Smart Moves

Money talks, but most of us don't speak its language fluently. However, when it comes to well-to-do folks, they make their money work harder for them through these deliberate strategies that anyone can learn.

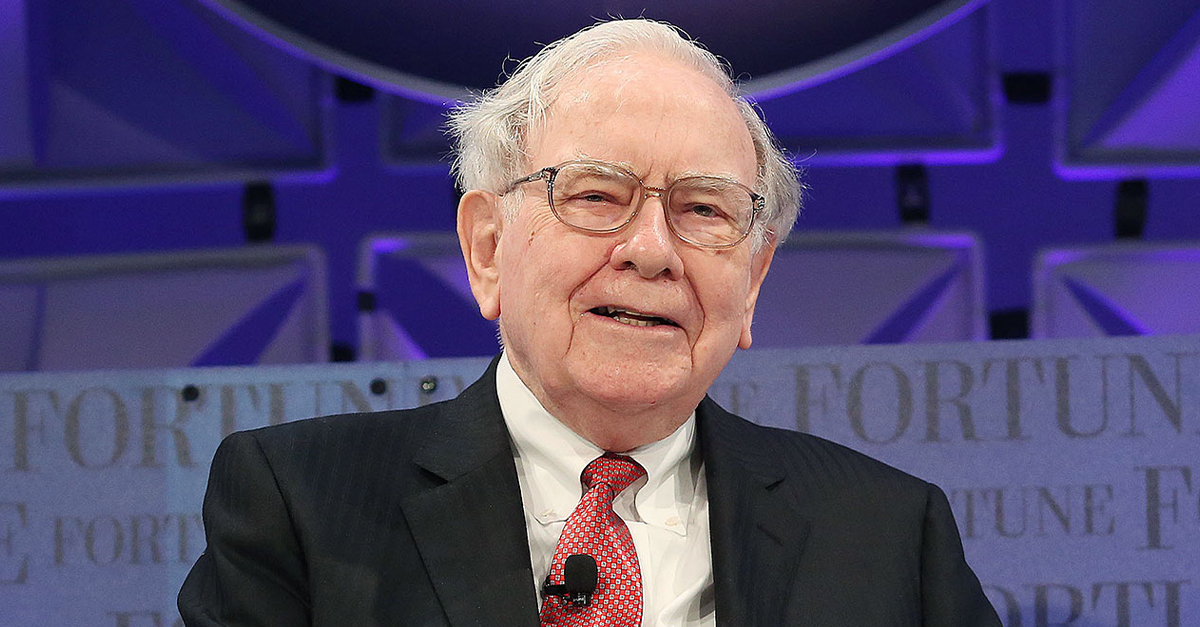

Diversify Investments

Warren Buffett once referred to diversification as “protection against ignorance”. However, he still diversifies Berkshire Hathaway's holdings. During the 2008 financial crisis, an all-stock portfolio lost over 50%, while a standard 60/40 stock-bond mix decreased by only 20%.

Diversify Investments (Cont.)

So, here is the most compelling reason for spreading your investments. The main goal is to reduce risk, particularly asset-specific risks while maintaining potential returns through a balanced approach. By including different types of investments, you can benefit from their varying performance in different conditions.

Focus On Growth Assets

The wealthy rarely waste money on depreciating toys. They're too busy buying things that grow in value. New cars lose roughly 20–30% of their value in the first year alone. Meanwhile, since 1926, large-company stocks have delivered an average annual return of around 10%.

Focus On Growth Assets (Cont.)

Note that focusing on growth assets is a strategic investment approach that targets companies expected to grow at an above-average rate. This is in comparison to their industry or the overall market. Growth companies usually operate in sectors with strong future earnings potential.

Leverage Equity Investments

Leverage refers to the utilization of debt or borrowed funds to finance investment activities. Investors use leverage to uplift their potential returns by investing more money than they possess. This can be achieved through financial instruments such as margin accounts, options, and futures contracts.

Leverage Equity Investments (Cont.)

Despite crashes, corrections, and bear markets, the S&P 500 has delivered positive returns in 40 of the last 50 years. Interestingly, the average millionaire holds between 45–55% of their portfolio in equities. This is because stocks have outperformed other asset classes over periods exceeding 15 years.

Invest In Retirement Accounts

Did you know that approximately 80% of millionaires maximize their retirement account contributions yearly? There's good reason. These accounts provide what amounts to "free money" through tax advantages. Investing in retirement accounts is a critical strategy for securing financial stability during retirement.

Invest In Retirement Accounts (Cont.)

Retirement accounts come with another hidden advantage. That is protection from lawsuits and creditors in many states. The power of tax-deferred compounding is astonishing. Consider identical investments earning 8% annually: after 30 years, a tax-advantaged account could contain up to 40% more money than a taxable account.

Vitalii Vodolazskyi, Shutterstock

Vitalii Vodolazskyi, Shutterstock

Reinvest Earnings

Here’s something intriguing. The richest woman in the world, L'Oreal heiress Francoise Bettencourt Meyers, built her $100+ billion fortune largely through reinvested dividends from a single company over 70+ years. After all, compound interest has been called the "eighth wonder of the world". Palmares des Prix scientifiques | Fondation Bettencourt Schueller 2020 by Fondation Bettencourt Schueller

Palmares des Prix scientifiques | Fondation Bettencourt Schueller 2020 by Fondation Bettencourt Schueller

Reinvest Earnings (Cont.)

Reinvesting your earnings is a smart way to increase your investments. It means taking the profits, dividends, or capital gains you’ve made from an investment and using that money to buy more of the same investment. This approach can enhance wealth accumulation over time through compounding.

Create Multiple Income Streams

Most wealthy people don't rely on just one paycheck. They build many ways to make money at the same time. Think of income like streams feeding into a river. The more streams you have, the stronger your financial river becomes.

Create Multiple Income Streams (Cont.)

A study by IRS data analysts found that the average millionaire has at least seven different income sources. These include a day job, side business, rental properties, dividends from stocks, interest from bonds, royalties from creative work, or consulting fees.

Build Passive Income

What if money worked for you instead of you working for money? That's exactly what passive income is. Earnings that require little or no daily effort to maintain. While most people trade time for money, passive income continues whether you're working, sleeping, or on vacation.

Build Passive Income (Cont.)

Robert Kiyosaki calls this “making money work for you”. Popular passive income sources include dividend-paying stocks, bonds, rental properties, business investments, and royalties. The best part is that such income is scalable. There’s virtually no limit to how many passive income sources you can build over time.

Eliminate Debt

High-interest debt often acts like a hole in your financial bucket. No matter how much you pour in, wealth leaks out through interest payments. The average credit card charges around 18% interest annually, while the stock market historically returns about 10%.

Eliminate Debt (Cont.)

This negative 8% gap makes building wealth nearly impossible while carrying consumer debt. Don't forget to prioritize paying off the debts with the highest interest rates first, while only making the bare minimum on the others. This method reduces the overall interest paid over time, saving money in the long run.

Save Before Spending

To "Pay yourself first" could be the most potent wealth-building habit. While many individuals save whatever's left after spending, intelligent, wealthy people reverse this process. They immediately set aside money for investments when income arrives and then live on what remains.

Save Before Spending (Cont.)

This psychological trick makes saving automatic rather than optional. Even saving just 10% of income consistently creates substantial wealth over time. You can make use of guidelines like the 80/20 rule, where 20% of income is saved, and 80% is allocated for expenses.

Adopt A Growth Mindset

Possessing a growth mindset is believing that with practice and hard work, you can improve your intelligence and acquire new talents. Studies show that the richest 1% read an average of 24 books per year, while the average American reads just 4.

Adopt A Growth Mindset (Cont.)

They're constantly learning through books, podcasts, courses, and conversations with other successful people. Originally introduced by psychologist Carol Dweck, this mindset contrasts with a fixed mindset, which assumes that qualities are innate and unchangeable. Learn to treat failures as valuable lessons, too.

Set Long-Term Goals

Most of us think about next month. But the rich think about the next decade. Long-term goal setting draws a roadmap for building wealth that guides daily decisions. Neuroscience research has found that having clear, written goals activates the conscious and subconscious parts of your brain.

Set Long-Term Goals (Cont.)

Divide your long-term goals into tinier, manageable steps or milestones. For example, if your goal is to become a department director in 10 years, milestones might include completing leadership training in 2 years and managing larger teams in 5 years. Track progress regularly.

Invest In Real Estate

Land—they're not making any more of it. This simple fact helps explain why real estate has created more millionaires than perhaps any other investment. Unlike stocks that exist only on paper, real estate gives you something you can see and touch while providing multiple ways to profit.

Invest In Real Estate (Cont.)

You can collect money through monthly rental income, property value growth over time, mortgage paydown by tenants, and tax advantages that shelter other income. Even during the 2008 housing crash, investors who held properties long-term eventually recovered and prospered. Always look for properties in growing areas.

Limit Spending

“Don't save what's left after spending; spend what's left after saving”. This Warren Buffett quote highlights how wealthy people approach money. A famous study in "The Millionaire Next Door" showed that most American millionaires buy used cars, live in middle-class neighborhoods, and rarely purchase luxury items.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

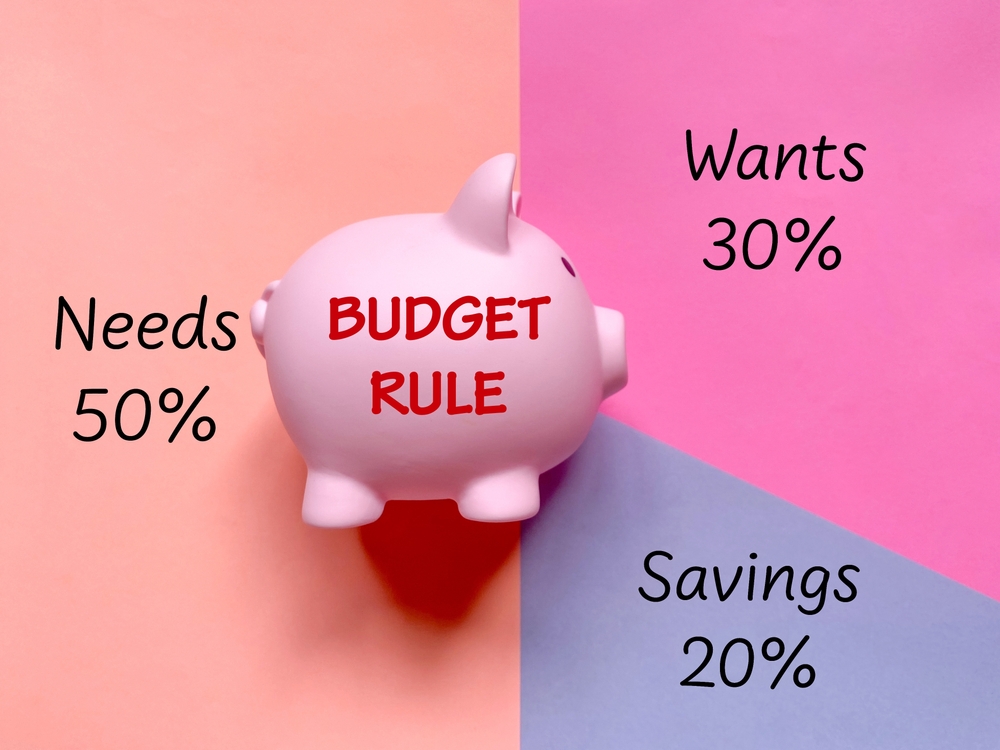

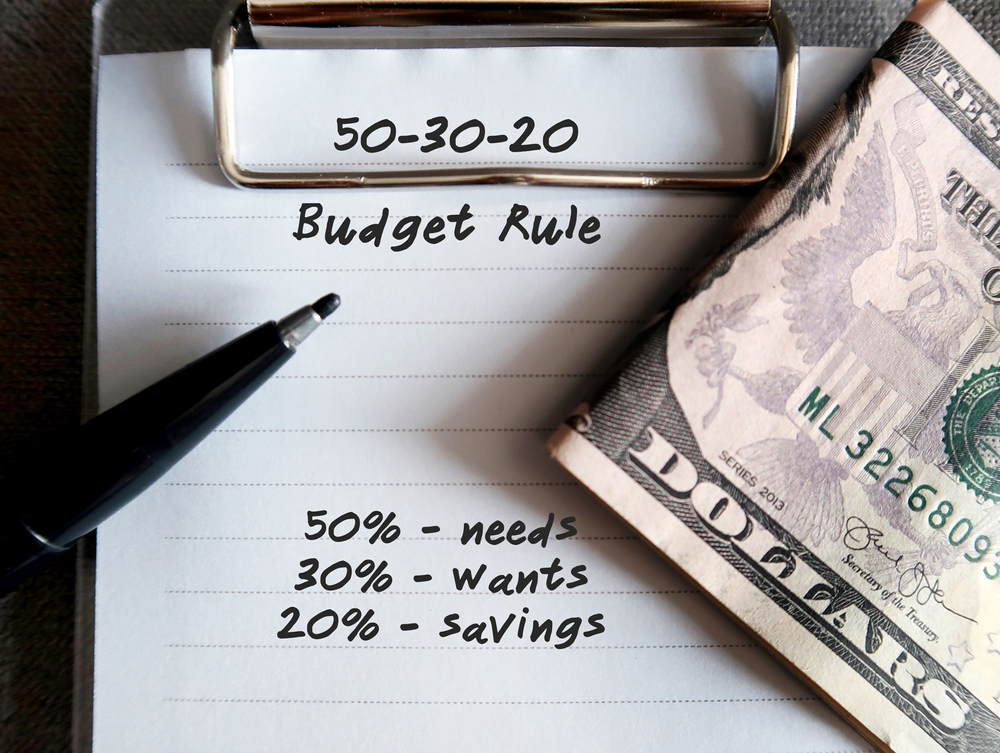

Limit Spending (Cont.)

They follow the 24-hour rule of waiting a full day before making any non-essential purchase over $100. This simple habit prevents impulse buying. One popular budgeting technique is the 50/30/20 rule. Here, 50% is for needs, 30% for wants, and 20% for savings.

Avoid Overleveraging In Real Estate

Now, too much of a good thing can be dangerous, especially when using borrowed money to buy property. While reasonable mortgage debt can amplify returns, taking on excessive real estate debt has reportedly bankrupted countless would-be real estate moguls.

Avoid Overleveraging In Real Estate (Cont.)

The 1% rule suggests monthly rent should be at least 1% of the purchase price (a $200,000 property should generate at least $2,000 monthly rent). Another way is maintaining a debt service coverage ratio above 1.25, meaning the property generates 25% more income than needed.

Preserve Wealth

Getting rich is one challenge, but staying rich is another. Preserving wealth is an important part of financial management that involves protecting your assets from loss while ensuring they grow over time. Insurance is key, as almost all wealthy individuals carry substantial liability umbrella policies.

Preserve Wealth

They also use estate planning tools like trusts to protect assets for future generations. Investment conservation becomes increasingly important as wealth grows. Many follow the "Rule of 100," wherein they subtract their age from 100 to determine their maximum stock market exposure percentage.

Start Businesses

Jeff Bezos, Elon Musk, Bill Gates. What do they have in common besides being among the world's richest people? They all built their fortunes through business ownership rather than working for others. IRS data tells us that business owners are four times more likely to become rich.

Start Businesses (Cont.)

Unlike a job with income limited by salary, business ownership offers unlimited upside potential. A landscaper making $50,000 yearly as an employee might earn $250,000 yearly with their own company and several crews. The business also builds value as a sellable asset.

Reinvest In Business Ventures

Successful businesses generate cash, but what you do with that money determines your long-term wealth. Some business owners reinvest earnings into their companies or new ventures rather than pulling profits to fund luxury lifestyles. Amazon famously reinvested nearly all its profits during its first 20 years.

Reinvest In Business Ventures (Cont.)

Reinvesting profits allows businesses to expand operations, improve infrastructure, or develop new products without incurring debt. This can lead to increased market share over time. "The fastest way to double your money is to fold it in half and put it back in your pocket," quips Will Rogers.

Stay Informed About The Markets

Imagine driving a car while wearing a blindfold. That's what uninformed investing looks like. Remove this blindfold by staying well-informed about economic trends, market conditions, and investment opportunities. A Spectrum Group study mentioned that affluent investors spend around 8–12 hours monthly researching investments and financial matters.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Stay Informed About The Markets (Cont.)

They track key economic indicators, such as GDP growth, unemployment rates, inflation, and interest rate trends. This information provides context for making smarter investment decisions. Websites like Investopedia provide educational content that can deepen your understanding of financial concepts.

Avoid Putting All Eggs In One Basket

Remember Enron employees who invested their entire retirement in company stock and then lost everything when the company collapsed? Their painful lesson shows us why concentration might make you rich, but diversification keeps you rich. Even seemingly "safe" investments can fail catastrophically.

Avoid Putting All Eggs in One Basket (Cont.)

Research from financial firm DALBAR shows that over-concentration in single investments is among the biggest wealth destroyers for average investors. For instance, from 1985 through 2023, the average equity fund investor earned over 10% less than the S&P 500 due to behavioral biases.

Seek Expert Advice

Even experts need experts. Those with exceptional financial knowledge often work with top financial advisors, accountants, attorneys, and other specialists. This seems counterintuitive until you consider the stakes involved. A single mistake in tax planning, estate structuring, or investment strategy can cost millions.

Seek Expert Advice (Cont.)

Advisors usually charge between 0.5% and 2% of the money they manage each year, or they might have flat rates for certain services. Look for certifications like CFP (Certified Financial Planner) or fiduciary status to ensure they are qualified and obligated to act as required.

Use Tax-Advantaged Accounts

The government provides legal "escape hatches" from taxes. They fall into two main categories: tax-deferred accounts (e.g., 401(k)s and traditional IRAs), where contributions made are pre-tax and taxes are deferred until withdrawal. Plus, tax-exempt accounts (e.g., Roth IRAs and Roth 401(k)s).

Use Tax-Advantaged Accounts (Cont.)

Here, contributions are made with after-tax dollars, but withdrawals are tax-free if rules are followed. Other examples include Health Savings Accounts (HSAs) for medical expenses, 529 Plans for education savings, and Flexible Spending Accounts (FSAs) for healthcare or dependent care costs.

Delay Gratification

According to the well-known Stanford marshmallow experiment, kids who could hold off on eating one marshmallow to get two later did better in life. This idea also applies to how people build their riches. Those who are financially successful tend to choose long-term security over quick rewards.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Delay Gratification (Cont.)

They understand that money spent today costs far more than just the dollar amount. It also costs all the future growth that money could have generated. Also, practicing delayed gratification fosters self-control and discipline, which are much-needed traits for good financial management.