Creating Wealth Even In The Downtimes

As interest rates dip, protecting your savings becomes more of a necessity. In these unpredictable times, these 25 shifts in strategy can safeguard your wealth.

Why Do Interest Rates Dip In The First Place?

Dips occur when central banks, like the Federal Reserve, aim to boost economic activity. Slower growth, low inflation, or financial crises often trigger these cuts, making borrowing cheaper to encourage spending. Global instability and government policies also play a role since they ensure markets remain stable for investment and growth.

Diversify Your Investment Portfolio

You hear this every day, but what does it mean to diversify? For one, getting a portfolio of stocks, bonds, real estate, and other assets helps you weather economic storms. By spreading your investments across various sectors, you’ll ensure that a downturn in one area doesn’t leave you empty-handed.

Consider Short-Term Bonds For Stable Returns

Short-term bonds are less affected by rate changes than long-term ones, but they still carry some risk. While they provide predictable returns, falling interest rates can make them less attractive over time. For balance, consider a mix of short- and long-term bonds to hedge against fluctuating rates while maintaining stability.

Focus On Dividend-Paying Stocks

Think of dividends as extra bonuses that keep on giving. These stocks provide consistent income streams through regular dividends, even when market conditions aren’t ideal. You’ll want to target companies with solid histories of paying dividends, as these stocks can still outperform low-interest savings accounts.

Invest In Real Estate For Cash Flow

Real estate offers more than just appreciation; it’s an excellent source of cash flow. Real estate can generate passive income via rental properties or REITs (Real Estate Investment Trusts). With rates declining, the mortgage cost becomes more manageable for investors. Rentals, in particular, give you that sweet recurring income.

Use Tax-Advantaged Retirement Accounts

Retirement accounts—IRAs and 401(k)s—become even more potent here. Why? They’re tax-advantaged accounts that allow you to grow your savings without worrying about taxes nibbling your returns. In fact, contributing the maximum to your 401(k) could shield your wealth from inflation’s bite. Let the taxman work for you.

Build An Emergency Fund In Liquid Assets

An emergency fund is essential because it becomes a lifeline when expenses suddenly rise. Cash, or liquid assets, are ideal for this because you can get to them without penalties or delays. Aim for at least three to six months’ worth of living expenses. An emergency fund is your umbrella.

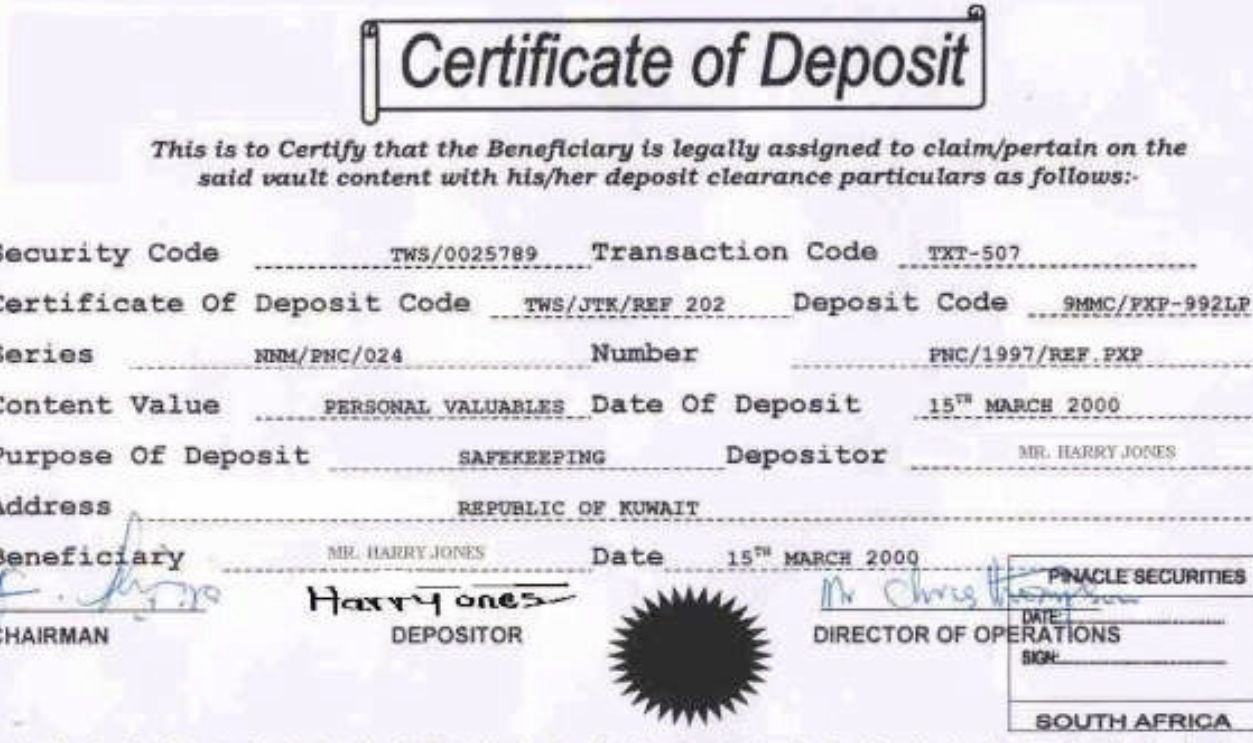

Consider Laddering Certificates Of Deposit

CD laddering is like building a safety net for your savings. By opening multiple CDs with varying terms, you’ll spread the risk of falling interest rates. As each CD matures, you can either reinvest or use the funds, ensuring that your savings grow consistently over time with less risk.

Anila annie 22, CC BY-SA 4.0, Wikimedia Commons

Anila annie 22, CC BY-SA 4.0, Wikimedia Commons

Explore Treasury Inflation-Protected Securities (TIPS)

TIPS are government-backed bonds designed to protect your savings from inflation. Their principal value increases with inflation to ensure your money keeps pace with rising prices. They’re an excellent hedge when interest rates fall, as they offer the dual benefit of safety and protection against inflation.

Invest In Gold For A Hedge Against Inflation

Gold is often seen as a safe haven, but it’s not a guarantee. While it can hold its value during inflation, its price fluctuates and doesn’t generate passive income. Instead of going all-in, consider gold as part of a broader diversification strategy and pair it with other inflation-resistant assets.

Seek Out Alternative Investments Like Art And Collectibles

Alternative investments, including art and rare collectibles like minerals and gems, offer a unique way to grow wealth in a low-interest-rate environment. These investments typically aren’t tied to traditional financial markets, and this provides diversification and potential for value appreciation, often outpacing inflation in the long run.

Refinance Existing Debt To Lower Rates

Refinancing existing loans is a smart way to take advantage of falling interest rates. Whether it’s a mortgage, car loan, business loan, or student debt, refinancing can lower your monthly payments. It frees up more cash that can be used to grow your savings or invest in higher-yield opportunities.

Rebalance Your Portfolio To Maintain Growth Potential

Once you diversify, rebalance your https://www.moneymade.com/investing/the-3-must-dos-for-effective-investinginvestment portfolio when interest rates are dropping. By regularly checking and revising your asset allocation, you ensure you’re not too heavily weighted in one area, like bonds, which could lose value in a declining rate environment. It’s like tending to your garden. Trim accordingly.

Consider Municipal Bonds For Tax-Advantaged Returns

Municipal bonds offer tax advantages and relatively safe returns—ideal for those looking to protect their savings during low-interest-rate periods. Local governments issue these bonds and can provide both stable income and tax-free growth, of course, depending on the bond type and jurisdiction.

Explore Peer-to-Peer Lending For Higher Yields

Peer-to-peer (P2P) lending venues allow you to loan directly to individuals or companies in exchange for higher interest rates. While riskier than traditional investments, P2P lending offers the potential for higher returns—especially when banks are offering low yields due to falling interest rates.

Take Advantage Of No-Fee Investment Platforms

Many no-fee investment platforms allow you to grow your savings without being penalized by hefty management fees. These platforms often allow for various investments, from stocks to ETFs, and are great for maximizing your savings while minimizing costs during low-rate periods.

Use Dollar-Cost Averaging To Protect Against Volatility

Dollar-cost averaging (DCA) is a technique where you invest a fixed amount at routine intervals, regardless of market conditions. This approach can help you avoid buying at the wrong time and reduce the impact of market volatility. It’s a smart move when interest rates are falling.

Invest in International Markets For Growth

When domestic markets slow, global investments can provide fresh opportunities—but they come with added risks. Currency fluctuations, geopolitical instability, conflicts, and economic downturns in other regions can impact returns. To minimize risks, look for diversified international ETFs or mutual funds rather than putting all your eggs in one country's basket.

Switch To A Fixed-Rate Loan For Predictability

When interest rates are on the decline, locking in a fixed-rate loan may seem counterintuitive, but it offers predictability. Fixed-rate loans give you a stable monthly payment that won’t fluctuate, which is a great way to plan for the future without worrying about future rate hikes or declines.

Consider Robo-Advisors For Efficient Portfolio Management

Robo-advisors can automate investing and keep fees low, making them a great tool for hands-off investors. However, they follow algorithms, not intuition, and may not always react optimally to market swings. If using a robo-advisor, ensure its strategy aligns with your goals, and periodically review its allocations for necessary adjustments.

Invest In Consumer Staples For Stability

Consumer staples tend to perform well in shaky markets. Why? Economic downturns positively impact food, beverage, and household goods companies because people still need these products, regardless of market conditions. These stocks can provide a steady income and a hedge against falling rates.

Keep Debt To A Minimum To Increase Financial Flexibility

When interest rates are falling, it’s an excellent time to focus on reducing high-interest debt. The less you owe, the more freedom you have to invest your savings elsewhere. You can build wealth by paying off debt aggressively without being bogged down by loan payments.

Look Into Socially Responsible Investments

Socially responsible investments (SRIs) are a way of investing with a conscience that is gaining momentum. These allow you to grow your wealth while supporting ethical companies and causes. SRIs can offer solid returns and diversify while aligning with your values. These investments consider environmental, social, and governance factors.

Reinvest Earnings To Leverage Compound Growth

Compound growth is the secret sauce for long-term wealth building, significantly when rates are declining. You let your money grow exponentially over time by reinvesting your earnings—whether from stocks, bonds, EFTs, or dividends. The longer you let it compound, the greater your returns will be.

Maximize Contributions To High-Yield Savings Accounts

These savings accounts can still be useful when interests drop, but keep in mind that their yields will likely decline, too. While they offer a safer place to park cash, don’t expect rapid growth. To maximize returns, compare rates, consider online banks with fewer fees, and explore other fixed-rate options.