Conversations To Have Before Saying "I Do"

Money can be a tricky topic, but avoiding the conversation before marriage can lead to bigger problems down the road. Before you walk down the aisle, what should you discuss about your financial future?

What Is Your Current Income?

Talking about income can feel uncomfortable, but it’s one of the most critical conversations to have before getting married. Knowing how much each person earns helps determine how expenses will be divided and how much can be saved.

Who Will Be Responsible For Paying Bills?

Managing household finances requires teamwork, but dividing responsibilities can be tricky. Will one of you handle all the bill payments, or will you split them evenly? If neither partner takes responsibility, bills could go unpaid. On the other hand, if one person manages everything, the other might feel left out.

Do You Currently Own Or Rent?

Your current housing situation plays a big role in your financial picture. Owning and renting come with different financial responsibilities, as homeownership includes maintenance costs and property taxes, while renting may offer flexibility. If you have different views on housing, it’s essential to discuss expectations.

What Are Your Overall Views On Money And Financial Security?

Money can be a tool for freedom or a source of stress. Financial security also means different things to different people. If you and your partner have vastly different views, conflicts may arise. Imagine one person is comfortable living paycheck to paycheck while the other insists on saving aggressively.

How Do You Plan To Financially Prepare For Children?

Kids are expensive—there’s no way around it. Think about medical bills, daycare expenses, tuition, clothing, and vacations. Raising a child requires financial planning that you should discuss with your partner because some couples don’t think ahead and find themselves overwhelmed by the financial burden of parenthood.

Do You Believe In Having An Allowance Spending For Each Partner?

Some couples swear by giving each person a set amount of "fun money" to spend however they choose, while others prefer a more flexible approach. Having personal money to spend without judgment can help avoid financial conflicts—especially if one of you enjoys shopping and the other is more frugal.

Do You Prefer Using Cash Or Digital Payments?

Some people rely on cash to control spending, while others use credit cards for rewards. Digital payments, like Apple Pay, have made transactions easier, but they’re harder to track. If one of you prefers cash while the other swipes a credit card for everything, how will that impact your budgeting?

How Do You Handle Impulse Purchases?

We all get tempted by unplanned buys. But how do you and your partner handle impulse spending? Do you make spontaneous purchases often, or do you carefully plan big buys? Addressing impulse buying habits ensures that financial goals aren’t derailed by spur-of-the-moment decisions.

Do You Think We Should Get Life Insurance Policies For Each Other?

It’s not the most romantic topic, but life insurance is one of the most important financial safety nets a couple can have. It ensures that the surviving spouse isn’t left struggling with mortgage, rent, debt, or the cost of raising children alone.

Do You Currently Have Any Debt?

Debt can either be manageable or a ticking time bomb. Before getting married, you must have an honest conversation about what you owe, whether it's credit card balances, student loans, car payments, or personal loans. Understanding each other’s financial obligations allows you to create a plan together.

Are You Open To The Idea Of Entrepreneurship Or Starting A Business?

Starting a business can be exciting and financially rewarding, but it also comes with risk and uncertainty. If one partner dreams of launching a business, how does the other feel about potentially unstable income? Without a conversation, that could lead to stress and financial struggles.

Do You Have An Emergency Fund?

An emergency fund can set the line between a financial crisis and a minor setback. When a disaster strikes out of the blue, will you have savings to cover it, or will you have to rely on credit cards? Without this conversation, handling unexpected expenses will be challenging.

Vitalii Vodolazskyi, Shutterstock

Vitalii Vodolazskyi, Shutterstock

How Much Financial Independence Do You Expect In Marriage?

Some couples share every financial decision, while others prefer a bit of autonomy. Conflicts happen when one partner expects full transparency while the other values financial privacy. Finding the right balance is key—perhaps setting a threshold where purchases above a certain amount require discussion.

Do You Invest In Stocks Or Other Assets?

Investing can be a major wealth-building tool, but it’s not for everyone. Some people prefer the stability of a savings account, while others are eager to put money into stocks. When one of you is an active investor while the other avoids risks, it could create a financial mismatch.

How Do You Feel About Budgeting?

For some, budgeting is a necessary tool for financial success, while for others, it feels restrictive. If one partner is a meticulous planner while the other operates on a “wing it” philosophy, financial disagreements will prevail. Finding a middle ground with some flexibility can help keep both of you happy.

Do You Believe In Joint Or Separate Finances?

One of the biggest decisions couples face is whether to combine all their money, keep separate accounts, or do a mix of both. Some couples believe that merging finances is a symbol of unity and simplifies money management, while others prefer to maintain independence and avoid potential conflicts.

What Financial Values Do You Want To Pass On To Future Children?

If you plan on having kids, your financial values will shape their understanding of money. Maybe you believe in providing financial support, or perhaps you expect them to start working early on. If you and your partner have opposing views, you’ll need to align on these big-picture goals.

Do You Consider Yourself A Saver Or A Spender?

This may seem like a simple question, but the answer will tell a lot about a person's priorities. A saver may feel anxious about unnecessary purchases and prioritize building a nest egg, while a spender might enjoy indulging in experiences and material comforts without much thought about the future.

How Did Your Parents Handle Money?

Our childhood experiences affect the way we view and manage money. Did your partner's parents openly discuss finances, or was it a source of stress and secrecy? Unpacking these influences can reveal deeply ingrained financial habits and expectations that may impact your marriage.

PeopleImages.com - Yuri A, Shutterstock

PeopleImages.com - Yuri A, Shutterstock

Will One Of Us Stay Home To Raise Children?

Many couples don’t think about this question until after kids arrive, but it’s a conversation worth having beforehand. If one partner stays home, that means giving up an income—how will you manage financially? On the flip side, will the stay-at-home partner feel financially dependent or undervalued?

What Financial Habits Are You Most Proud Of?

We all have strengths when it comes to managing money, and recognizing them can be a great way to build financial confidence as a couple. If one of you is particularly good at researching investments, they might take the lead on retirement planning.

What Financial Habits Do You Think Need Improvement?

No one is perfect when it comes to money, and recognizing areas for growth is just as important as acknowledging strengths. Maybe you struggle with impulse spending or tend to avoid looking at your bank statements. Discussing these areas openly with your partner creates an opportunity for growth and accountability.

What Would Financial Success Look Like For You In 10 Years?

Everyone has their own definition of financial success. For one person, it might mean being debt-free with a comfortable savings cushion, while another might envision owning a second home or retiring early. Setting clear financial goals ensures you're working toward the same future rather than pulling in opposite directions.

Do You Have Any Other Income Sources Besides Your Main Job?

Not all income comes from a traditional paycheck. Understanding additional sources of income is important for budgeting and financial security. It’s also helpful to discuss how reliable these streams are, as some side gigs are consistent while others fluctuate dramatically.

Do You Expect To Change Careers Or Go Back To School?

Long-term plans can have a major impact on your marriage. If one of you plans to take a lower-paying job for personal fulfillment or return to school, it’s essential to discuss how that will affect your household income and whether the other partner needs to pick up the financial slack.

Do You Want To Buy A House Together?

Buying a home is one of the biggest commitments a couple can make, so it's essential to be on the same page. Do you both want to own property or is one of you hesitant about taking responsibility? Without a shared plan, homeownership can become a major source of stress.

What Is Your Credit Score?

A conversation about your credit score may not seem romantic, but it plays a huge role in your financial future together. When one partner has excellent credit, and the other has a history of missed payments, there might be challenges when applying for joint loans.

Are You Comfortable With One Partner Earning Significantly More Than The Other?

Some couples are perfectly fine with one person earning much more, while others feel uneasy about the imbalance. If one partner is the primary breadwinner, does that mean they have more financial decision-making power? If expectations aren’t clear, resentment can build over time.

How Do You Feel About Co-Signing Loans For Family Or Friends?

Co-signing a loan means taking financial responsibility if the borrower—whether it’s a sibling, parent, or best friend—fails to pay. If one of you co-signs a family member’s car loan without discussing it first, your credit and finances could take a serious hit.

What Benefits Does Your Job Provide?

Salary is just one piece of the financial puzzle—benefits like health insurance and paid leave can be just as valuable. Understanding what each partner’s job offers helps you make smart financial decisions, from choosing the best health coverage to maximizing retirement contributions.

How Do You Feel About Taking A Job That Requires Relocation?

Would you be willing to pack up and move for a better opportunity? Some people are eager to relocate for career growth, while others prioritize family ties or stability. This conversation is especially important if one partner has a job that frequently requires moving—like a military or corporate position.

Would You Be Willing To Take A Pay Cut For A Job You Love?

Job satisfaction versus financial security is a balancing act. Some want to earn less if it means doing something they love. If one of you wants to leave a stressful job for a lower-paying, fulfilling career, how will that impact you? Being upfront ensures you are prepared for potential adjustments.

How Do You Handle Unexpected Income Changes?

No one likes to think about losing a job, but financial security depends on having a plan for the unexpected. If one of you were suddenly laid off, how would you handle it? Without prior discussion, this could lead to frustration and pressure, as planning ahead can prevent panic.

What Kind Of Mortgage Do You Prefer?

Buying a home is a major financial step, and the type of mortgage you pick will impact your finances for decades. A fixed-rate mortgage offers stability with consistent monthly payments, making budgeting easier. On the other hand, an adjustable-rate one starts with a lower rate but can fluctuate.

Have You Ever Filed For Bankruptcy?

This might be one of the toughest financial questions to ask, but it’s important. Defaulting on loans or filing for bankruptcy can have long-lasting effects on financial stability. If a partner has struggled in the past, it’s important to understand why it happened and what they’ve learned from it.

How Much Have You Saved So Far?

Although this feels like a personal question, it’s an important one if you’re in a serious relationship. When one partner has substantial savings and the other has nothing, how will that affect financial decision-making? If neither of you has much saved, that’s also important to address.

How Much Should Be In An Emergency Fund?

There’s no universal rule for emergency savings, and that’s why discussing it is so important. Some financial experts suggest three to six months’ worth of expenses, while others believe a year’s worth is safer. But what do you and your partner think? This question determines how you’ll handle financial uncertainty.

Vitalii Vodolazskyi, Shutterstock

Vitalii Vodolazskyi, Shutterstock

How Do You Feel About Home Renovation Projects?

Are you the type to take on fixer-upper projects, or do you prefer a move-in-ready home? Renovations add to your property value, but they also come with significant costs and stress. There could be arguments if one loves DIY projects while the other sees them as a financial burden.

Do You Have A Retirement Savings Plan?

Retirement may seem far away, but how you prepare for it now will affect your future quality of life. If one of you has been diligently saving in a 401(k) or IRA while the other hasn’t started yet, you may find yourselves struggling to catch up down the road.

How Do You Feel About Investing In Cryptocurrency?

Some see crypto as the future, while others think it’s gambling. If one is all-in on Bitcoin while the other thinks it’s a waste of money, it’s bound to cause disagreements. Talking about your views on digital currencies helps set boundaries on what you’re comfortable investing in as a couple.

Would You Be Willing To Get Financial Advice From A Professional?

Money is complicated, and sometimes, an outside perspective can make a big difference. But not everyone is open to seeking professional help. What if you and your partner have conflicting financial habits—would you be open to third-party help? Avoiding financial advice when needed can lead to costly mistakes.

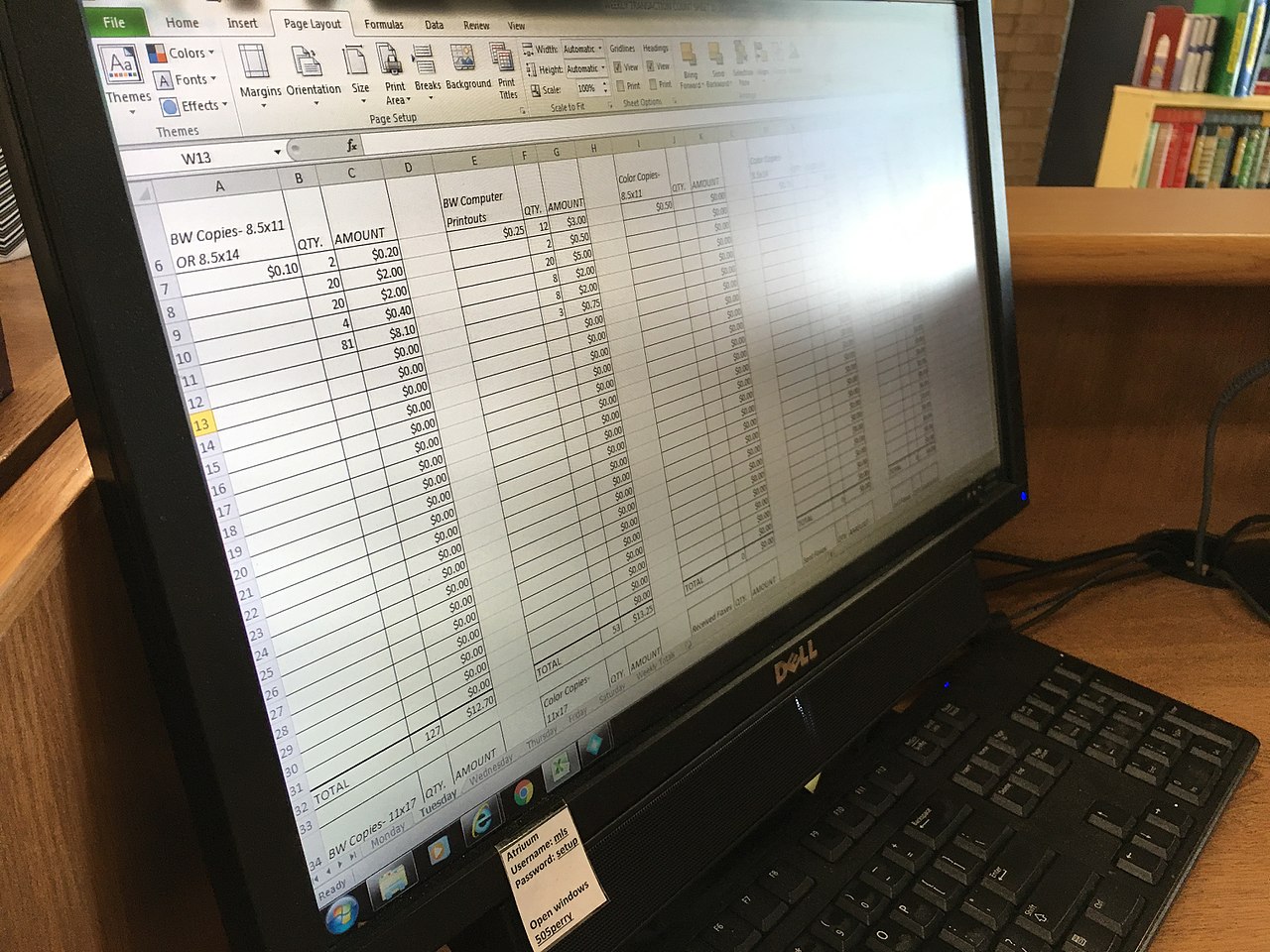

How Do You Track Your Spending?

Do you keep a detailed spreadsheet or use a budgeting app? Tracking spending helps you understand where your money goes, but not everyone does it the same way. If one of you is meticulous about tracking expenses and the other rarely looks at their statements, financial disagreements may arise.

Texas State Library and Archives Commission, CC BY 2.0, Wikimedia Commons

Texas State Library and Archives Commission, CC BY 2.0, Wikimedia Commons

What Are Your Biggest Financial Priorities Each Month?

Everyone has different financial priorities. For some, it’s paying off debt or saving for retirement. For others, it’s enjoying life. If your priorities don’t align, money conflicts can arise. Would you rather focus on eliminating debt quickly or invest more in experiences?

How Do You Feel About Shopping At Discount Stores Vs Brand-Name Stores?

Some people love a good deal at discount stores, while others prefer high-end brands and premium quality. If one of you insists on shopping at name-brand stores while the other values bargain hunting, how will that affect your budget? Would you be comfortable compromising?