These Bankers Became Some Of The Richest Men In The World

The world's oldest bank, Banca Monte dei Paschi di Siena, was founded in 1472 in Siena, Italy, as a charitable organization designed to provide financial assistance to the poor. Today, banks are much larger and serve far greater purposes than the original banks. Here are some of the world's most famous bankers: those who changed history and became some of the most successful bankers ever.

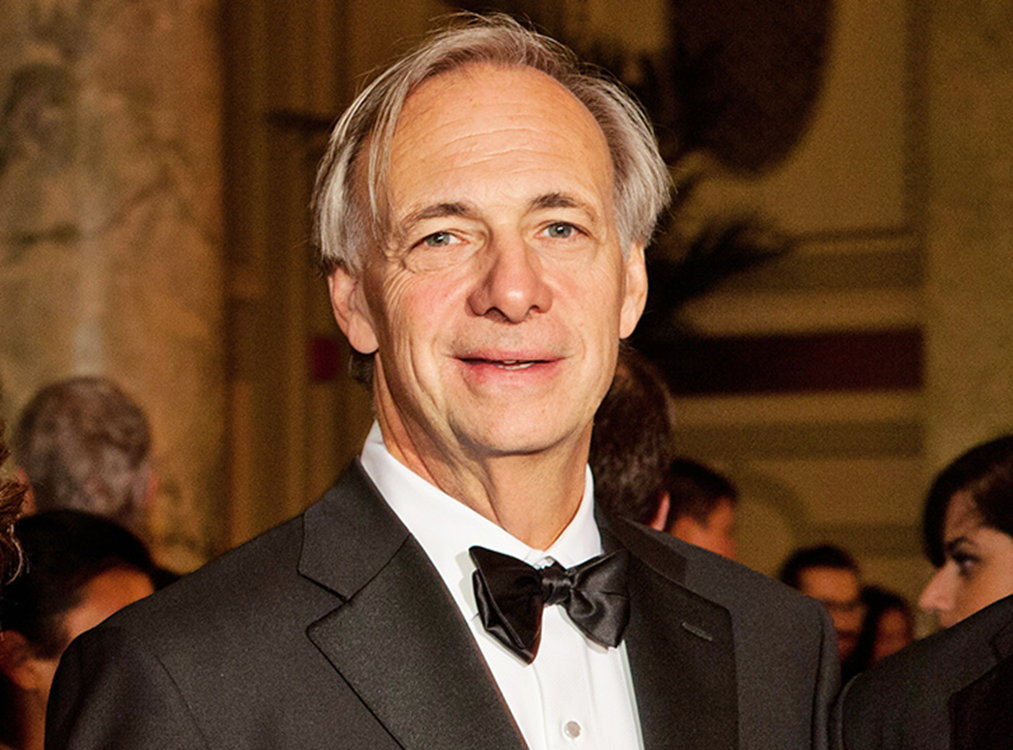

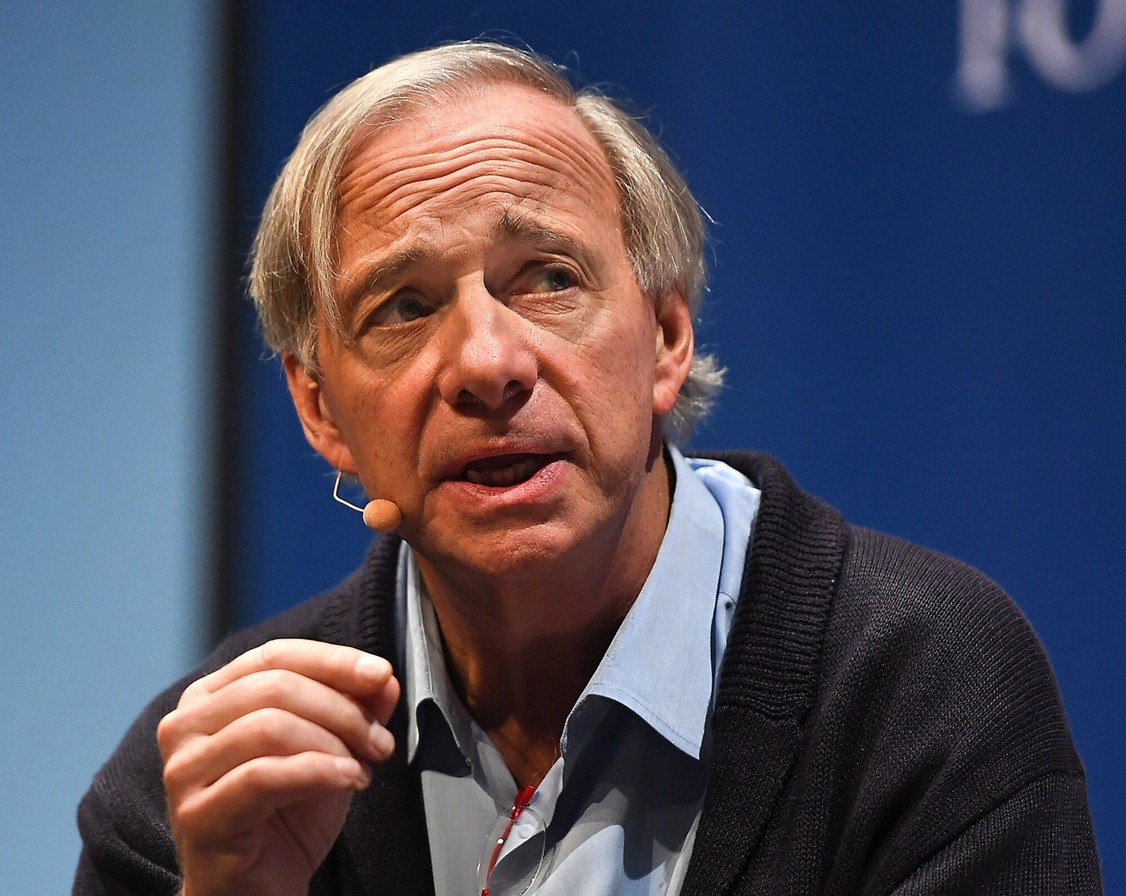

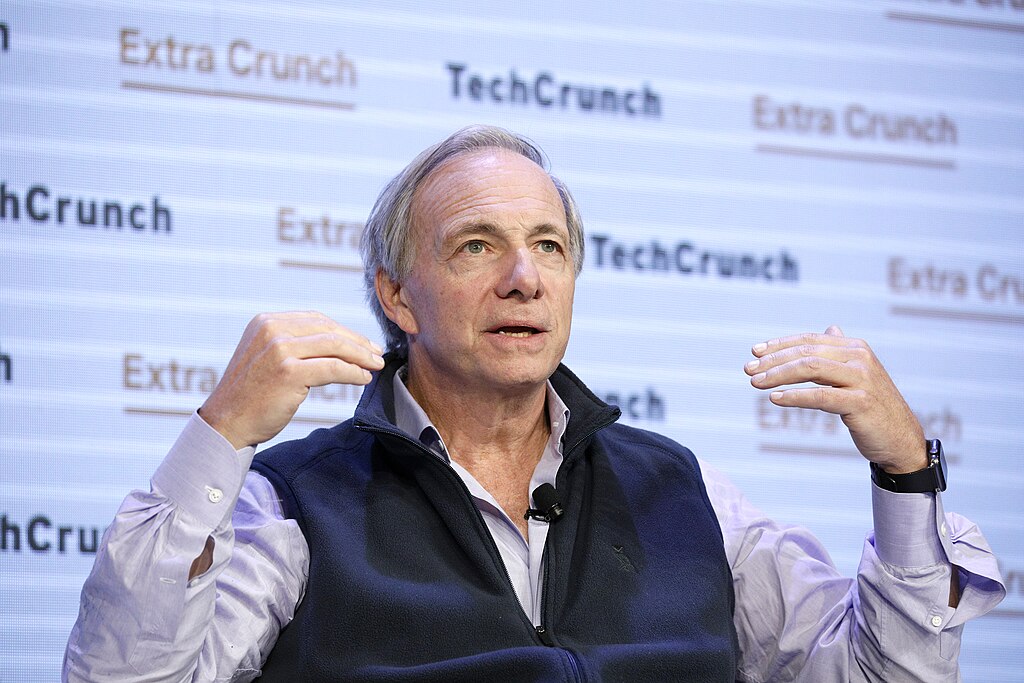

Ray Dalio

One of America's richest men, Ray Dalio is a hedge fund manager and founder of Bridgewater Associates. With a $19.1 billion net worth, Dalio may be one of the world's most successful investment bankers, but how did he get there?

Locksteel888 , CCBY-SA 4.0 , Wikimedia Commons

Locksteel888 , CCBY-SA 4.0 , Wikimedia Commons

How Ray Dalio Got His Start

Growing up, Dalio lived not far from the Links Golf Course in New York, where he caddied for Wall Street professionals during his childhood. One of them, George Leib, struck up a friendship with the young Dalio, while Leib's son gave Dalio a summer job at his trading firm on Wall Street. With these earnings, Dalio purchased shares in Northeast Airlines for $300 at the age of 12.

Web Summit, CC BY 2.0, Wikimedia Commons

Web Summit, CC BY 2.0, Wikimedia Commons

Staying Successful

Ray Dalio took what he learned in Wall Street at his summer job and applied it to his schooling, graduating from Harvard and starting his own company, Bridgewater Associates, at the age of 27. McDonalds was his first big client, followed by managing pension funds for World Bank and Kodak. By the early 2000s, Bridgewater Associates was the world's largest hedge fund.

TechCrunch, CC BY 2.0, Wikimedia Commons

TechCrunch, CC BY 2.0, Wikimedia Commons

His Strategy: Invest In Global Economic Trends

How, then, did Ray Dalio become a $19 billion man? He monitored and invested in global economic trends with Bridgewater, balancing risk by diversifying assets across the globe by wagering on or against the success of various global markets—unlike Warren Buffett's approach. Dalio is without doubt one of the most influential American bankers of the late 20th century.

Grameen America, CC BY 3.0, Wikimedia Commons

Grameen America, CC BY 3.0, Wikimedia Commons

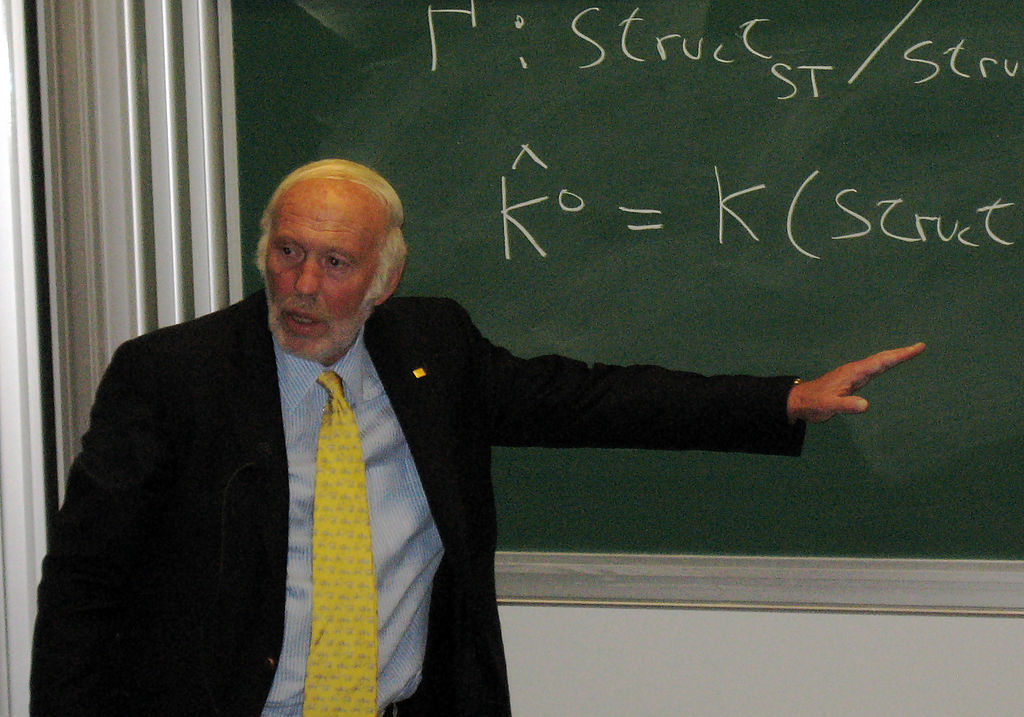

Jim Simons

Jim Simons may have been one of the smartest men on Wall Street. Originally from a mathematics background, Simons founded Renaissance Technologies in 1978, which was then called Monemetrics. This new company, a hedge, used revolutionary computing and quantitative analysis, created by Simons, to time the market and make the best investments.

BillCramer , CC BY-SA 4.0 , Wikimedia Commons

BillCramer , CC BY-SA 4.0 , Wikimedia Commons

Jim's Early Career As A Code-Breaking Math Genius

Born in 1938 and raised in Massachusetts, Simons had received bachelors, masters, and doctoral degrees in mathematics by the time he was 23. He graduated from MIT and then traveled for a year from Boston to Bogota before beginning work for the NSA as a code breaker in 1964. From 1964 to 1968, he worked in national security, before being forced to leave due to his opposition to the Vietnam War.

BillCramer , CC BY-SA 4.0 , Wikimedia Commons

BillCramer , CC BY-SA 4.0 , Wikimedia Commons

Founding A Hedge Fund

In 1978, Jim Simons founded Monemetrics and used his understanding of mathematics to design a quantitative analysis method for investing. Essentially, quantitative analysis analyzes which investments will give the best level of return relative to your risk tolerance as an investor. This methodology made Jim Simons a billionaire. At the time of his passing in May 2024, his net worth was an estimated $31.4 billion.

Gert-Martin Greuel, Wikimedia Commons

Gert-Martin Greuel, Wikimedia Commons

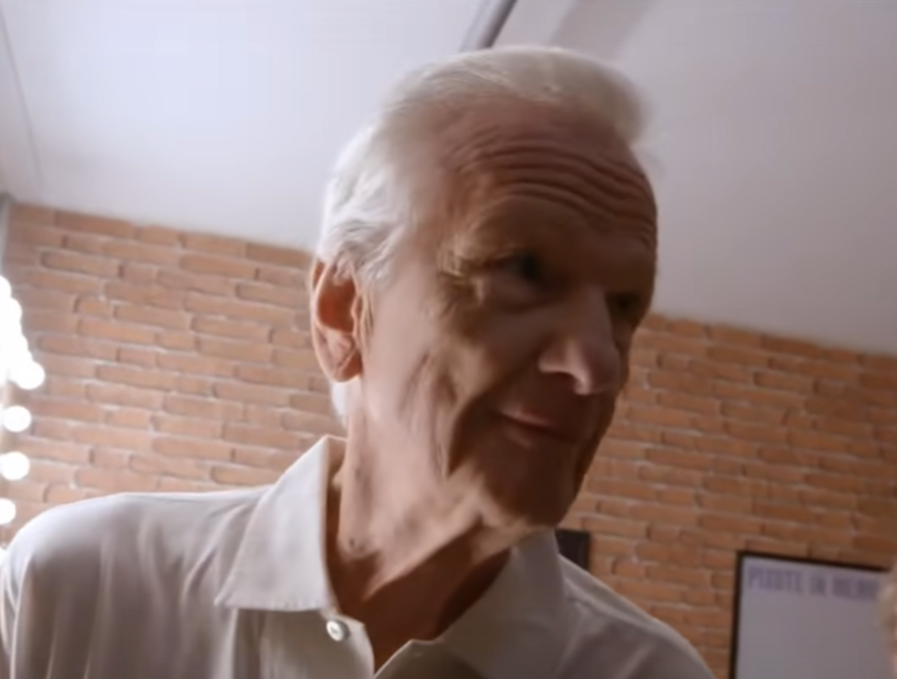

Jorge Paulo Lemann

Jorge Paulo Lemann is a Swiss-Brazilian investment banker who founded 3G Capital, one of the world's largest investment firms that skyrocketed to acclaim in the early years, by acquiring massive companies—a huge step for a Brazilian company managed by a boy born in Rio de Janeiro in 1939.

Jorge Paulo Lemann - CNN BRAZILIAN VIEWS - 06/05/2022, CNN Brazil

Jorge Paulo Lemann - CNN BRAZILIAN VIEWS - 06/05/2022, CNN Brazil

Lemann's Early Years

Jorge Lemann graduated from the American School of Rio de Janeiro with top marks and headed immediately for Boston and Harvard, where he graduated with a bachelor's degree in economics in 1960. In the early 1960s, he worked for Credit Suisse in Geneva. It wasn't until 1971 that he and three business partners began Banco Garantia.

Jorge Paulo Lemann - CNN BRAZILIAN VIEWS - 06/05/2022, CNN Brazil

Jorge Paulo Lemann - CNN BRAZILIAN VIEWS - 06/05/2022, CNN Brazil

Becoming The "Goldman-Sachs Of Brazil"

Despite a market crash just weeks after Banco Garantia got off the ground, Lemann was able to build the company into the "Goldman-Sachs of Brazil," according to Forbes. Going from strength to strength over the coming decades, Banco Garantia owned 60% of Brazil's drinks industry and 80% of Argentina's.

Jorge Paulo Lemann - CNN BRAZILIAN VIEWS - 06/05/2022, CNN Brazil

Jorge Paulo Lemann - CNN BRAZILIAN VIEWS - 06/05/2022, CNN Brazil

The Richest Person In Brazil Is A "Business-Class" Hero

In 2023, Lemann once again became the richest person in Brazil, with a net worth of approximately $21.5 billion. Although he rarely gives interviews, he has been heralded as Brazil's "business-class hero that's part-Buffett, part Sam Walton and part Roger Federer".

Jorge Paulo Lemann - CNN BRAZILIAN VIEWS - 06/05/2022, CNN Brazil

Jorge Paulo Lemann - CNN BRAZILIAN VIEWS - 06/05/2022, CNN Brazil

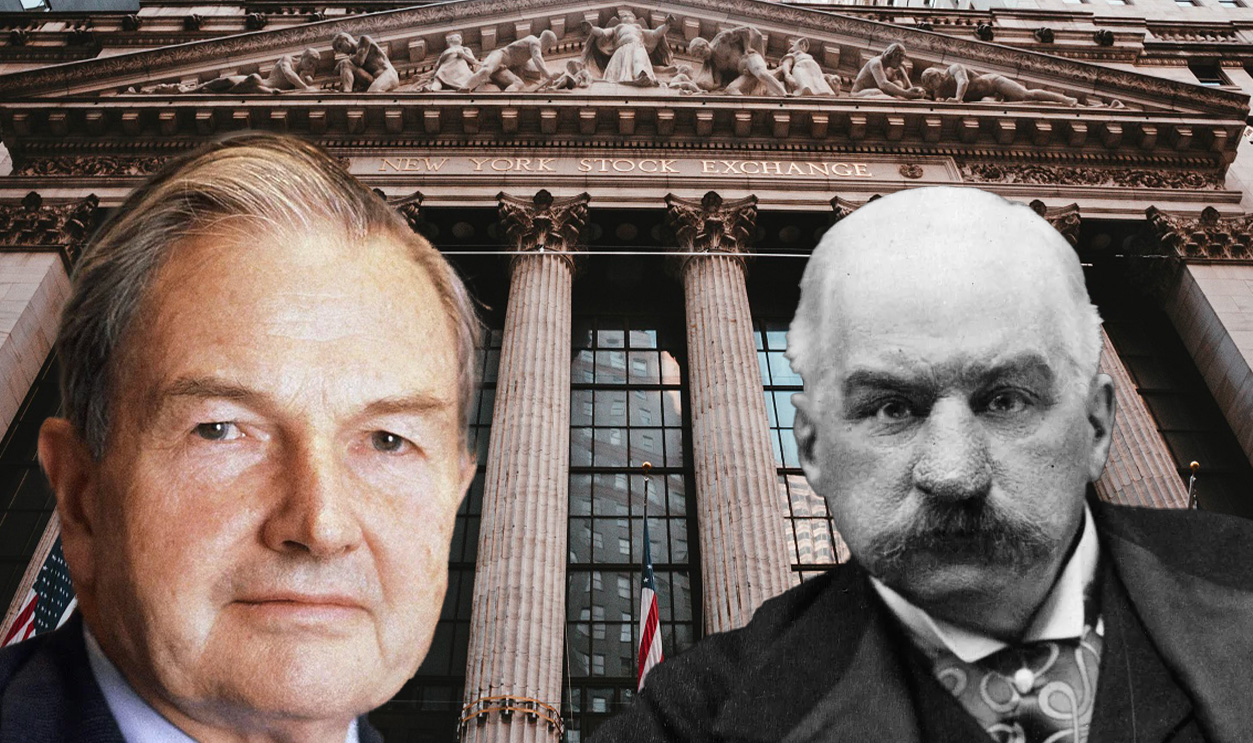

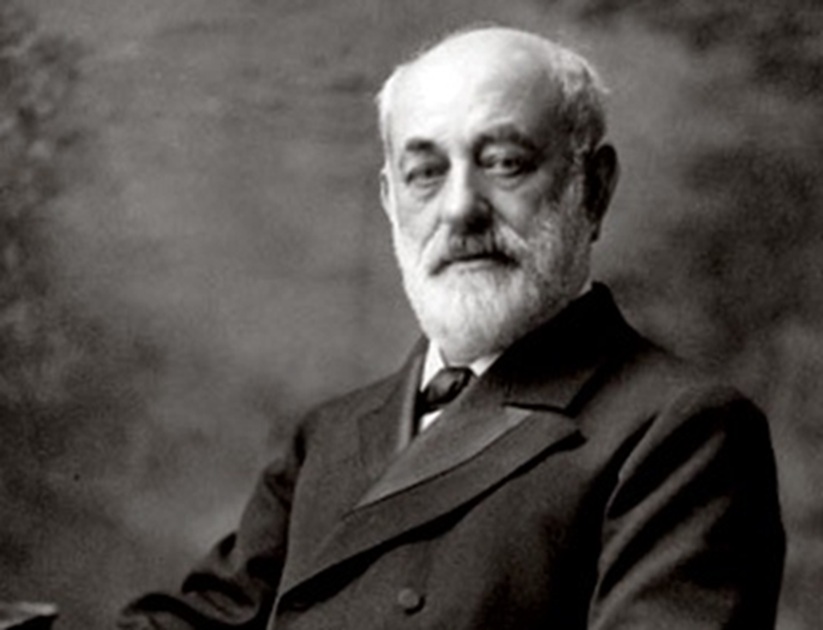

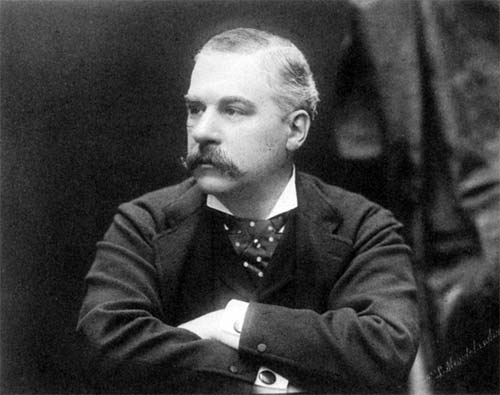

Marcus Goldman

Marcus Goldman not only founded Goldman Sachs, the world's largest investment bank, but also revolutionized how companies were evaluated for investment. More on that later. Goldman was born in 1821 in Germany and immigrated to the United States in 1848. He would later become a shopkeeper in Philadelphia, where he rented a room from his friend, Joseph Sachs.

vanityfair.com/business, Wikimedia Commons

vanityfair.com/business, Wikimedia Commons

The Beginnings Of A Businessman

In 1869, Goldman set up a small signboard on Market Street in Philly, identifying himself as a broker of IOUs, under the name Marcus Goldman & Co. In his first few years, he was turning over $5 million of IOUs per year.

Photo For Everything, Shutterstock

Photo For Everything, Shutterstock

All In The Family

By 1882, Marcus Goldman had taken on his son-in-law, Samuel Sachs, to become part of his firm, which began turning over $30 million a year in brokered IOUs. It had $100,000 worth of capital. Most interestingly, all of the new partners in Goldman Sachs were members of Marcus Goldman's immediate and extended family.

Building Goldman Sachs

Today, Goldman Sachs is one of the world's largest and most successful investment firms and the second largest investment bank in the world by revenue. In 1885, Marcus Goldman's son, Henry Goldman, joined the firm after Marcus retired, and took the company to the New York Stock Exchange in 1896. Its revenue in 2024 was $53.5 billion.

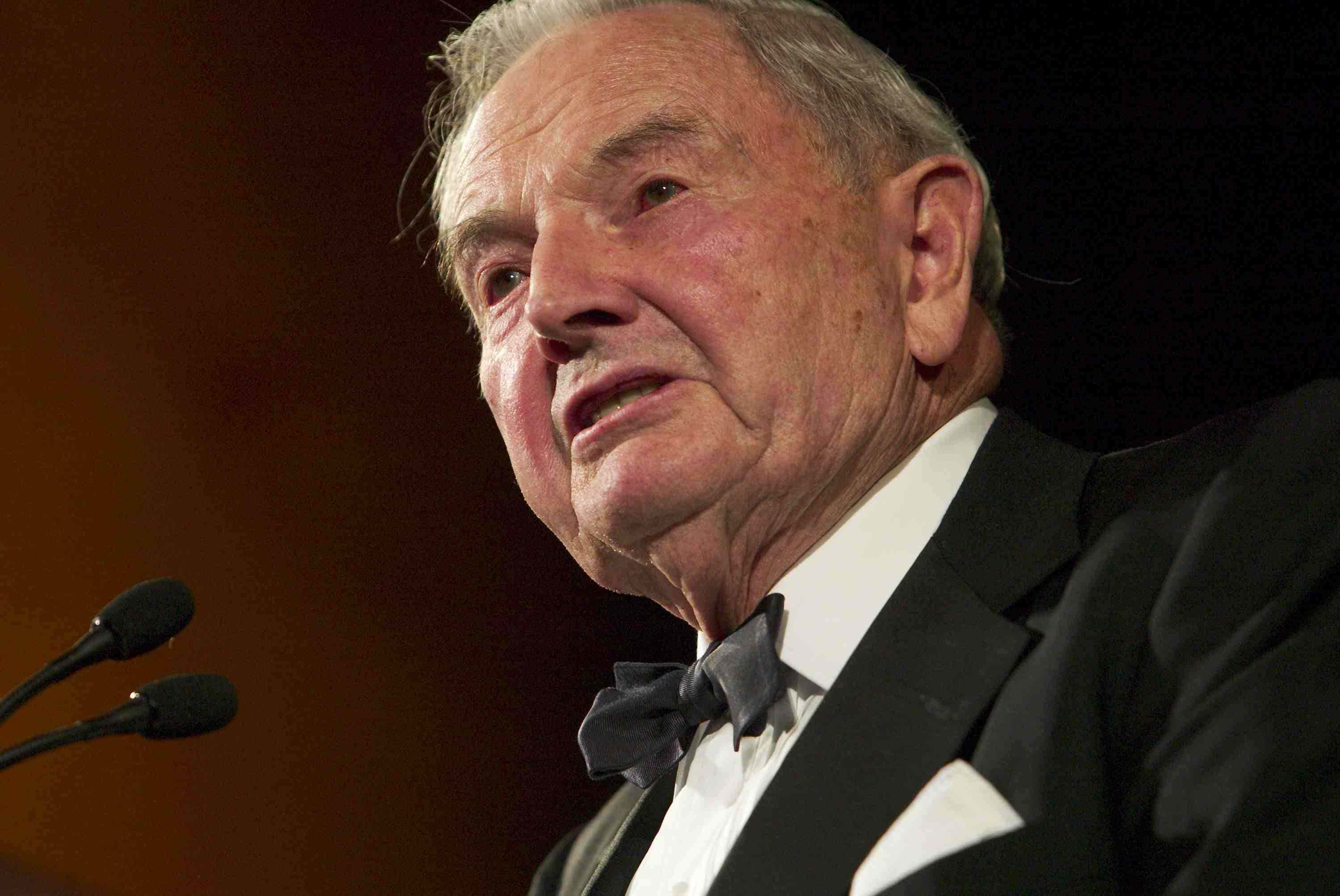

David Rockefeller

Born in 1915, David Rockefeller was the youngest child of John D Rockefeller and socialite Abigail Aldrich. After attending Harvard University and graduating cum laude in 1936, Rockefeller studied economics for one year at the London School of Economics under professor Friedrich von Hayek. He also worked for the London branch of what was to become Chase Bank. He received a PhD in economics from Chicago University in 1940.

Brendan Smialowski, Getty Images

Brendan Smialowski, Getty Images

A Soldier Before A Banker

Before he became an investment banker, Rockefeller enlisted in the US Army in 1943, being promoted to captain by 1945 after serving in North Africa and France for military intelligence, as he spoke fluent French. While working for MI, Rockefeller was assigned to be a "Ritchie Boy"—someone who participated in the interrogation of German soldiers and was an American military attaché in Paris.

National Archives and Records Administration, Wikimedia Commons

National Archives and Records Administration, Wikimedia Commons

His Time At JPMorgan Chase

After retiring from the military, Rockefeller joined JPMorgan Chase, working in the bank's foreign department financing international trade in several commodities including sugar, coffee, and tea. After 14 years at the bank, he became the bank's president in 1960, then becoming chief executive from 1969 to 1980. He established the first American bank headquarters in Moscow in 1973 and grew the bank to be one of the largest in the world.

Embroiled In Scandal In 1979

In 1979, Rockefeller, Henry Kissinger, and John J McCloy convinced President Jimmy Carter to permit Mohammed Reza Pahlavi, the Shah of Iran, to enter the United States to receive life-saving treatment for lymphoma. This directly precipitated the Iranian hostage crisis of 1979, wherein terrorists stormed the US Embassy in Tehran. This led to negative press coverage of Rockefeller for the first time.

Hashmoder , CC BY-SA 4.0 , Wikimedia Commons

Hashmoder , CC BY-SA 4.0 , Wikimedia Commons

Winding Down His Time At JPMorgan Chase

In 1981, David Rockefeller stepped down as the CEO of the bank, having built JPMorgan Chase into a powerhouse. He passed away in 2003, leaving a fortune of $3.3 billion to his heirs and successors, but will long be remembered as a historic figure in the world of finance.

Gotfryd, Bernard, Wikimedia Commons

Gotfryd, Bernard, Wikimedia Commons

Amadeo Giannini

Amadeo Gianni was born the son of Italian immigrants in 1870 in San Jose, California. He's credited with founding many modern banking practices and was the creator of the Bank of Italy, which later became the Bank of America. He began working in business via his stepfather's company, working in the produce brokerage section, serving farms in the Santa Clara Valley. He was able to retire at the age of 31, as he married the daughter of a real estate magnate and was tasked with managing his estate upon his passing.

Rol Agency. Photographic agency, Wikimedia Commons

Rol Agency. Photographic agency, Wikimedia Commons

Creating The Bank Of Italy

In 1904, Giannini founded the Bank of Italy as a bank that was for the "little fellow," most commonly being used by Italian immigrants, who he felt were underserved in their new homes. On the first day of opening, deposits totaled over $8,000. In the first year, deposits were over $700,000. He introduced the concept of branch banking in 1909, by opening a second Bank of Italy location in San Jose, with many others to follow.

Davide Papalini,, Wikimedia Commons

Davide Papalini,, Wikimedia Commons

Merging With The Bank Of America

The Bank of America's Los Angeles branch opened in 1923, which Giannini began investing in because the more conservative business leaders in Los Angeles were less interested in the Bank of Italy, but would definitely be receptive to the Bank of America. He proposed a merger with the Bank of America and was successful. By 1929, the Bank of America had several hundred offices across California.

A Loan To Walt Disney & Pre/Post-War Investments

As a patron of the arts, Giannini was the man who loaned Walt Disney the money to produce Snow White (1937), and he helped fund the construction of the Golden Gate Bridge in the early 1930s. During World War II, he bankrolled Henry Kaiser who supported the war effort and in Italy, after the conclusion of the war, he helped Fiat get back to building cars.

Giannini, The Pioneer

His innovative practices and creation of the Bank of Italy, along with opening different branches of that bank and merging with the Bank of America, brought his "bank branch" pioneering to a whole new level. This made Amadeo Giannini one of the forefathers of modern American banking and founder of one of the most influential banks of the 20th century.

Unknown Author, Wikimedia Commons

Unknown Author, Wikimedia Commons

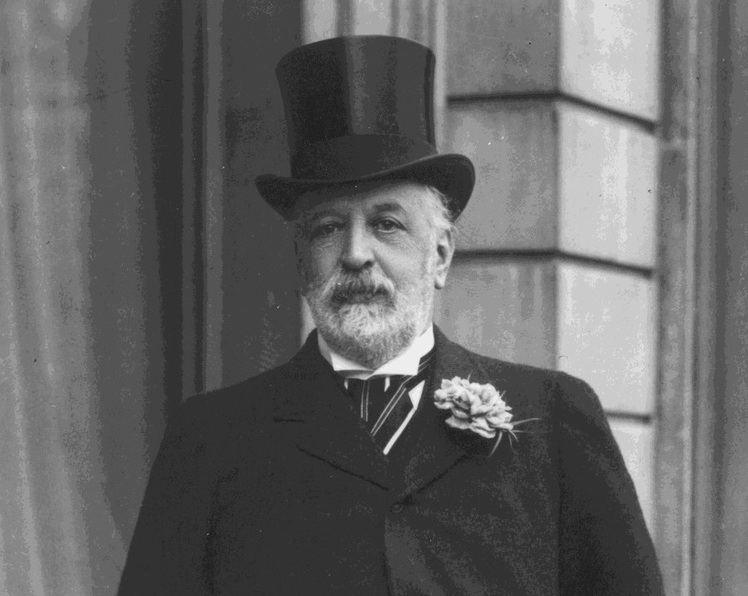

Siegmund Warburg

Outside of the Rothschild family, the Warburgs may be one of the most influential European banking families of all time. Paul M Warburg was the director of Wells Fargo between 1910 and 1914 before being appointed to the Federal Reserve Board and continuing on the legacy of Robert Morris. He had a younger brother, Siegmund, who's impacts in the banking industry were felt in Europe.

Georges Chevalier, CC BY 4.0, Wikimedia Commons

Georges Chevalier, CC BY 4.0, Wikimedia Commons

Fleeing Germany As A Spy

Allegedly, Siegmund Warburg worked as a spy for MI6 during the Second World War, undercover in Nazi Germany. He would flee the Nazis during the war and founded the English bank, S.G. Warburg, in 1946, which became one of the biggest post-war investment banks in Europe.

Establishing Eurobonds

Siegmund Warburg was one of the champions of the Eurobond market in the 1960s, which opened up a world of financial possibilities within Europe, with bonds now able to be issued in a convertible currency (the Euro) without having to worry about currency conversions and taxes from other issuers. This was a major innovation in global trade.

Panchenko Vladimir, Shutterstock

Panchenko Vladimir, Shutterstock

The Legacy Of The Warburgs

From valiant actions during World War II to establishing the Eurobond market in the 1960s, both Warburg brothers cemented their legacies at the heart of banking of both sides of the Atlantic, making them two of the most successful bankers ever and the second most prestigious banking family outside of the Rothschilds.

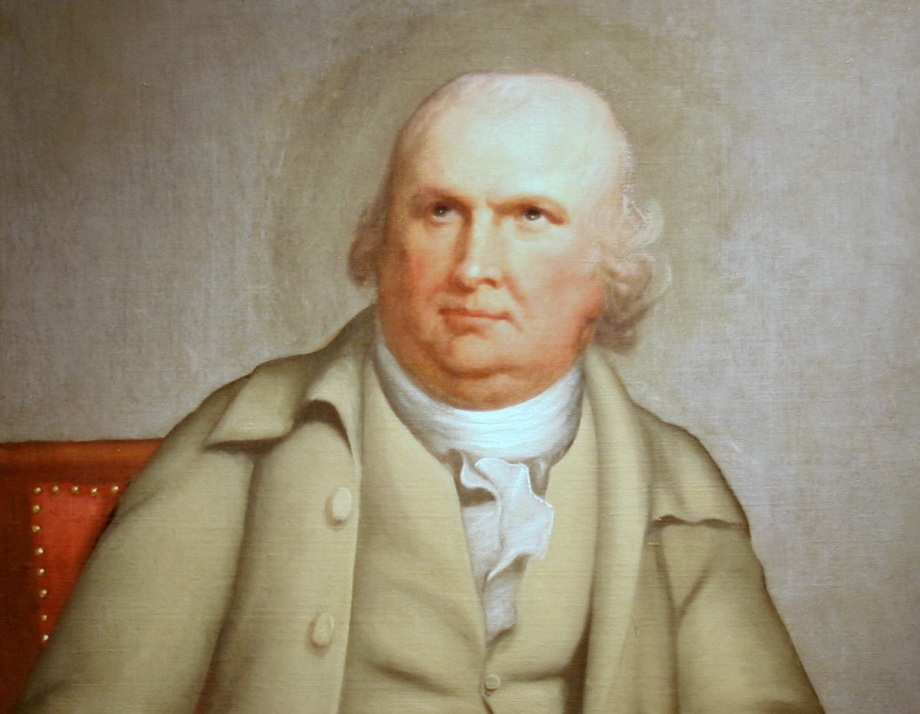

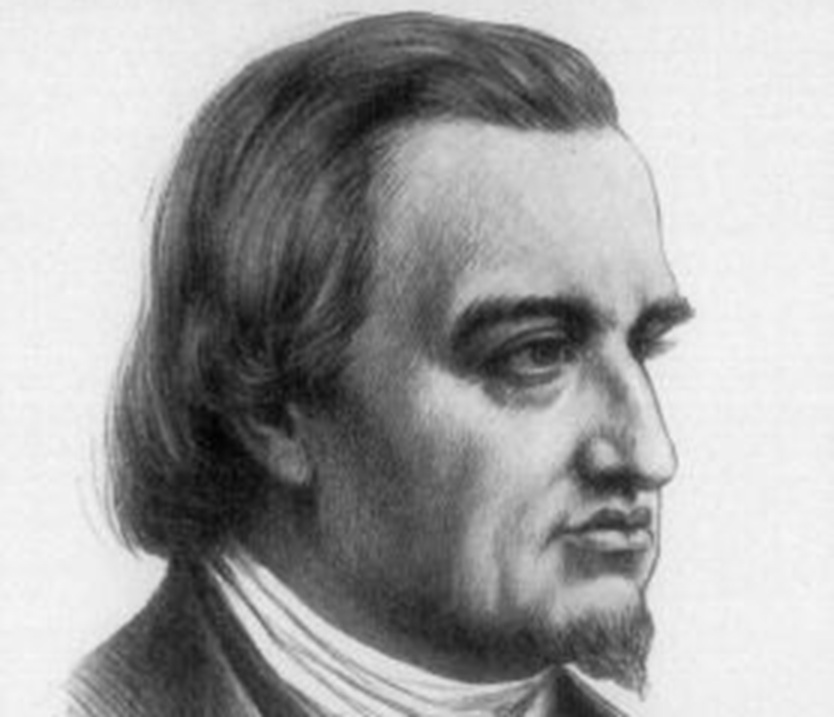

Robert Morris

Morris is the English-born financier that would go on to become a Founding Father of the United States after being brought to the US by his father at the age of 13. He would become a partner in a shipping firm in Pennsylvania and joined with other merchants in opposing British tax policies in the 1760s.

Robert Edge Pine, CC BY 2.0, Wikimedia Commons

Robert Edge Pine, CC BY 2.0, Wikimedia Commons

Role In The American Revolutionary War

As a merchant in opposition of Britain, he naturally wound up on the side of the Americans during the Revolutionary War, becoming a member of the Second Continental Congress in 1775, handling the secret procurement of supplies for the war effort. He became a leading member of Congress until 1778 and is one of only two people to sign the Declaration Of Independence, the Articles of Confederation, and the US Constitution.

Henry Hintermeister, Wikimedia Commons

Henry Hintermeister, Wikimedia Commons

Appointment To The Superintendent Of Finance

As the Revolutionary War wore on, Congress found itself strapped for cash. They appointed Robert Morris to be the new Superintendent of Finance to oversee financial matters. He also controlled the Continental Navy as Agent of Marine of the United States. He would play a key role in providing arms to General Washington at the pivotal Battle of Yorktown.

Charles Willson Peale, Wikimedia Commons

Charles Willson Peale, Wikimedia Commons

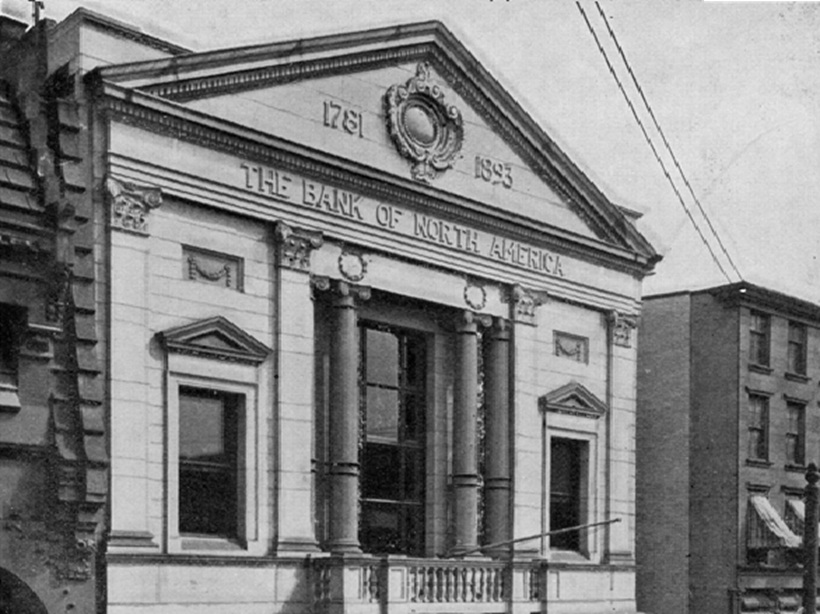

Establishing The Bank Of North America

One of the key things that Robert Morris did as Superintendent of Finance was to establish the Bank of North America. This is widely viewed as the United States' first central bank. Morris posited that without the power to levy taxes and tariffs, the new government would be unable to produce financial stability. The Bank of North America opened in 1782 and its successor, the First Bank of the United States, was opened in 1791, with the Bank of North America going private.

Helen C. Perkins, Wikimedia Commons

Helen C. Perkins, Wikimedia Commons

Morris' Legacy In National Banking

While not a banker per se, Robert Morris' foresight in establishing the Bank of North America was the key precursor to centralized banking in the United States and is one of the reasons why the Federal Reserve exists.

Charles Willson Peale, Wikimedia Commons

Charles Willson Peale, Wikimedia Commons

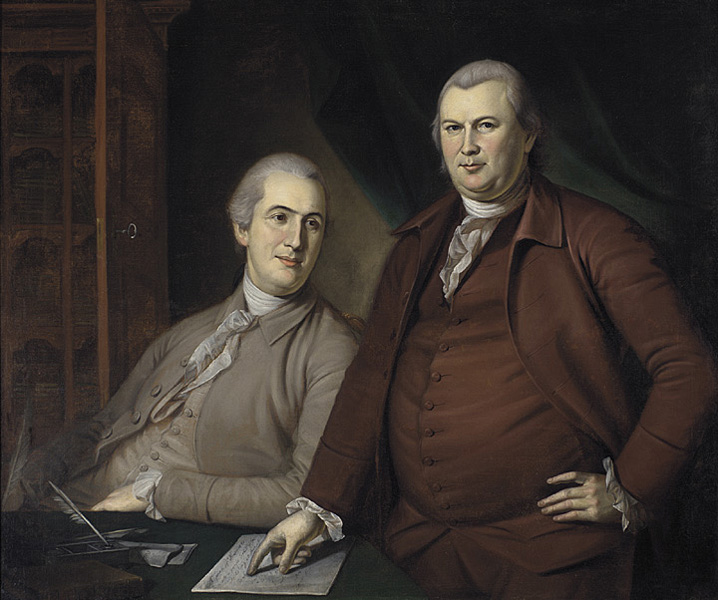

Junius & JP Morgan

Junius Morgan was the first of the Morgan family banking legacy. Born in 1813 in Holyoke, Massachusetts, Junius Morgan established JS Morgan & Co as an investment bank in London in 1964, after training as a bank clerk in the 1830s and spending many years at banks in the US. His son, John Pierpont Morgan (JP), would become one of the most recognizable names in American banking history.

JS Morgan & Co Starts

In 1964, JS Morgan & Co began as an investment in London, after Morgan's former business partner, George Peabody, refused to let Morgan use the name and business location of Peabody & Co—George was an American banker in London and had been something of a mentor for the young Junius. Morgan partnered with Philadelphia-based Anthony Drexel in 1873 and capitalized on the collapse of Jay Cooke's banking empire in the US in 1877.

Southwarth and Hawes, Wikimedia Commons

Southwarth and Hawes, Wikimedia Commons

JP Morgan Learns Under Anthony Drexel

JP Morgan, son of Junius, would take lessons in finance from Anthony Drexel in the late 19th century and quickly worked his way up the chain at JS Morgan & Co until 1895, when Drexel passed away and the firm was renamed JP Morgan & Co. It would become one of the world's most powerful banks by 1910.

Photography of XIX Century, Wikimedia Commons

Photography of XIX Century, Wikimedia Commons

Constructing The American Railroad & "Restructuring"

JS Morgan & Co played a key role in financing the construction of the Great American Railroad, meanwhile Junius Morgan's son consolidated many industries like steel and electricity under the JP Morgan umbrella. Junius pioneered the concept of "restructuring" in the finance world by purchasing companies that were "going under" and then working to rejig their finances and structures to help them become more successful.

Moody's Magazine, Wikimedia Commons

Moody's Magazine, Wikimedia Commons

The Rothschild Family

Of course, one of the most iconic banking families in the United States are the Rothschilds. The founding fathers of international finance and banking, financing kings and lords and princes at astonishingly low rates of interest, the Rothschild family were soon a favorite source of coin for Europe's political and royal elites in the 18th century.

Elbert Hubbard, Wikimedia Commons

Elbert Hubbard, Wikimedia Commons

Bankrolling The Napoleonic Wars

The Rothschild bank was the first bank to transcend national borders, assisting the British with their fight against Napoleon by almost single-handedly bankrolling the 12-year war. Toward the end of the 19th century, the Spanish Government handed over almost full control of the government-owned mining corporation Rio Tinto to the Rothschilds, further increasing their incalculable fortune.

Édouard Detaille, Wikimedia Commons

Édouard Detaille, Wikimedia Commons

Nathan Rothschild Acted As A Central Bank For Europe

By using pigeons to communicate with his siblings, Nathan Rothschild, son of Mayer Rothschild, would broker purchases for kings from elsewhere, rescue the national banks of various European countries by giving them low-interest loans to save them from bankruptcy, and even save the textile industry, which led to the Industrial Revolution.

No Family Is More Influential

It's widely agreed that there is no family in the world that is more influential than the Rothschilds. Unfortunately, their name is also synonymous with sinister conspiracy. Today, the family still owns the British bank Rothschild & Co, with Nathaniel Rothschild having a net worth of more than $1 billion.

You May Also Like:

Famous Investors & How Their Stock Picks Measure Up

Where Do Millionaires Keep Their Money?

Quiz: Can You Name The World's Biggest Companies?

RTVatlas, CC BY 4.0, Wikimedia Commons

RTVatlas, CC BY 4.0, Wikimedia Commons