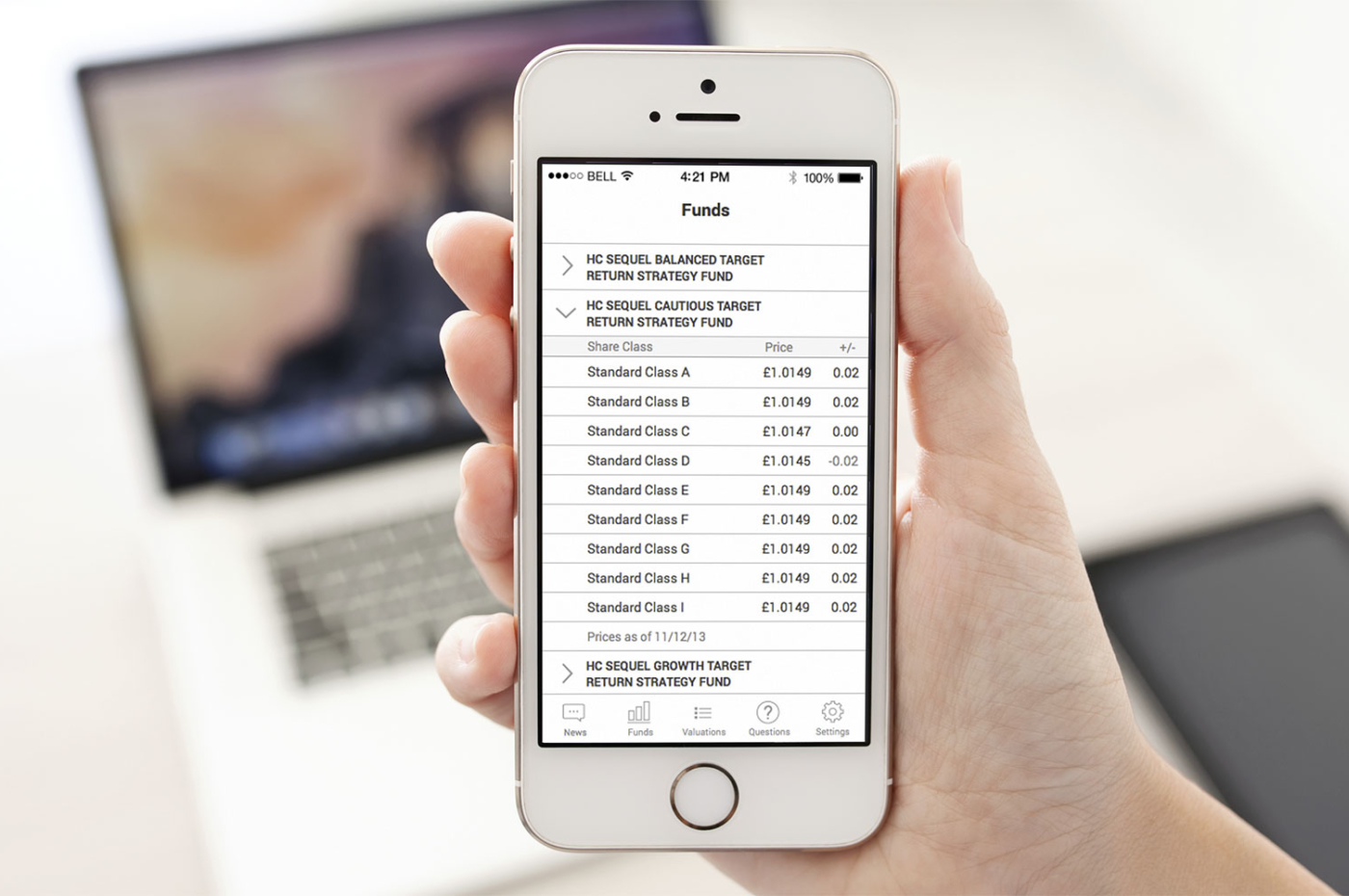

#2 Get a roboadvisor

A roboadvisor is a digital platform that provides financial planning services without any human supervision. It is purely automated, using specific algorithms to determine the best options for investing your money. They were created to make your life as easy as possible—you don't need any prior investment experience to use them.

Perhaps one of the biggest advantages of using a roboadvisor is to avoid making bad investment decisions. Because the human factor is taken out, you don't have to worry about making emotional decisions during market highs and lows. Typically, it's those gut feelings that can get you in trouble. A roboadvisor does not make those kinds of mistakes.

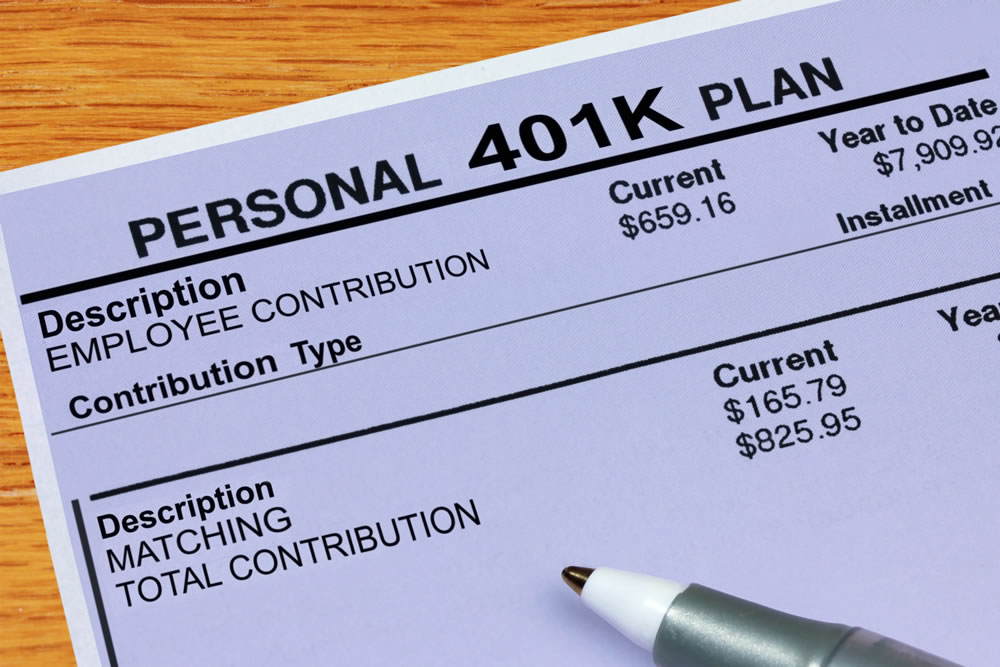

#3 Join your company's retirement plan

Another quick way to start investing is to join your company's retirement plan. If you don't have a flexible budget, this may seem out of reach, but don't be discouraged—even investing as little as 1 percent of your salary is good enough. That should be a small enough amount that you won't even notice it. The tax deduction will end up being smaller, too. After committing to a 1 percent contribution, you can then increase that every year, which would then coincide with your annual pay raise.

#4 Low-initial-investment mutual funds

If you're a new investor, you should consider putting your money into a mutual fund, which allows you to invest your money in a portfolio of stocks and bonds with a single transaction. The one catch is that most mutual funds require a minimum investment between $500 and $5,000; however, some may waive those minimums if you opt for automatic monthly investments of around $50 or $100.

The automatic arrangement is perfect for those on the payroll since you could just set up the direct deposits. Over time, you'll get used to the direct deposits and won't even feel that money being taken out of your account. If this is something you're interested in, talk to your company's human resources department to get it all worked out.

#5 Consider treasury securities

Treasury securities are saving bonds issued by the U.S. government. Through the Treasury Direct, you can buy fixed-income securities that have maturities between 30 days to 30 years, in denominations as low as $100. The nice thing about them is that they are viewed in the market as having virtually no credit risk, which means your interest and principal will very likely be paid fully and on time.

Most first-time investors don't choose this option, to begin with, but it's still an option nonetheless. While you may never get rich with these securities, it's a great place to start. Put your money behind them, earn some interest, and then eventually move your money to higher risk, higher return investments when you're ready.