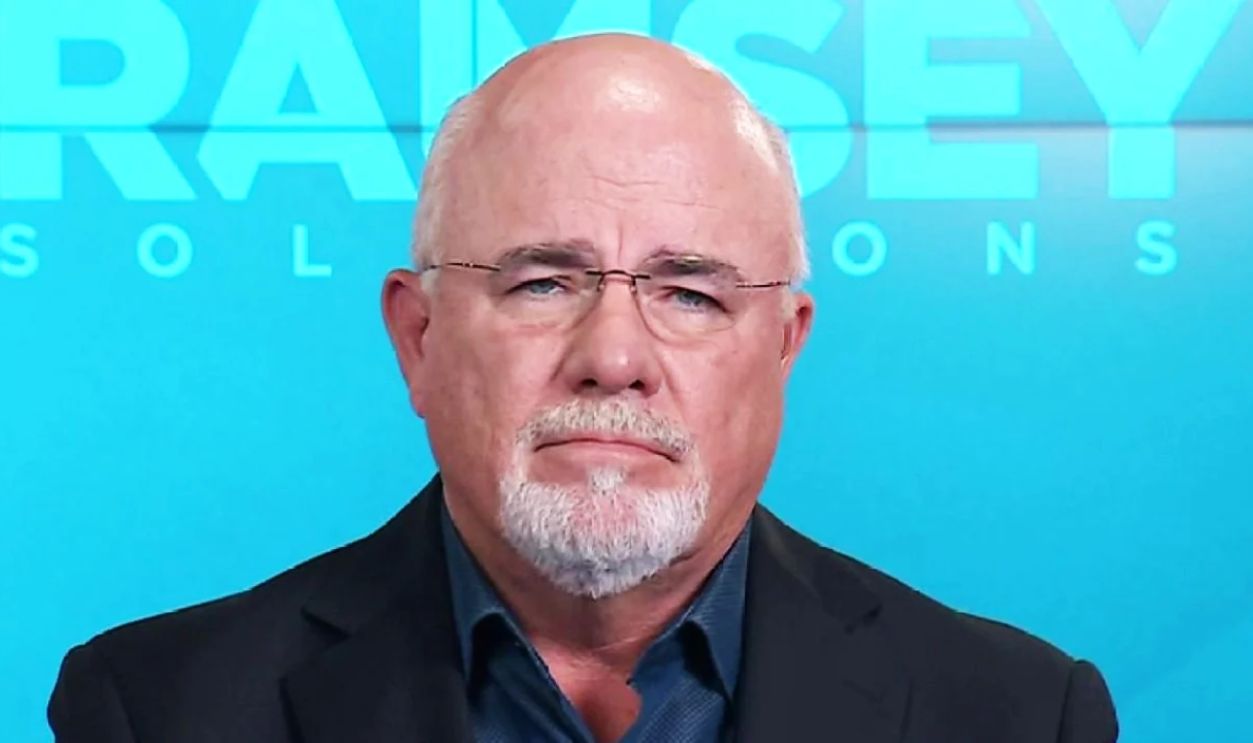

Dave Ramsey Is Just One Of Many

Dave Ramsey is a legend. But he isn’t the only one. Today, meet another who is a Chartered Financial Analyst who retired at 42 through strategy. That’s Michael Gregory. While Gregory values Ramsey’s foundational advice, here is what he can add.

He Started Building Through Real Estate

Michael Gregory bought his first rental property when he was 20, and it completely changed the game for him. Real estate gave him a steady income and helped him build long-term wealth, but Ramsey recommends waiting until you’re debt-free with a solid emergency fund before diving in.

He Leveraged Rentals For Long-Term Wealth

Real estate comes with risks, but you can mitigate them with market knowledge and effective tenant management. For Gregory, rentals played a key role in his early retirement, and his strategy was simple: Let tenants pay off properties over time, then sell them for profit.

He Took Strategic Debt To Grow

While strategic debt is a cautious approach, it can slowly expand a wealth-building process. By using mortgages wisely, Gregory was able to grow his investments much faster than if he had only used cash. While this approach helped Gregory, Ramsey’s method may align better with some.

He Took Strategic Debt To Grow (Cont.)

Ramsey’s caution around debt is understandable, as many people misuse it. However, for those disciplined enough to manage it wisely, debt can be a wealth-building tool rather than a setback. Gregory’s path to early retirement wouldn’t have been possible without understanding the power of leverage.

Gregory Invested Early

Dave Ramsey encourages starting young, and Gregory is living proof. In Gregory’s account, he began dipping his feet into investing in his late teens and focused on stocks, specifically mid-cap companies that dominated their markets. It worked.

He Focused On Vision Over Market Hype

Mr Gregory had a long enough time horizon to handle the risk, though he never saw the companies he invested in as risky. For instance, in the early 2000s, he bought Microsoft stock in the $20s when most people thought it was overpriced. Now, it’s in the $400s.

He Prioritized Strategy Over Simplicity

Gregory never lost a dollar on any of his stock picks. While he doesn’t believe stock picking is the right strategy for most people, this is an area where he differs from Ramsey. For him, early investing isn’t just about getting started; it’s about making smart, strategic choices.

He Set Conserved Investment Expectations

While Dave Ramsey advises investing in mutual funds can deliver 12% annual returns, Gregory’s approach is more conservative. According to him, Historically, the S&P 500 has averaged closer to 10%. Please note Gregory prefers more realistic projections, but both approaches can be practical based on individual goals.

He Set Conserved Investment Expectations (Cont.)

Michael Gregory takes a more cautious approach, using realistic projections of 6-8% for long-term financial planning. Overestimating returns can result in under-saving or risky assumptions about future growth. He believes it’s wiser to plan conservatively and be pleasantly surprised rather than aim too high and fall short.

Amnaj Khetsamtip, Shutterstock

Amnaj Khetsamtip, Shutterstock

Gregory Invested Smart, Not Fast

Ramsey’s recommendation to pay off mortgages quickly focuses on eliminating debt, but Gregory believes in locking up capital in a low-interest loan. He prioritized investing that money into higher-return assets like index funds and rental properties. Both strategies can be beneficial based on your financial goals.

Labunskiy Konstantin, Shutterstock

Labunskiy Konstantin, Shutterstock

He Focused On Meaningful Living

Gregory prioritizes the Financial Independence Retire Early (FIRE) lifestyle, using financial independence to gain more time for family and meaningful experiences. Early retirement, in his view, is about pursuing passions and being fully present. Ramsey’s? Live like a popper until the debt is paid.

He Used Wealth As A Tool For Freedom

For Gregory, this meant leaving corporate life in his 40s to focus on his children and hobbies. FIRE takes Ramsey’s methods a step further by redefining retirement as an active and fulfilling phase of life where your best-earned asset is freedom early in life.

He Achieved Financial Freedom For Early Exit

As mentioned, Gregory retired at 42 by following the principles of the FIRE movement. In contrast, Ramsey’s approach assumes a traditional career path, with retirement often pushed into the 60s. While Ramsey prioritizes debt elimination, Gregory focuses on balancing aggressive saving and investing.

Gregory Used Credit Cards Wisely

Ramsey advises eliminating credit cards altogether, but Michael Gregory views them as a helpful tool when managed responsibly. For him, credit cards provide rewards, build credit history, and offer buyer protection. The key, he believes, is paying them off in full every month to avoid interest and fees.

Gregory Used Credit Cards Wisely (Cont.)

While Ramsey’s approach is great for those struggling with debt, it can be overly restrictive for others who aren’t. Credit cards are a valuable part of a financial strategy if used wisely. They aren’t inherently bad; it all depends on how they’re used.

Suradech Prapairat, Shutterstock

Suradech Prapairat, Shutterstock

He Focused On Worthwhile Moments

The strict budgeting approach of Ramsey during debt repayment can sometimes limit experiences, but Gregory prioritizes meaningful, low-cost activities. Family trips to the library, board game nights, and free local events provide great value without straining finances.

He Focused On Worthwhile Moments (Cont.)

He believes these moments create lasting memories and reinforce the idea that joy doesn’t have to come with a price tag. While Ramsey’s approach is helpful for those working to eliminate arrears, Gregory emphasizes the importance of balancing financial goals with enjoying life along the way.

He Did Efficient Emergency Planning

Dave Ramsey recommends a standard emergency fund of 3-6 months of expenses, but Michael Gregory prefers a more customized approach. He tracks his rolling 24-month expenses to determine an emergency fund that fits his unique financial situation.

Vitalii Vodolazskyi, Shutterstock

Vitalii Vodolazskyi, Shutterstock

He Did Efficient Emergency Planning (Cont.)

This method provides a buffer tailored to his lifestyle, which offers peace of mind without tying up excess cash. While Ramsey’s approach is great for simplicity, Gregory believes that personalizing a safety net ensures money isn’t sitting idle unnecessarily.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Gregory Believed In Private Wealth, Public Simplicity

Both Ramsey and Gregory emphasize the importance of avoiding lifestyle inflation, but Gregory takes it a step further with the concept of stealth wealth. This means continuing to live modestly even after achieving financial success, helping to avoid unnecessary judgment or expectations.

Gregory Believed In Private Wealth, Public Simplicity (Cont.)

Driving an older car or living in a reasonably sized home makes life simpler and less stressful. While Ramsey’s advice in this area is solid, stealth wealth adds another layer of strategic planning. Don’t think of it as hiding success but protecting personal priorities.

He Believes In Giving More Than Money

Ramsey emphasizes consistent tithing, but Gregory prioritizes giving time and resources, especially in the early stages of financial freedom. In his case, volunteering at local organizations or mentoring others has been far more rewarding than simply making monetary donations.

He Believes In Giving With Purpose

While generosity is essential, Gregory believes it should align with one’s current financial situation. Giving back can also mean sharing knowledge, time, or skills. As financial freedom grows, so does the ability to give more effectively.

Gregory Understood Impact Beyond Wealth

The key is to make giving an ongoing part of the journey, not just a final goal. While acknowledging that Ramsey donates generously, he urges him (and you) to shift away from empire-building and improve financial education in schools without profit.

Andrii Yalanskyi, Shutterstock

Andrii Yalanskyi, Shutterstock

He Mastered Taxes And Maximize Wealth

Michael Gregory takes a more strategic approach to wealth accumulation, which incorporates methods like depreciation and tax-loss harvesting. For instance, owning rental properties provides tax benefits that enhance returns and reduce liabilities. These tactics are available to anyone willing to learn.

He Mastered Taxes And Maximize Wealth (Cont.)

Gregory believes ignoring tax advantages is a missed opportunity. Understanding and leveraging tax laws can accelerate financial independence. Doing this takes advantage of the loopholes the system provides, and is also about making the most of the tools it offers.

Gregory Adjusted His Budget To Fit Changing Needs

Gregory compares budgeting to dieting; it only works if it’s sustainable. While Ramsey advocates strict budgeting, Gregory believes flexibility leads to better long-term success. His approach allows for adjustments as life changes, whether it’s an unexpected expense or an occasional splurge.

Gregory Adjusted His Budget To Fit Changing Needs (Cont.)

A budget should serve as a roadmap, not a source of frustration. By tracking spending and making reallocations as needed, financial goals stay on track without feeling overly restrictive. For Gregory, flexibility transforms budgeting from a burdensome task into a lasting and effective habit.

He Did Detailed Tracking

While Ramsey promotes tracking simplicity with envelope systems or budgeting apps, Gregory prefers detailed spreadsheets. Tracking every penny provides him with a clear view of cash flow, investments, and future projections. It’s about staying informed and prepared.

He Did Detailed Tracking (Cont.)

Spreadsheets offer customization, allowing him to focus on what aligns best with his financial goals. Ramsey’s straightforward approach is excellent for beginners, but spreadsheets can be a game-changer for those who enjoy data and more profound financial control.

He Believes Teaching Money Skills Early

Ramsey’s advice on teaching kids about money is sound but broad. Gregory customizes lessons based on his children’s developmental stages, making sure the concepts are practical and age-appropriate. For younger kids, he focuses on earning through chores and saving for simple goals.

He Believes In Teaching Money Skills Early (Cont.)

As they become teenagers, they learn about investments, taxes, and the power of compounding. This tailored approach ensures they’re prepared for real-world financial decisions, not just theoretical knowledge. Financial literacy isn’t one-size-fits-all because it evolves alongside a child’s understanding of life.

Gregory Diversified His Income

Ramsey says a steady, single income suffices, while Gregory prioritizes diversifying income sources. Real estate, side hustles, and investments have provided him a safety net that no single job ever could. Relying on just one income is risky, especially in an unpredictable economy.

Gregory Diversified His Income (Cont.)

Multiple streams create stability and flexibility, even during tough times. While Ramsey’s approach is practical for repayment of money owed, Gregory believes true long-term wealth requires diversification. Financial freedom goes beyond saving by maximizing earnings.

He Took Calculated Risks

The advice by Ramsey caters to a risk-averse audience, but Michael Gregory embraces calculated risks, particularly with rental properties and leveraging debt. When managed wisely, risks can yield far greater rewards than simply playing it safe.

He Took Calculated Risks (Cont.)

For Gregory, real estate investments needed thorough research, a strategic approach, and a readiness to take chances. Not every move was a success, but the ones that worked made a significant impact. Calculated risks entail making informed decisions that drive progress.

He Used Smart Tools To Maximize Wealth

While Ramsey simplifies financial strategies, Michael Gregory recognizes the value of advanced tools like HSAs, index funds, and tax-efficient accounts. These are accessible to anyone willing to learn. Such tools optimize growth and minimize unnecessary expenses, accelerating financial goals.

He Used Smart Tools To Maximize Wealth (Cont.)

While Ramsey’s straightforward approach is great for beginners, overlooking these strategies can mean leaving money on the table. Gregory believes that understanding and utilizing these financial tools can significantly enhance one’s strategy. The more resources you have, the better prepared you are for long-term success.

He Believed Every Dollar Has Potential

Each financial decision comes with an opportunity cost, a concept Gregory believes Ramsey doesn’t emphasize enough. For instance, every dollar used to pay off low-interest debt is a dollar that could be invested for growth.

He Believed Every Dollar Has Potential (Cont.)

This isn’t about neglecting debt but about balancing priorities to maximize returns. Opportunity cost influences Gregory’s decision-making and ensures the distribution of resources where they have the most impact. While Ramsey’s approach is effective for reducing financial stress, Gregory believes that considering opportunity costs leads to smarter financial strategies.

Gregory Took Flexible Steps

Ramsey’s Baby Steps provide a solid framework, but Michael Gregory finds them too rigid. Financial goals aren’t always linear, and adaptability is essential. Adjusting the steps to fit personal circumstances allows for steady progress without unnecessary stress.

Gregory Took Flexible Steps (Cont.)

For example, Gregory prioritized investing while maintaining a manageable mortgage, which deviates from Ramsey’s order but aligns with his long-term strategy. The steps should serve the individual, not the other way around. Flexibility transforms Ramsey’s foundation into a personalized plan that evolves with changing financial needs.

He Capitalized On Market Cycles

Instead of blindly following a “buy and hold” strategy, Gregory studied market cycles to make informed investment decisions. He took advantage of downturns to acquire undervalued assets and sold strategically when markets peaked. While Ramsey discourages market timing, Gregory’s success came from understanding trends and making calculated moves.

He Focused On Cash Flow Over Net Worth

Finally, while many chase high net worth numbers, Gregory prioritized cash flow—ensuring his investments generated consistent, passive income. He structured his portfolio to cover his expenses without ever needing to dip into principal. This approach gave him financial freedom much earlier than traditional retirement-focused strategies.