Big Decisions, Bigger Losses

For some billionaires, success is temporary. One wrong move, one unexpected challenge, and everything built over the years can collapse overnight. These tales of loss remind us that no fortune is unshakable.

Elizabeth Holmes

Holmes promised to revolutionize healthcare with Theranos, a company once valued at $9 billion. At just 31, she was the world’s youngest self-made female billionaire. But it was all smoke and mirrors. In 2015, investigations revealed her blood-testing tech didn’t work. She then became a villain who traded boardrooms for a cell in 2022.

Tali Mackay, CC BY-SA 4.0, Wikimedia Commons

Tali Mackay, CC BY-SA 4.0, Wikimedia Commons

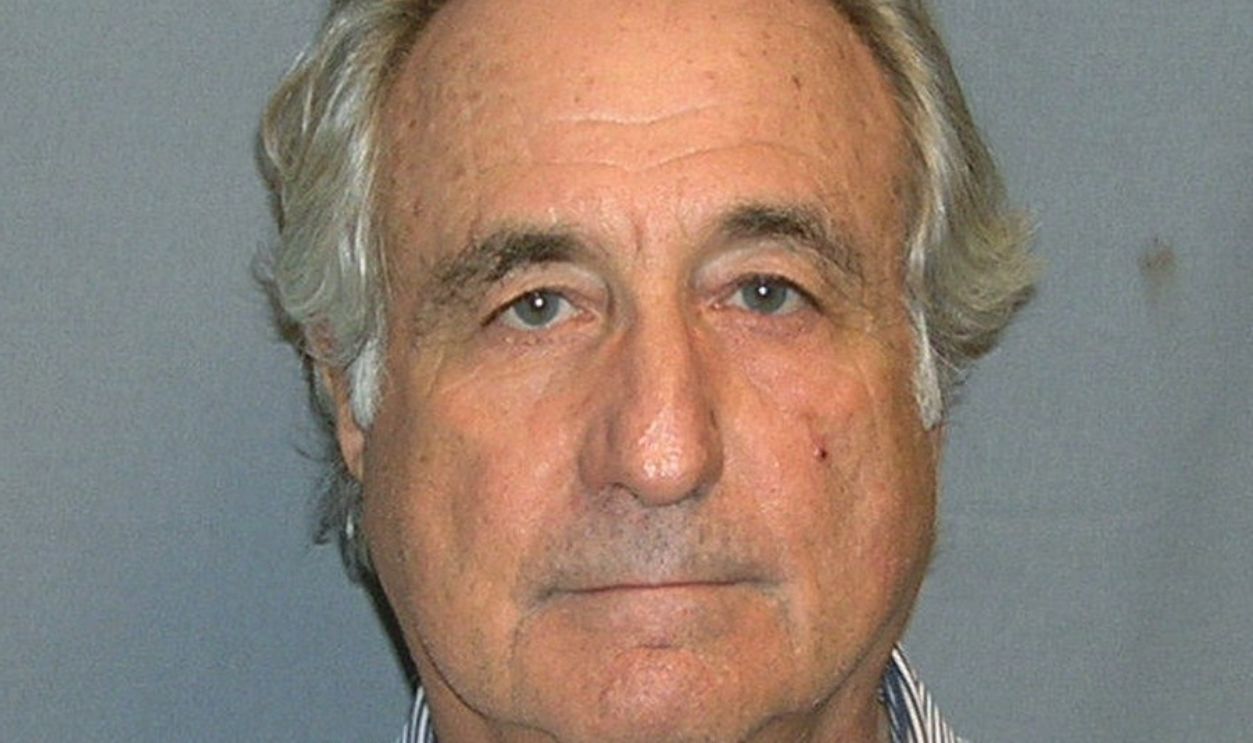

Bernie Madoff

More than a Wall Street player, Bernie Madoff was the master of the world's biggest Ponzi scheme. For decades, he duped investors out of $65 billion with promises of impossible returns. When his house of cards collapsed in 2008, Bernie's legacy became a 150-year sentence.

U.S. Department of Justice, Wikimedia Commons

U.S. Department of Justice, Wikimedia Commons

Vijay Mallya

Vijay Mallya lived like a king, but his debts ruled him. His Kingfisher Airlines collapsed under $1.3 billion of unpaid loans. As creditors circled, Vijay fled India in 2016, trading his luxurious lifestyle for a life dodging extradition in the UK courts.

Copyright World Economic Forum/Photo by Dana Smillie, CC BY-SA 2.0, Wikimedia Commons

Copyright World Economic Forum/Photo by Dana Smillie, CC BY-SA 2.0, Wikimedia Commons

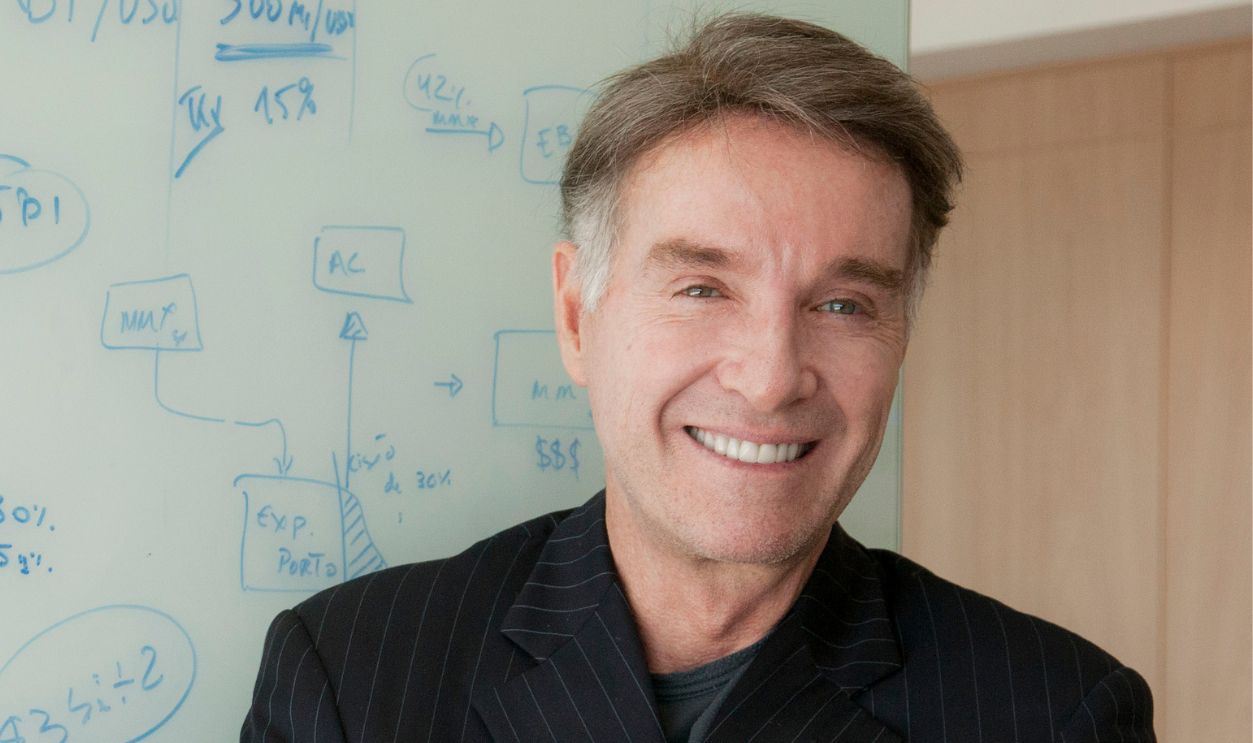

Eike Batista

Back in the day, Eike Batista was Brazil's golden boy with a net worth of $30 billion. He bragged about becoming the world's richest man. Then, his oil company, OGX, struck dry wells instead of black gold. By 2014, his empire crashed, and corruption charges kept him busy.

JulianaCoutinho, CC BY-SA 3.0, Wikimedia Commons

JulianaCoutinho, CC BY-SA 3.0, Wikimedia Commons

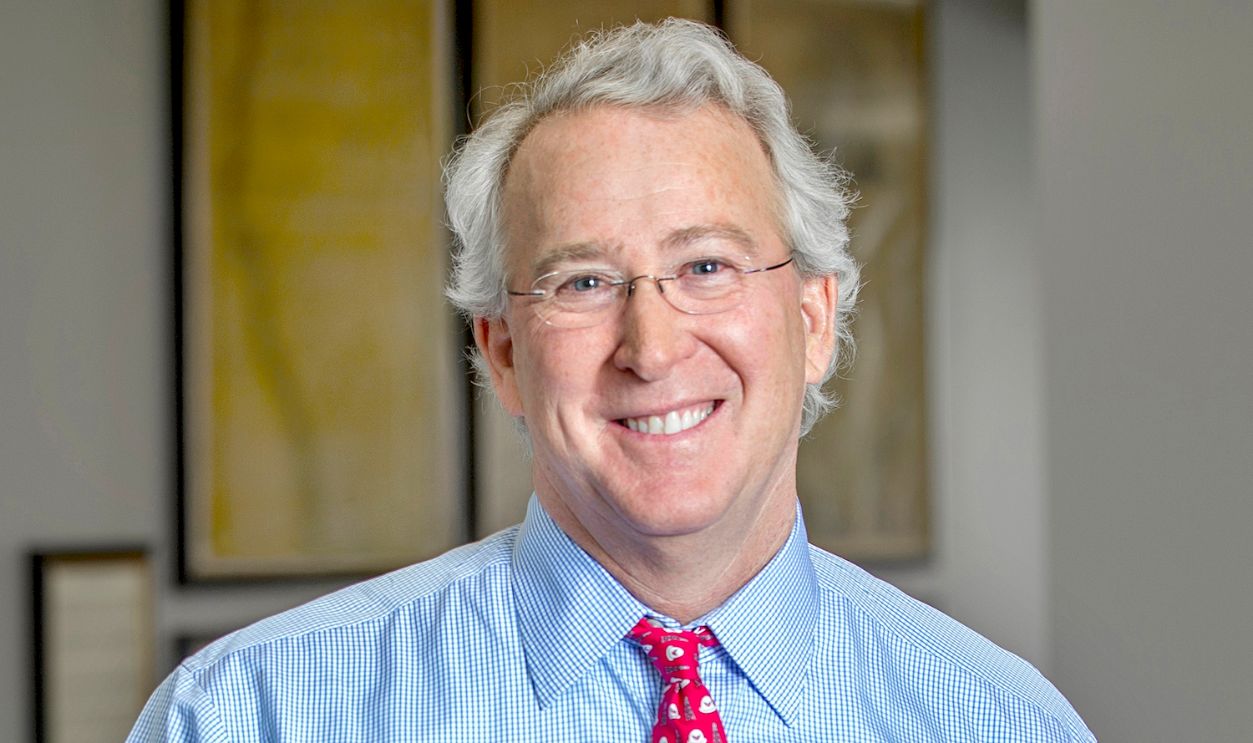

Aubrey McClendon

Aubrey McClendon built Chesapeake Energy into a natural gas juggernaut. However, his risky land-leasing deals and $1 billion personal debt caught up to him in 2016. He met a tragic end in a high-speed crash right after being indicted for bid-rigging—wealth went up in flames, just like his empire.

McNeese Studios, CC BY 3.0, Wikimedia Commons

McNeese Studios, CC BY 3.0, Wikimedia Commons

Robert Allen Stanford

Stanford styled himself as a Texan billionaire with a golden touch. Instead, his touch turned into a scam. His $7 billion Ponzi scheme through Stanford Financial Group unraveled in 2009. Investors lost everything, and Allen earned himself a cozy, 110-year vacation behind bars.

United States Marshals Service, Wikimedia Commons

United States Marshals Service, Wikimedia Commons

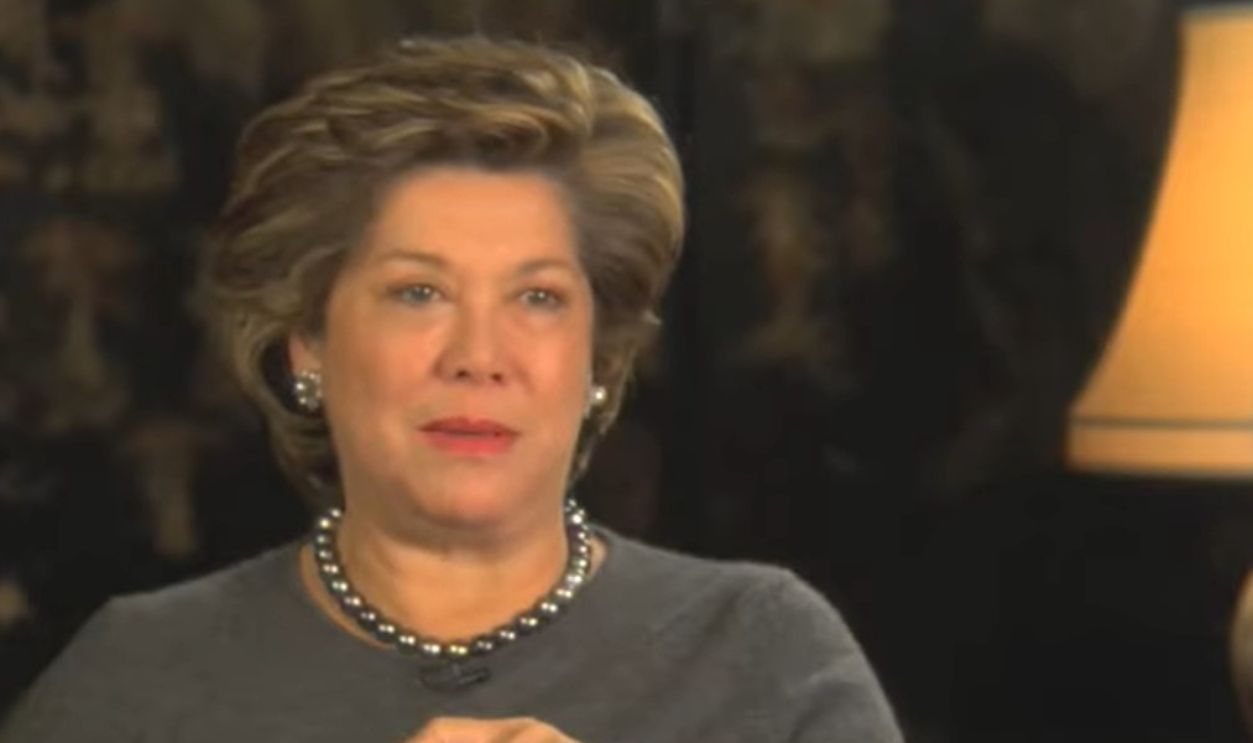

Patricia Kluge

Once a billionaire's wife, Patricia Kluge went from high society to high anxiety. After her divorce settlement made her fabulously wealthy, she poured millions into a luxury vineyard business. The market soured, and creditors closed in. By 2011, her fortune and 200-acre estate were gone with the wind.

Vladimir Gusinsky

Gusinsky built a media empire in Russia, but the news wasn't always good. His criticism of the Kremlin made him a target. When 2000 arrived, his property was seized, his networks shut down, and his billions were one. Gusinsky fled after learning that free press can cost you everything.

Anton Nossik, CC BY-SA 2.0, Wikimedia Commons

Anton Nossik, CC BY-SA 2.0, Wikimedia Commons

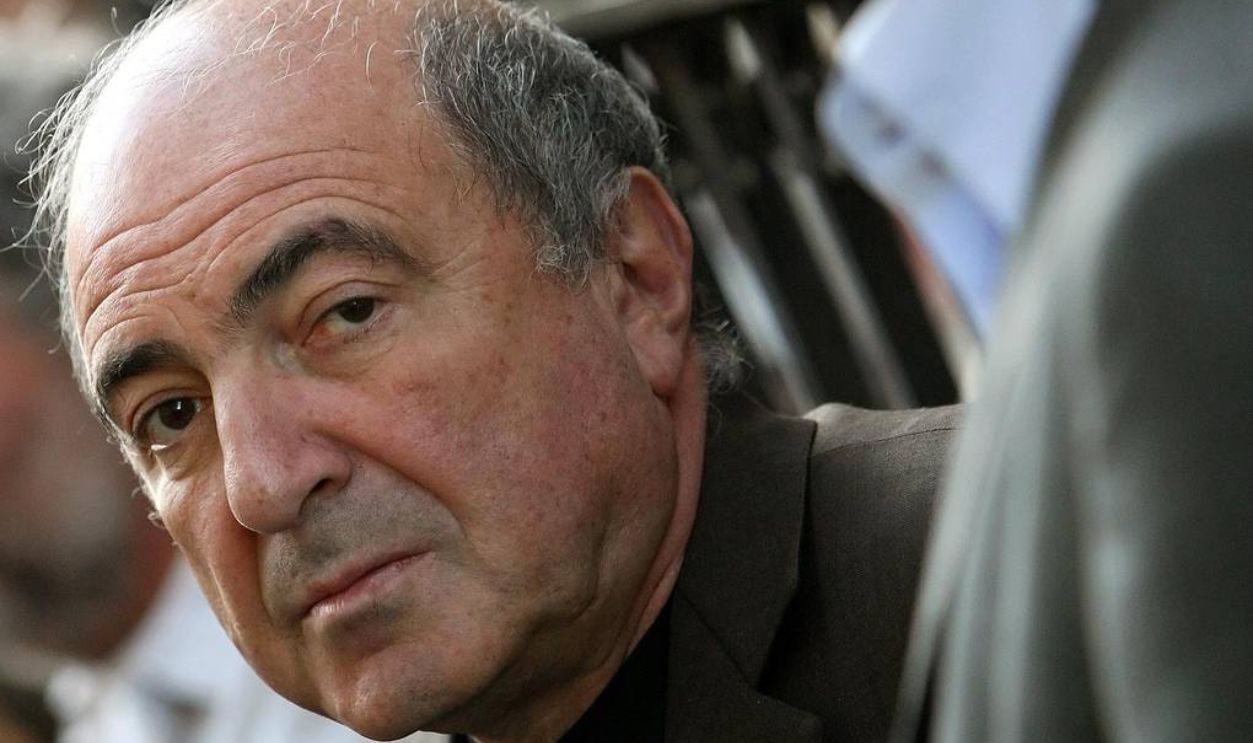

Boris Berezovsky

Here's another one from Russia. Former kingmaker and billionaire oligarch Boris Berezovsky was falling out with Vladimir Putin. It was a big mistake. Berezovsk's assets were grabbed, and his fortune disappeared in a mess of lawsuits and exile. The Boris empire was dust by 2013, hinting at what Russian politics can be like.

Boris Berezovsky by Lára Hanna Einarsdóttir

Boris Berezovsky by Lára Hanna Einarsdóttir

Bernie Ebbers

A hotel manager turned telecom titan, Bernie Ebbers ran WorldCom with swagger and spreadsheets. There was no need for him to do an $11 billion accounting scandal—the largest in U.S. history. But he did it and was sentenced to 25 years. Ebbers' billions went from boardroom to bust, sending him straight into disaster.

U.S. National Communications System, Wikimedia Commons

U.S. National Communications System, Wikimedia Commons

Sam Bankman-Fried

This is the story of a crypto king who became a courtroom regular. Sam Bankman-Fried was a crypto genius who promised to "fix finance." He had a $16 billion fortune, but only until 2022. After that year, his company got into a huge mess of embezzlement and missing funds—his net worth hit zero within days.

Cointelegraph, CC BY 3.0, Wikimedia Commons

Cointelegraph, CC BY 3.0, Wikimedia Commons

John Foley

John Foley pedaled Peloton from a startup to a $50 billion fitness phenomenon. Then reality set in: overproduction, plummeting demand, and tumbling shares. The fitness entrepreneur was out as CEO, and his success became a cautionary tale of spinning too hard, too fast.

TechCrunch, CC BY 2.0, Wikimedia Commons

TechCrunch, CC BY 2.0, Wikimedia Commons

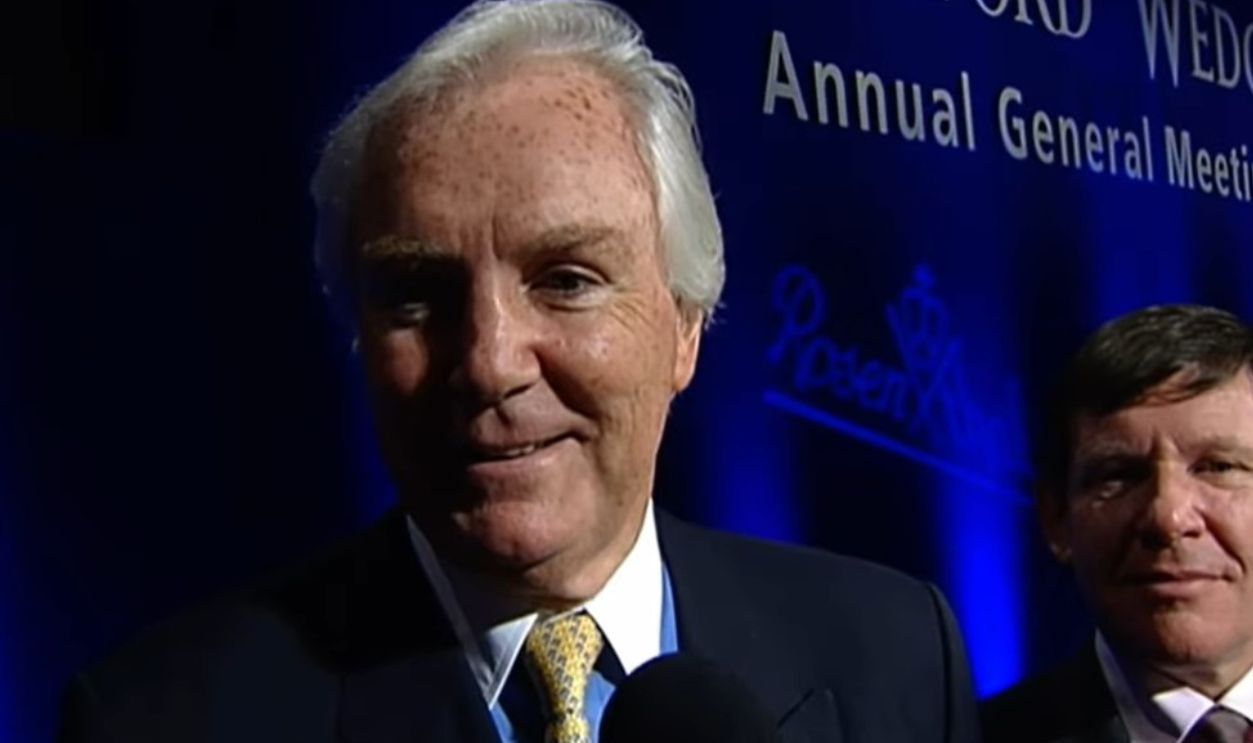

Anthony O'Reilly

A rugby legend and Heinz CEO, Anthony O'Reilly, spread his wealth across newspapers, oil, and real estate. Sadly, this man who made ketchup global couldn't keep his own finances from curdling. Bad bets and $1 billion in debt pulled him under in 2015. O'Reilly's lavish Irish estate was auctioned off, and bankruptcy loomed.

Tony O'Reilly's death announced on RTÉ News (18th May 2024) by Larry Wyse

Tony O'Reilly's death announced on RTÉ News (18th May 2024) by Larry Wyse

Jérôme Kerviel

A junior trader with big ambitions, Jérôme Kerviel, made high-stakes bets that no one knew about—soon, they unraveled. Kerviel's unauthorized trades cost Société Générale €4.9 billion in 2008. Fired, fined, and put behind bars, he discovered that one rogue move could bankrupt more than just a career.

Max malafosse, CC BY-SA 4.0, Wikimedia Commons

Max malafosse, CC BY-SA 4.0, Wikimedia Commons

Allen Iverson

$200 million in NBA earnings didn't last long when Allen Iverson started spending faster than he scored. Mansions, jewelry, and a 50-person entourage drained his fortune. In turn, he faced bankruptcy in 2012. His crossover was legendary, but financial discipline? Not so much.

Keith Allison, CC BY-SA 2.0, Wikimedia Commons

Keith Allison, CC BY-SA 2.0, Wikimedia Commons

Curt Schilling

World Series trophies don't guarantee business wins. Curt Schilling's $50 million bet on 38 Studios, his video game company, ended in disaster. He, too, went bankrupt, which shut down the dream. From hero on the mound to zero on the balance sheet, Schilling's strikeout was painful and public.

Curt Schilling's Dark Past Resurfaces Amid Recent Scandal by TYT Sports

Curt Schilling's Dark Past Resurfaces Amid Recent Scandal by TYT Sports

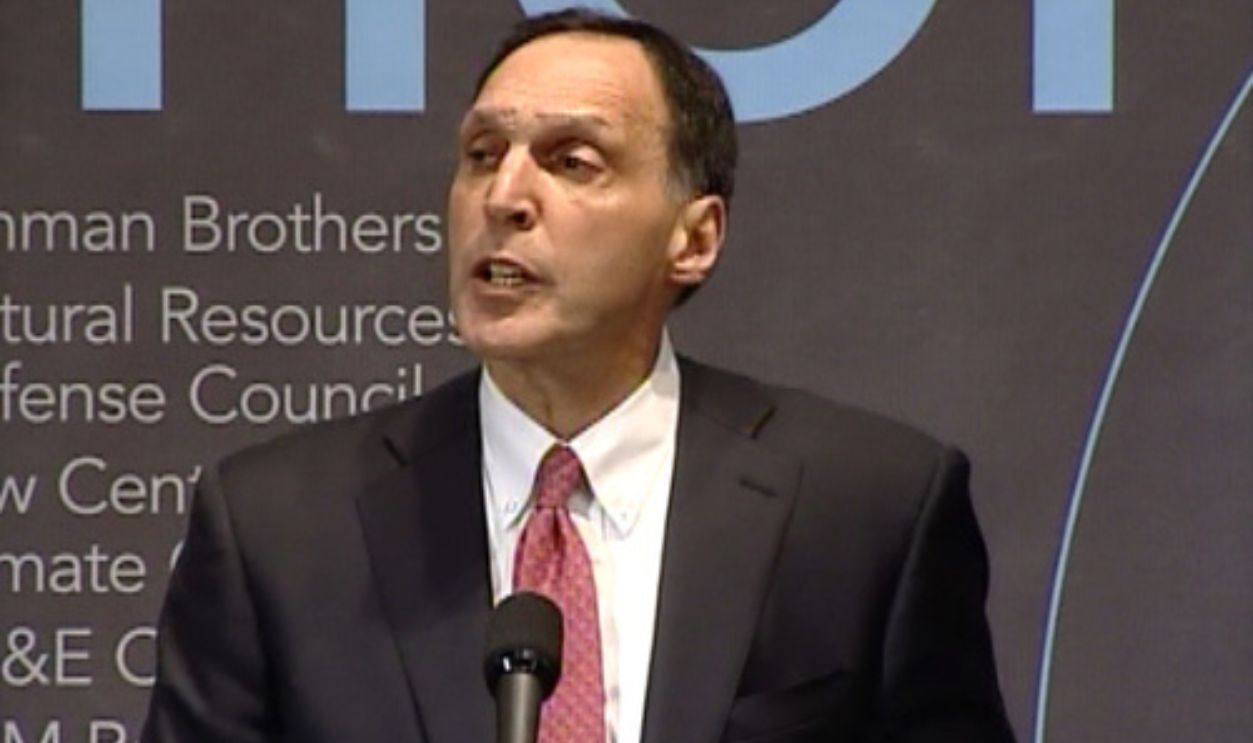

Richard S. Fuld Jr.

Richard S. Fuld Jr.’s decisions sealed Lehman Brothers’ fate. He ignored the looming disaster by betting big on unsafe mortgage assets, poor management decisions, and failed negotiations. In 2008, Lehman's $639 billion insolvency shattered global markets, costing up to $10 trillion—one of the biggest losses in history!

World Resources Institute Staff, CC BY 2.0, Wikimedia Commons

World Resources Institute Staff, CC BY 2.0, Wikimedia Commons

Vladimir Potanin

In 2022, Vladimir Potanin, Russia's second-richest man, faced a financial storm as sanctions froze assets like his $300 million yacht “Nirvana”. As Norilsk Nickel's largest shareholder, he took another hit when the company’s stock plummeted over 50%, shrinking his $27 billion net worth by $4.5 billion.

Kremlin.ru, CC BY 3.0, Wikimedia Commons

Kremlin.ru, CC BY 3.0, Wikimedia Commons

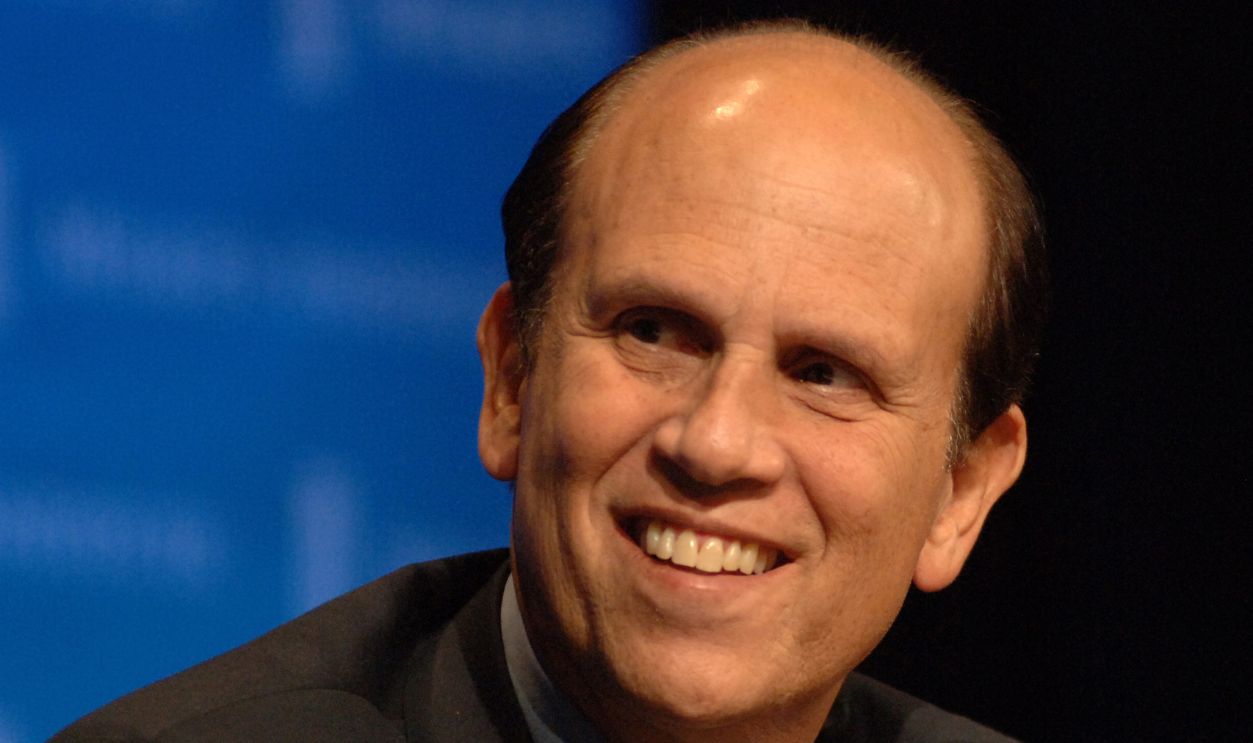

Michael Milken

In the 1980s, Michael Milken ruled Wall Street as the "Junk Bond King," with billions to his name. When his high-yield empire crumbled under securities violations charges, he paid $600 million in fines and invited 10 years of jail time. Once a financial genius, he became a cautionary tale of greed.

LarryWeisenberg, CC BY-SA 3.0, Wikimedia Commons

LarryWeisenberg, CC BY-SA 3.0, Wikimedia Commons

William Herbert Hunt

William Herbert Hunt and his brother tried to corner the silver market, inflating prices to $50 an ounce. When the bubble burst in 1980, and the prices plunged, they lost $1.7 billion. Their silver dreams turned to dust. It forced Hunt's glittering gamble into insolvency.

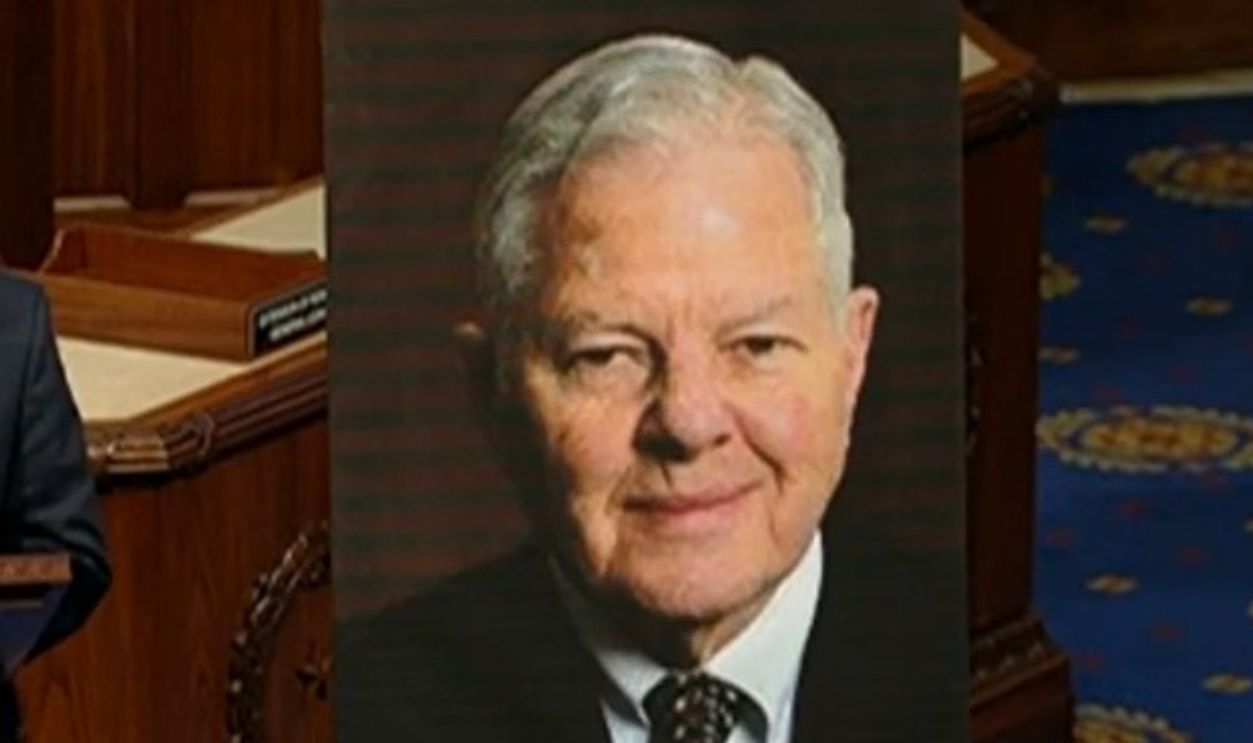

Rep. Carter Honors the Life of William Herbert Hunt by Congressman Buddy Carter

Rep. Carter Honors the Life of William Herbert Hunt by Congressman Buddy Carter

Jocelyn Wildenstein

A $2.5 billion divorce settlement put Jocelyn Wildenstein in the spotlight. But then, her passion for luxury—mansions, yachts, and endless cosmetic surgeries—drained her fortune. By 2018, debt papers replaced bank statements. Jocelyn's wealth disappeared, but her reputation for extravagant excess is still very much alive.

Naomi Campbell

Supermodel Naomi Campbell's runway to riches hit a snag when her charity, Fashion for Relief, was found spending donations on luxury hotels, spa treatments, and other personal extravagance. In 2024, the UK Charity Commission banned her from serving as a trustee for five years. Looks like philanthropy isn't always glamorous.

Jgro888, CC BY-SA 2.5, Wikimedia Commons

Jgro888, CC BY-SA 2.5, Wikimedia Commons

Raj Rajaratnam

As head of the Galleon Group hedge fund, Raj Rajaratnam played the markets with insider tips. Eventually, the SEC caught on in 2009, leading to his conviction for insider trading and an 11-year jail time. Raj lost his $1.8 billion fortune and sent a message that cheating the system isn't the best choice.

DigitasSL, CC BY 4.0, Wikimedia Commons

DigitasSL, CC BY 4.0, Wikimedia Commons

Jho Low

Malaysian financier Jho Low orchestrated the 1Malaysia Development Berhad scandal, embezzling $4.5 billion to fund a Hollywood lifestyle. When the scheme unraveled in 2015, it triggered global manhunts and asset seizures. Though still at large, like Vijay Mallya, his fortune disappeared—a vanishing act worthy of Hollywood itself.

Jho Low approached China’s elite to resolve 1MDB’s woes, book claims by Free Malaysia Today

Jho Low approached China’s elite to resolve 1MDB’s woes, book claims by Free Malaysia Today

Gigi Jordan

Gigi Jordan was a pharmaceutical millionaire whose life took a dark turn when she was convicted of manslaughter in her autistic son's death. She claimed it was an act of mercy to protect him from his biological father's exploitation. But courtroom battles drained her $56 million fortune, and she was later found dead in an apparent suicide.

Gigi Jordan on Her Son’s Safety: I Felt It Was Like a Ticking Time Bomb by Dr. Phil

Gigi Jordan on Her Son’s Safety: I Felt It Was Like a Ticking Time Bomb by Dr. Phil