How Misinformation Skews Our View Of The US Economy

Did you know that many beliefs about the American financial system are flat-out skewed? Some myths feel like undeniable truths, but what if they lead you to poor financial decisions? Here’s the truth.

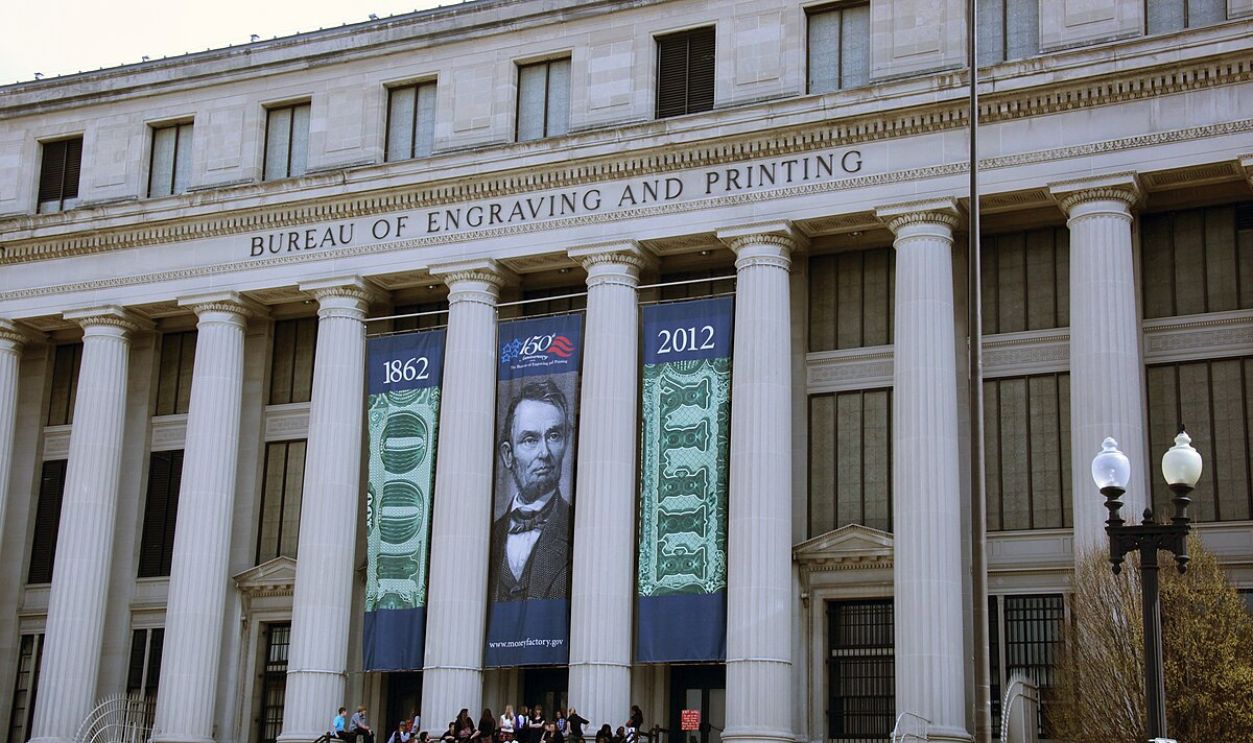

The Federal Reserve Prints All US Money

Contrary to popular belief, the Federal Reserve doesn’t print physical money. This responsibility lies with the US Treasury’s Bureau of Engraving and Printing. The Federal Reserve’s primary role is managing the economy through monetary policies, such as setting interest rates and conducting open market operations.

Tim Evanson, CC BY-SA 2.0, Wikimedia Commons

Tim Evanson, CC BY-SA 2.0, Wikimedia Commons

The Federal Reserve Prints All US Money (Cont.)

Then, why do we hear about the Fed creating money? This refers to purchasing government securities or adjusting reserve requirements for banks. These practices increase the electronic money supply but not the amount of cash circulating in your wallet.

The Stock Market Reflects The Economy

The stock market is often used as a shorthand for economic health, but it is not a comprehensive indicator. It shows the performance of publicly traded companies, which represent only a fraction of the overall economy. GDP growth, unemployment rates, consumer spending, and small business performance are also relevant.

Kaptan Ravi Thakkar, CC BY-SA 4.0, Wikimedia Commons

Kaptan Ravi Thakkar, CC BY-SA 4.0, Wikimedia Commons

The Stock Market Reflects The Economy (Cont.)

Stock prices are influenced by investor sentiment and global events, which may not align with actual economic conditions. For example, during the COVID-19 pandemic, the stock market rebounded quickly due to stimulus measures and low interest rates, even as unemployment soared and small businesses struggled.

All Wealthy Americans Inherited Their Fortunes

The stereotype that all wealthy Americans inherited their wealth from family dynasties paints an inaccurate and overly simplistic picture. According to PR Newswire, 79% of American millionaires say that their wealth is self-made, while 6% won it by surprise, like in the lottery.

Matt May, CC BY 2.0, Wikimedia Commons

Matt May, CC BY 2.0, Wikimedia Commons

All Wealthy Americans Inherited Their Fortunes (Cont.)

These self-made millionaires built their wealth through hard work, entrepreneurship, or high-paying careers rather than inheritance. For example, Warren Buffett famously pledged to donate the vast majority of his fortune to encourage his children to forge their paths. Similarly, individuals like Oprah Winfrey rose from poverty to unparalleled success.

USA International Trade Administration, Wikimedia Commons

USA International Trade Administration, Wikimedia Commons

The Stock Market Is Only For The Rich

This myth is widespread because of movies and the historical image of Wall Street as an exclusive club for wealthy investors. This might have been true in the past, but not anymore. Thanks to technology and innovative financial tools, the barrier to entry has been lowered.

jamiejohndavis, CC BY 2.0, Wikimedia Commons

jamiejohndavis, CC BY 2.0, Wikimedia Commons

The Stock Market Is Only For The Rich (Cont.)

Today, you can become an investor with as little as $5 through platforms like Robinhood or Stash. Additionally, workplace retirement accounts such as 401(k)s often include stock-based mutual funds. This means millions of middle-class Americans are invested in the market without actively managing portfolios.

Your Money Is Safer At Home Than In A Bank

During the Great Depression, savings were wiped out. However, modern banking systems are heavily regulated to protect depositors. The Federal Deposit Insurance Corporation pays up to $250,000 per account holder per bank as a protection. Even if a bank collapses, your money is insured up to that limit.

ajay_suresh, CC BY 2.0, Wikimedia Commons

ajay_suresh, CC BY 2.0, Wikimedia Commons

Your Money Is Safer At Home Than In A Bank (Cont.)

Keeping large amounts of cash at home, on the other hand, is risky due to theft and loss in value due to inflation. Unlike cash sitting at home, money in a bank account can grow through interest or investments. Banks also offer tools for making secure transactions.

Binarysequence, CC BY-SA 4.0, Wikimedia Commons

Binarysequence, CC BY-SA 4.0, Wikimedia Commons

Social Security Is About To Disappear Entirely

While reforms are needed to maintain full benefits in the long term, Social Security is not on the brink of extinction. Many reports show funding challenges, as it’s financed by payroll taxes. Yet, the system still stands strong.

Bohao Zhao, CC BY 3.0, Wikimedia Commons

Bohao Zhao, CC BY 3.0, Wikimedia Commons

Social Security Is About To Disappear Entirely (Cont.)

As the birth rates decrease and the population ages, fewer workers contribute to the system relative to the growing number of retirees. However, even if the Trust Fund were exhausted, payroll taxes would still fund most benefits.

Credit Scores Are Only Important When Buying A House

Credit scores are essential for securing a mortgage, but their influence extends far beyond homeownership. Your credit score directly influences your ability to obtain credit cards, personal loans, auto loans, and rental agreements. Many landlords check credit scores to evaluate potential tenants’ financial reliability.

Credit Scores Are Only Important When Buying A House (Cont.)

But that’s not all. Insurance companies sometimes use credit scores to calculate premiums, as they assume lower scores impose higher risk. As a result, you will pay higher interest rates. Keep a good score by paying bills on time and using your credit cards only in emergencies.

Inflation Is Caused Entirely By Government Overspending

Government spending can influence inflation, but it’s not the sole cause. Inflation occurs when prices of services and goods rise to erode purchasing power. Multiple factors contribute to inflation, including supply chain disruptions, increased consumer demand, rising production costs, and monetary policies set by the Federal Reserve.

Inflation Is Caused Entirely By Government Overspending (Cont.)

During the COVID-19 pandemic, inflation surged due to increased demand for goods and supply chain bottlenecks as economies reopened. Central banks like the Federal Reserve play an important role in controlling inflation through tools like interest rate adjustments and quantitative tightening. Blaming government overspending alone oversimplifies a complex economic phenomenon.

Gold Is The Safest Investment

Gold is a good hedge against inflation or currency devaluation as it’s known to store value. However, it’s not always the safest investment. It should be part of a diversified portfolio rather than the sole investment vehicle for long-term financial growth.

Gold Is The Safest Investment (Cont.)

During times of uncertainty, choose gold as a “haven” because it isn’t directly tied to any government or currency. However, gold prices can be influenced by global events and speculative trading. Gold doesn’t generate income or dividends, unlike stocks or bonds, and its value depends on price appreciation.

Andrzej Barabasz, CC BY-SA 4.0, Wikimedia Commons

Andrzej Barabasz, CC BY-SA 4.0, Wikimedia Commons

Paying Off Debt Hurts Your Credit Score

Paying off debt is a smart move and does not harm your credit score when done correctly. This myth likely arises from misunderstandings about how credit scores work. Paying off debt, mainly revolving debt like credit cards, improves your credit score.

Paying Off Debt Hurts Your Credit Score (Cont.)

This practice reduces your credit utilization ratio, which shows lenders that you manage credit responsibly. However, in some cases, paying off and closing old accounts can slightly lower your score because it reduces your overall credit limit and potentially shortens your credit history.

The US Dollar Is Backed By Gold

Many people assume the US operates under a gold standard. However, it abandoned the gold standard in 1971 under President Richard Nixon. Since then, the dollar has been a fiat currency whose value is not tied to a physical commodity but backed by the government’s credibility and the economy’s strength.

The US Dollar Is Backed By Gold (Cont.)

The dollar’s value comes from trust in the government’s continuous ability to repay its obligations, as well as the dollar’s role as the world’s reserve currency. While gold remains valuable, the economy and monetary policy determine the dollar’s stability.

You Should Avoid All Debt At Any Cost

The idea that all debt is bad oversimplifies the role debt can play in financial planning. Excessive or poorly managed debt can lead to financial trouble. However, certain types of debt—like mortgages or business loans—can be valuable tools for building wealth.

You Should Avoid All Debt At Any Cost (Cont.)

Innovative use of debt can help you achieve milestones like homeownership and business expansion. On the other hand, high-interest credit card balances for big purchases should be minimized or avoided. If unavoidable, these debts should be paid on time.

The Fed Is Funded By Taxpayer Money

A common misconception is that the Federal Reserve is directly funded by taxpayer money. In reality, the Fed is an independent entity with its own funding sources. It’s a part of the economic system but doesn’t rely on taxes collected from individuals or businesses.

The Fed Is Funded By Taxpayer Money (Cont.)

Most of its funding comes from its own operations. These include interest earned in the US Treasury securities and other government-backed assets, as well as the fees charged for providing banking services to financial institutions. After covering its operational expenses, the Fed transfers any extras back to the US Treasury.

AgnosticPreachersKid, CC BY-SA 3.0, Wikimedia Commons

AgnosticPreachersKid, CC BY-SA 3.0, Wikimedia Commons

Taxes Are Higher Now Than Ever Before

Many people believe that tax rates are at an all-time high, but history tells a different story. In the mid-20th century, federal income tax rates peaked at 94% during WW2 and remained above 70% until the 1980s. By contrast, the top federal income tax rate in 2023 was 40.8%.

Taxes Are Higher Now Than Ever Before (Cont.)

Americans benefit from a range of credits that lower their tax credits, like the Earned Income Tax Credit. Although local taxes and property taxes may create a perception of higher overall expenses, federal income tax rates are lower than they have been for much of modern history.

stevepb, CC0, Wikimedia Commons

stevepb, CC0, Wikimedia Commons

Millennials Will Never Be Able To Retire

The narrative that millennials are financially doomed and unable to retire is based mainly on concerns about stagnant wages and the high cost of living. Such challenges are real, but they don’t make retirement impossible. Millennials are actually saving for retirement at earlier ages than previous generations.

Millennials Will Never Be Able To Retire (Cont.)

Many employers now offer 401(k) plans with matching contributions, and financial technology has made saving and investing more accessible. Additionally, lifestyle changes like delayed homeownership and family planning can free up income for retirement savings despite the unique economic hurdles.

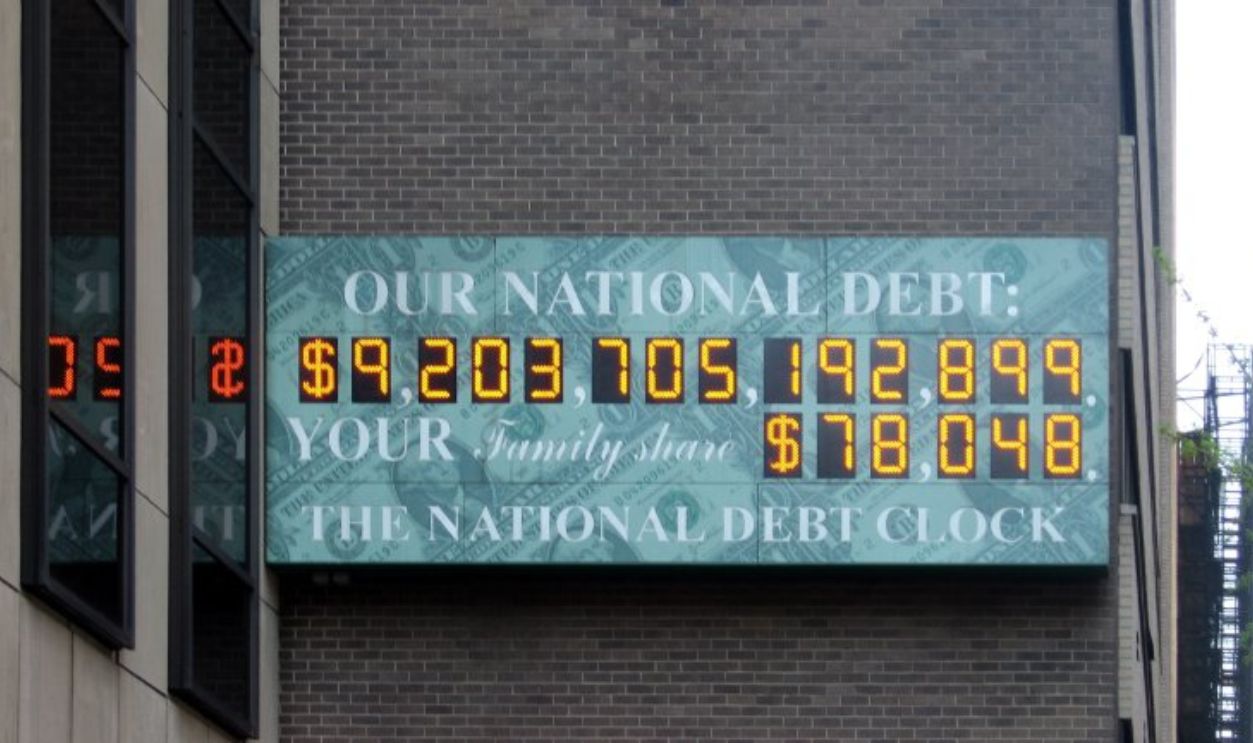

The National Debt Must Be Paid Off Immediately

Do you hear discussions about paying the national debt? Many claim it’s essential to avoid economic collapse. However, national debt doesn’t function like personal debt. Governments can sustain debt indefinitely as long as they can meet interest payments and maintain investor confidence.

Everyme, CC BY 3.0, Wikimedia Commons

Everyme, CC BY 3.0, Wikimedia Commons

The National Debt Must Be Paid Off Immediately (Cont.)

As a matter of fact, the national debt has been a feature of US finances since the country’s founding, and it has grown alongside the economy. Attempting to pay off the debt rapidly could require drastic spending cuts or tax hikes, which could harm economic growth and essential programs.

The Rich Pay No Taxes

According to the Tax Foundation, the top 50% of earners pay more than 97% of all federal income taxes, while the bottom 50% contribute less than 3%. Nevertheless, stories of wealthy individuals or corporations using loopholes to minimize their tax liability keep the myth going.

The Rich Pay No Taxes (Cont.)

It’s true that tax laws provide opportunities for deductions and strategic planning. Some wealthy individuals may pay lower effective tax rates than middle-class Americans due to the nature of their income, such as capital gains or dividends, which are taxed at lower rates.

Johnacastro2012, CC0, Wikimedia Commons

Johnacastro2012, CC0, Wikimedia Commons

Renting Is Throwing Money Away

Buying a home requires significant upfront expenses, such as a down payment and closing costs. Renting can be a good investment, but it has some advantages. It’s especially beneficial for those who value flexibility or are not ready for the long-term financial commitments of homeownership.

Renting Is Throwing Money Away (Cont.)

Renters avoid costs associated with property taxes and maintenance in addition to homeowners’ insurance. Additionally, it can free up funds for other investments or priorities while providing the flexibility to relocate as needed. The reality is that whether to rent or buy depends on individual circumstances and lifestyle preferences.

Cryptocurrency Is A Guaranteed Way To Get Rich

Cryptocurrency as a get-rich-quick scheme has been fueled by stories of early investors who made fortunes overnight. Many became rich. However, this perception overlooks the extreme volatility and risks associated with cryptocurrencies. Digital assets like Bitcoin and Ethereum have seen meteoric rises but have also experienced sharp declines.

Cryptocurrency Is A Guaranteed Way To Get Rich (Cont.)

The truth is that cryptocurrency is a speculative investment, not a guaranteed path to riches. Its value depends on market demand, regulatory developments, technological advancements, and adoption rates, all of which can change rapidly. Unlike traditional investments, they lack intrinsic value or a long history of performance.

The Wealth Gap Is A Recent Problem

Do you believe that only recently the rich have been getting richer? The wealth gap is a long-standing economic reality and has existed in varying degrees throughout history. This gap has been shaped by factors like industrialization and technological advancements.

The Wealth Gap Is A Recent Problem (Cont.)

Income inequality was pronounced during the Gilded Age of the late 19th century. However, it narrowed during the mid-20th century due to policies like progressive taxation and social safety nets. Today, stagnant wages for the middle class and the concentration of wealth among the top earners made the gap bigger.

A Strong Dollar Is Always Good For The Economy

At first glance, a strong dollar seems beneficial because it boosts purchasing power. However, the impacts of a strong dollar are more nuanced and not always advantageous for the broader economy. Exports are more expensive for foreigners and this harms industries that rely on global markets.

A Strong Dollar Is Always Good For The Economy (Cont.)

Additionally, multinational companies may see reduced profits when foreign earnings are converted back to dollars. A strong dollar can also hinder developing economies with dollar-denominated debt, as it makes repayment more expensive. The dollar’s impact varies depending on the economic context and sectors affected.

More Inequality Means More Poverty

In some cases, inequality can coexist with reductions in poverty. It’s possible for the wealth of the richest individuals to grow while the standard of living for the poorest also improves. Economic growth and technological advancements can lift many people out of poverty, even in societies with significant income inequality.

More Inequality Means More Poverty (Cont.)

Inequality can increase social tensions and economic disparities. However, the relationship between inequality and poverty is more complex than this simple cause-and-effect narrative. The key factor is how wealth is distributed and the availability of social services with policies aimed at alleviating poverty.