Where There's A Will...

Think your will is complete? Even the most carefully crafted ones often miss necessary elements that could leave your family in limbo. If you want it to be a peaceful ride, continue reading.

Funeral Arrangements

Death is inevitable, and so is that funeral. It's sometimes better to mention the type of funeral service you'd want to have so that nobody gets a chance to argue over it. Whether you prefer a traditional funeral or a less formal gathering---all of that can be mentioned in it.

Personal Possessions

Disputes over personal possessions are a common source of tension among heirs. People usually make a broad statement in their will—something like: "I leave all my tangible personal property to my spouse". Personal possessions refer to physical items owned by an individual.

Personal Possessions (Cont.)

These items usually hold personal significance. This can encompass tangible personal property items like furniture, cars, jewelry, and artwork, as well as items of sentimental value that might not have high monetary value but are emotionally cherished.

Alternate Beneficiaries

An alternate beneficiary is someone who steps in to receive property or benefits if the main beneficiary can't take them, usually because they've passed away or decided not to accept the inheritance. This ensures that the testator's wishes are fulfilled, regardless.

Alternate Beneficiaries (Cont.)

When writing a will, it's a good idea to clearly state who will get your stuff if your first choice isn't around anymore. For instance, you might say, "I'm leaving my estate to my son, Jack. If Jack dies before me, then my estate goes to my daughter, Jill".

Digital Assets

These assets are any files or records you have online that are worth something, whether it's money, memories, or both. This can include your bank accounts, social media profiles, digital photos, and even things like trademarks or copyrights.

Digital Assets (Cont.)

Including digital assets in your estate plan is needed in this tech-savvy world. A lot of states have even put laws in place, like the Revised Uniform Fiduciary Access to Digital Assets Act, which lets executors handle digital assets unless your will says otherwise.

Guardianship Of Minor Children

When talking about parenting, the main focus is always on what's best for your child. By choosing a guardian for your minor child, they will be able to grow up in a setting that reflects your values. If you fail to do so, the court will do it for you.

Guardianship Of Minor Children (Cont.)

However, this may not align with your intentions. It's also considered wise to name an alternate or backup guardian; just suppose your first choice is not able to serve or unavailable when the time comes. Remember to think about their age and health as well.

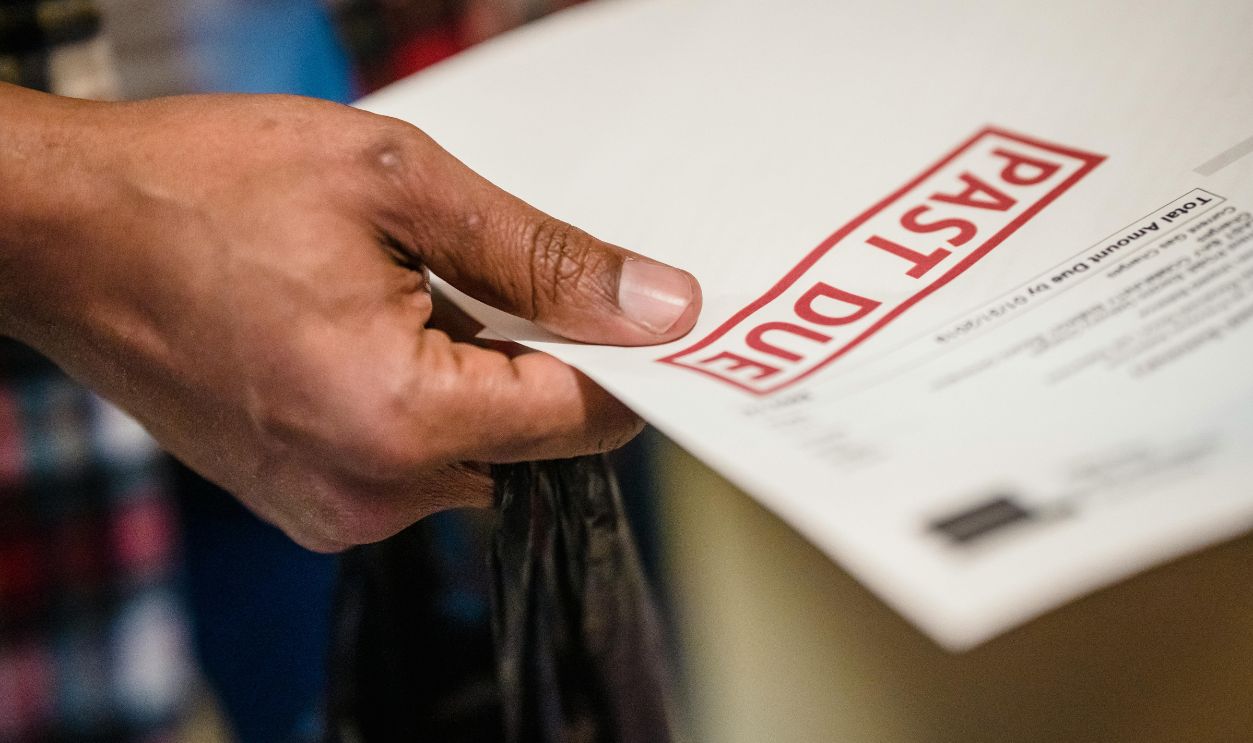

Outstanding Debts And Liabilities

Simply speaking, outstanding debts are any sum of money a person owes at the time of their death. This can cover a few different types of debts: Secured debts are things like mortgages and car loans, which are tied to specific elements.

Outstanding Debts And Liabilities (Cont.)

There are also unsecured debts, which consist of credit card bills, personal loans, and medical expenses. There can also be other unpaid expenses that need to be dealt with. Also, note that outstanding debts can reduce the total value of the inheritance that beneficiaries receive.

Executor And Trustee

An executor is named in a will who takes care of a deceased person's estate. Their main jobs are to start the probate process, take stock of what the person owns, pay off any debts and taxes, distribute the assets, and keep the beneficiaries in the loop.

Executor And Trustee (Cont.)

Besides, a trustee is picked through a trust document and is responsible for handling the trust's assets based on what the trustor has laid out in the agreement. They have a fiduciary responsibility to act in the best interests of the beneficiaries.

Important Passwords

Of course, everything is online, from banking to social media to storing personal documents. If your executor doesn't have your passwords, it could be tough for them to handle your accounts and help sort everything out after you're gone.

Important Passwords (Cont.)

Password managers (like Dashlane or LastPass) are great and they'll safely save your credentials and let you grant trustworthy people access. If you prefer a non-digital option, you could keep a physical list stored in a secure location, but it might be a bad idea if it falls into the wrong hands.

Binarysequence, CC BY-SA 4.0, Wikimedia Commons

Binarysequence, CC BY-SA 4.0, Wikimedia Commons

Letters Or Personal Notes

Writing personal letters gives you a chance to connect with your family and friends, sharing memories, life lessons, and love that can bring them some comfort. You can even use letters to clarify your intentions regarding specific bequests or family dynamics.

Charitable Donations

Giving to charities can drastically lower your taxed estate. You can save more of your fortune for your heirs by donating to eligible organizations, which are exempt from inheritance taxes. Charitable giving can be structured differently, allowing for flexibility.

Charitable Donations (Cont.)

You can indicate a specific sum or proportion of your estate that will be given to one or more charities. Similarly, establishing a donor-advised fund will help you make contributions during your lifetime while retaining the ability to recommend grants.

Charitable Donations (Cont.)

Think about giving appreciated assets—like stocks, bonds, or real estate—directly to a charitable organization. This method can remove capital gains taxes and provide a charitable deduction according to the asset's actual market value at the time of donation.

Healthcare Directives

Healthcare directives, often referred to as advance directives, are legal documents that outline your picks and preferences for medical care when you are not in the position to communicate those wishes yourself. They typically include something known as a living will.

National Cancer Institute, Wikimedia Commons

National Cancer Institute, Wikimedia Commons

Healthcare Directives (Cont.)

This document dictates the types of treatment you would or wouldn't like, particularly in end-of-life situations. It can address scenarios such as resuscitation, mechanical ventilation, and other life-sustaining treatments. Another one is the healthcare proxy.

Healthcare Directives (Cont.)

Also known as a durable power of attorney, a healthcare proxy appoints a trusted individual to make such decisions on your behalf if you are incapacitated. You can opt for Do-Not-Resuscitate orders, which indicate that you do not wish to receive CPR if you stop breathing.

James D. Sims, Wikimedia Commons

James D. Sims, Wikimedia Commons

Residuary Estate

When certain donations specified in a will are fulfilled, the "leftover" assets are commonly referred to as the residuary estate. Cash, real estate, assets, and personal belongings that weren't designated for distribution can all fall under this category.

Residuary Estate (Cont.)

The residuary clause is an important part of a will that states who gets the remaining assets after all the debts and specific gifts are sorted out. It can name one person or a few people or even give details on how to split things up among them.

Works Of Art Or Creative Works

If you are an artist, you need to plan for the future management and distribution of your work. Art pieces often gain value, which can lead to hefty federal estate taxes. If there isn't a solid plan in place, heirs might have to sell these to cover the taxes.