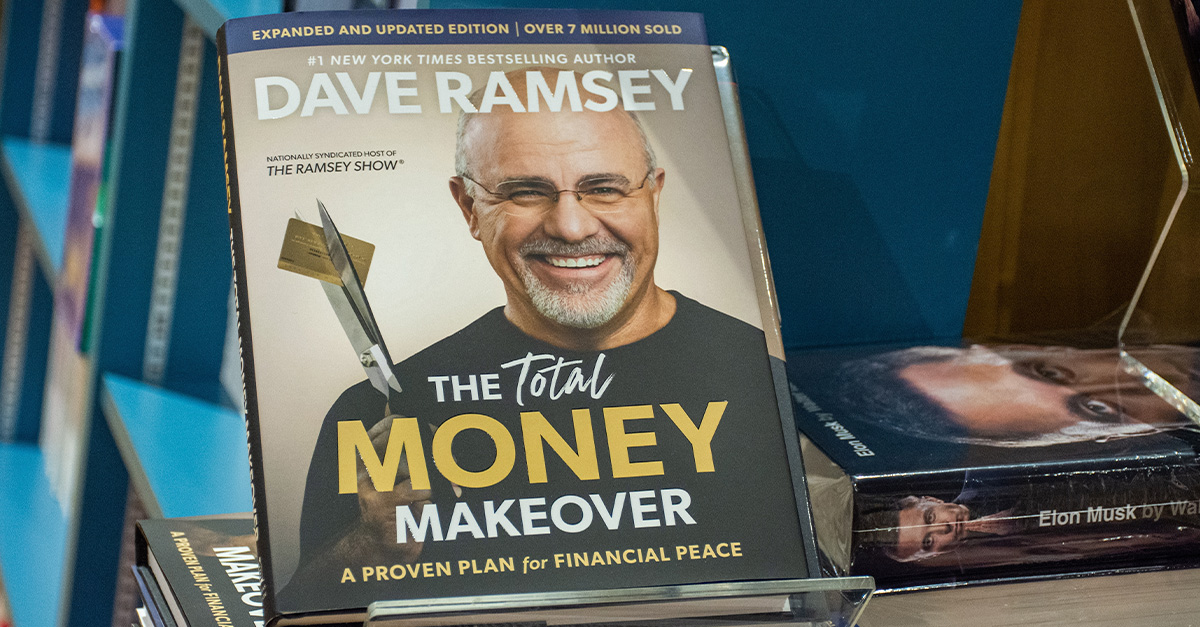

The Best Money Advice From Top Financial Gurus

Whether you're just beginning your investment journey, or are a seasoned investor looking to up your game—here is some of the best money advice from the world's most brilliant financial minds.

Investigate Investments Thoroughly And Be Patient

This advice comes from the father of value investing, Benjamin Graham, who pioneered the investment strategy in his 1949 book The Intelligent Investor, centering on buying undervalued stocks with growth potential. Before you invest, you'll want to investigate your investment option thoroughly to get the best possible projection of its success. And, as you wait for your stock values to increase, you'll need to be patient and wait for the tree to bear fruit.

Unknown Author, Wikimedia Commons

Unknown Author, Wikimedia Commons

Diversification Isn't Always Necessary

Warren Buffett may be one of Benjamin Graham's most profitable students—but the "Oracle Of Omaha" doesn't always follow his teacher's advice. For example, he doesn't see diversity of stocks as a strength. Instead, Buffett's preference (and advice to others) is to pick and choose your stocks carefully and concentrate your investments in a few well-selected stocks that continue to grow over time.

USA International Trade Administration, Wikimedia Commons

USA International Trade Administration, Wikimedia Commons

Going Big Isn't Always The Answer

This piece of advice comes from Peter Lynch, who provided investors in the Fidelity Magellan Fund with a 29% compounded rate of return. The hyper-successful hedge fund manager says that sticking with investments in small companies with better projected growth is often a more successful strategy than investing in one of the big boys of the stock market.

Invest In Index Funds

John Bogle, the creator of index funds, might be a little biased about whether or not you should invest in the thing he created—but there's lots of truth to the viability of index funds. He's also responsible for driving down the price of index funds, allowing you to invest in the market for less.

BillCramer, CC BY-SA 4.0, Wikimedia Commons

BillCramer, CC BY-SA 4.0, Wikimedia Commons

Passive Income Is Critical

The other pioneer of index funds, Burton Malkiel, continuously hammers home the importance of having a passively managed index fund or stock portfolio. By reducing your actual involvement in your investments, you'll free up your intellectual capital and life for more important pursuits, while your money makes money for you.

The Washington Post, Getty Images

The Washington Post, Getty Images

Invest In The Money Makers With Moats

In finance, a moat is the ability of a company to remain competitive and maintain a competitive advantage. Warren Buffett's right-hand man, Charlie Munger, tells us to invest in companies with the most ability to make money—discovered by conducting thorough research—but also those with the ability to remain competitive. This means investing in a company that's flexible and can make positive money moves in reaction to their market performance.

Nick Webb, CC BY 2.0, Wikimedia Commons

Nick Webb, CC BY 2.0, Wikimedia Commons

Bet Smart To Make Money

If you're going to make money from betting against a certain stock or company, it's important that you conduct thorough research beforehand. While you can't control the market, you can control how prepared you are to make those money moves when the time is right, possibly generating untold riches for yourself. George Soros gives us this particular piece of financial advice—he would know, after his bet against the Bank of England in 1992 made him $1 billion in a single day.

World Economic Forum, CC BY-SA 2.0, Wikimedia Commons

World Economic Forum, CC BY-SA 2.0, Wikimedia Commons

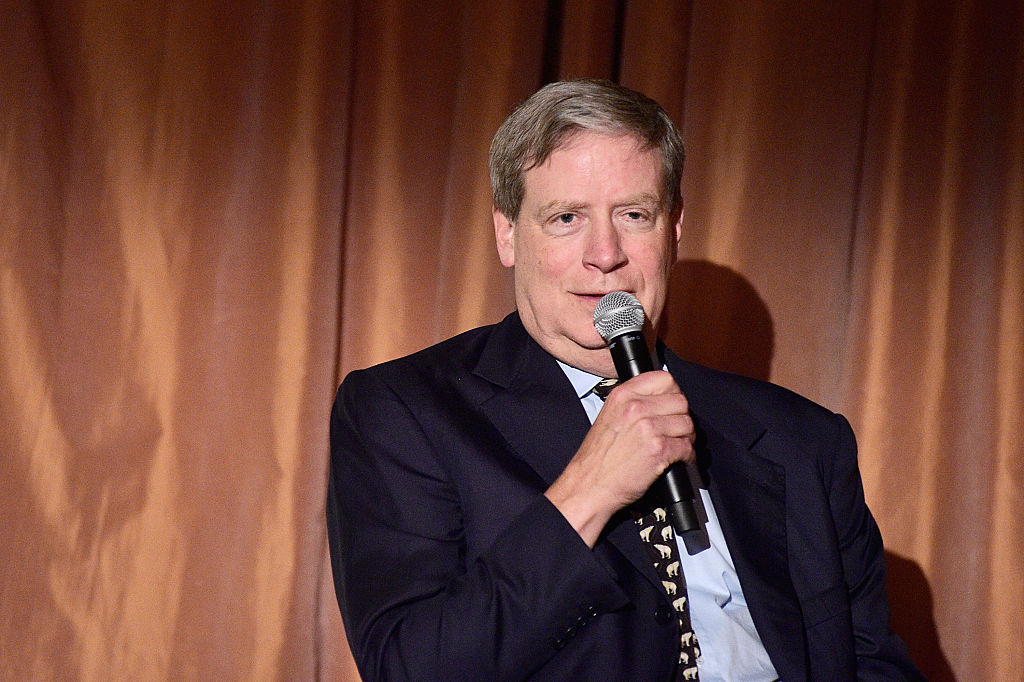

Invest From The Top Down

Instead of making investments on individual stocks or companies, Stanley Druckenmiller's financial advice is to employ a top-down approach that features investing on things after examining them on a large scale, like the GDP of a country. So, rather than researching a particular company or individual, you'd look at the GDP first, then work your way down to the individual or company, employing a top-down approach.

Invest In What You're Passionate About

No one other than activist-investor Carl Icahn could give us this advice. Icahn's investment strategy is to build up a large position in struggling companies, take over and then rebuild the company by using his stock to force changes that positively impact the company's overall value. By investing in what you're passionate about, it will become easier for you to make investment decisions.

AviateHistory, Wikimedia Commons

AviateHistory, Wikimedia Commons

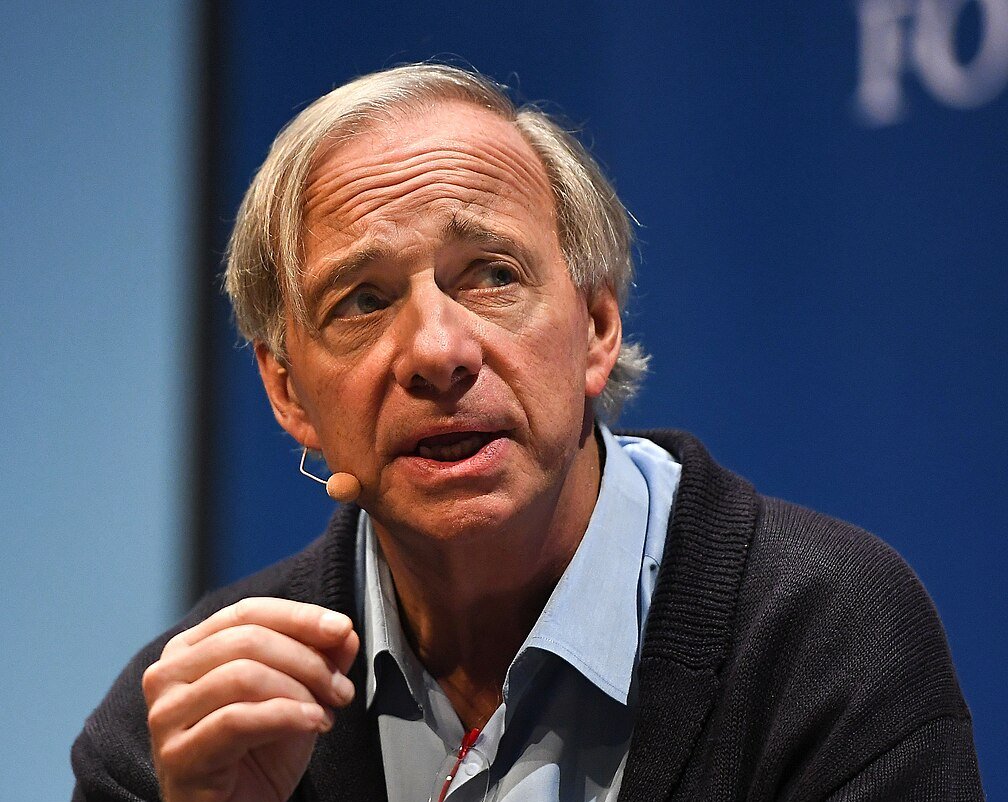

Focus On Cause And Effect

Ray Dalio, Chief Investment Officer of hedge-fund Bridgewater Associates, says that one should focus on cause and effect when it comes to investing. Work out what the effect will be of your money moves in the market, then invest in such a way as to minimize the negative effects and maximize the positives.

Web Summit, CC BY 2.0, Wikimedia Commons

Web Summit, CC BY 2.0, Wikimedia Commons

Conduct An Annual Subscription Audit

We're all subscribed to everything under the sun—between Netflix, Amazon Prime, Hulu, Paramount+, Sportsnet, and so on. We all know how much it costs us every month—or how much it cost us when we initially signed up for the service, but is it possible that you're subscribed to too many streaming services? Canadian finance guru Preet Banerjee tells us to conduct an annual subscription audit and cut out what we don't use to save money.

Own Your Own Happiness First

Personal finance expert Melissa Leong tells us that the old adage of "money can't buy happiness" is true. Before money can make you happy, you have to be happy within yourself. Money might be a means to an end, but you need to spend consciously and really think about how you're spending your money. Are you buying things that'll really make you happy? Or are you just spending frivolously?

Automation Is Key To Saving

The CEO of Credit Canada, Bruce Sellery, says that automation is the key to good savings habits. We all know that if you have to think about saving, chances are you probably won't. Creating an automated rule within your banking app that will transfer money into a savings account without you needing to lift a finger will mean that you don't notice that small amount going into a savings account every month, until suddenly you've reached your savings goals.

Use Tech To Help You Analyze Your Savings And Spending

There are all kinds of budgeting apps out there. These can be very useful in creating a budget that's easily accessible at a glance. Or, you can use apps like STASH to automatically set aside a little money each month, after the app automatically analyzes your spending patterns and pulls money from what's left-over each month. Using technology to help you make money moves based on data is excellent advice from consumer expert, Andrea Woroch.

Start Saving Young

Even if you're no spring chicken anymore, the best day to start saving is today. But, if you have children, wealth management expert Kate Ryan says it's best to teach them the importance of saving at a young age. Teach them about the importance of compound interest, which can make $100-a-month contributions into a savings account into a $48,000 balance after 40 years. That becomes $186,000 with an annual 6% return.

Invest A Small Salary Amount Into A Portfolio

You don't need a complex portfolio to make money. What's important is that you regularly contribute to it. Here's another way that automation can help—set aside 15% of your salary every paycheck into a simple portfolio, like an index fund, and watch it grow. This advice comes from investment guru William Bernstein.

Don't Increase Spending After A Raise

After you've received a raise, it can be easy to increase your spending because you have the extra money to do so. But by keeping your spending levels the same, you'll actually be paying yourself first (one of the golden rules of investment) and increasing your saving capability. Chad Risxe, founder of Millennial Wealth, says it's important to maintain your spending levels, even though you've received a raise.

Keep Track Of Your Credit Report

One of the most important aspects of your financial life is your credit report. But you'd be amazed at how many people don't actually keep track of their credit report and/or credit rating. Personal finance expert Mark Fidelman says that maintaining a close eye on your credit report will undoubtedly serve you well throughout life, as you're able to see in real-time if your credit is good, or where it could use improvement.

Maximize Loyalty Programs

While loyalty programs are undoubtedly a way to get people buying into more credit cards, they're not a huge scam that's worth nothing. By using credit cards that provide loyalty points, you can use these to pay for flights, vacations, groceries and more, all the while paying off your credit card debt and maintaining a good credit score. This piece of advice is from Joe Cortez of NerdWallet.

Let Your Money Work For You

We're all used to working for our money, but what if you could make your money work for you? Having a savings account is all well and good, but that money's not really working for you, is it? Instead, explore your investment options with a 401(k), Roth IRA, real estate, or other investment options. Todd Kunsman, investment guru with Invested Wallet, advises you not just bank your money into a low-interest savings account.

Save Every $5 Bill

Breaking a five-dollar bill is much easier than breaking a $20, or a $50, right? Well, instead of breaking it—save it. Take every five-dollar bill you receive and put it in an envelope. You'll be amazed at how much you've saved after a year. And, because it's just $5, you won't notice it as much. This from Paris Chevalier, CFO at Xceed Financial Credit Union.

Continue To Enjoy The Little Things In Life

Life isn't all about money. Many finance gurus will tell you to cut out that morning coffee, or some other monthly expense that you really enjoy. But, life isn't all about money—and if that morning coffee at your favorite coffee shop brings you joy, then you should go for it. It's certainly possible to overspend, but those little expenses (in general) won't amount to much throughout your lifetime.

Beware Financial "Influencers"

The internet is amok with financial "influencers" all claiming to have the answers for your money problems. While much good financial advice can be gleaned from others, it's important to know when an influencer is trying to sell you a product, versus imparting decent, salient financial advice.

Should You Get A Financial Advisor?

While advice from finance gurus can be useful, they're often abstract concepts or methodologies that aren't always applicable to your particular financial situation. You don't need to be rich to have a financial advisor. While most financial advisors do charge a fee per consultation, their advice on your money can be invaluable. Here are a few reasons to seek the advice of a certified, licensed financial advisor.

Personalized Advice

Financial advisors will gather information about your personal financial situation in order to make your money work for you. They'll then be able to offer you personalized financial advice that's specifically tailored to your current financial situation and future financial goals.

Another Pair Of Eyes On Your Money

Particularly when we're in financial trouble, all we can see is the dollar signs—we're often not able to interpret our financial data correctly, or use the information in a productive way. By having a financial advisor to provide you with an outside perspective on your money and advice on where you're going wrong, so you can break the rut you're in and take a step back.

Better Financial Outcomes

Individuals managing their own investments is great for control over your money, but slightly misses the point of investments—to make money passively. By using a financial advisor, you could have better financial outcomes. A VanGuard study discovered that those with a financial advisor received an 8% higher annualized growth rate over 25 years, than those without.

They Can Aid With Retirement Planning And Ensuring Financial Stability

As you reach retirement, the very last thing you want to be worrying about is money. By having a financial advisor, you'll get advice on the best money management options for your retirement funds and get help achieving long-term financial stability, even as you enter the golden years. By taking the pressure off, you can enjoy retirement even more.

Access To The Experts

Financial advisors don't just have the education in finance, they also have the experience of working with clients from every walk of life and financial situation imaginable and helping them turn their rags into riches. By working with a financial advisor, you're using their expertise and experience to better your own financial situation—that's something you can't replace, no matter how many YouTube videos you watch from finance gurus, or books you read on good money management.

Which piece of financial advice from these gurus have you used? Which has served you the best in your life? Do you have any other pieces of financial advice that you'd like to share? Hit up the comments with all your money-making tips.