Barbara Corcoran: From The Ground Up

Barbara Corcoran: From The Ground Up

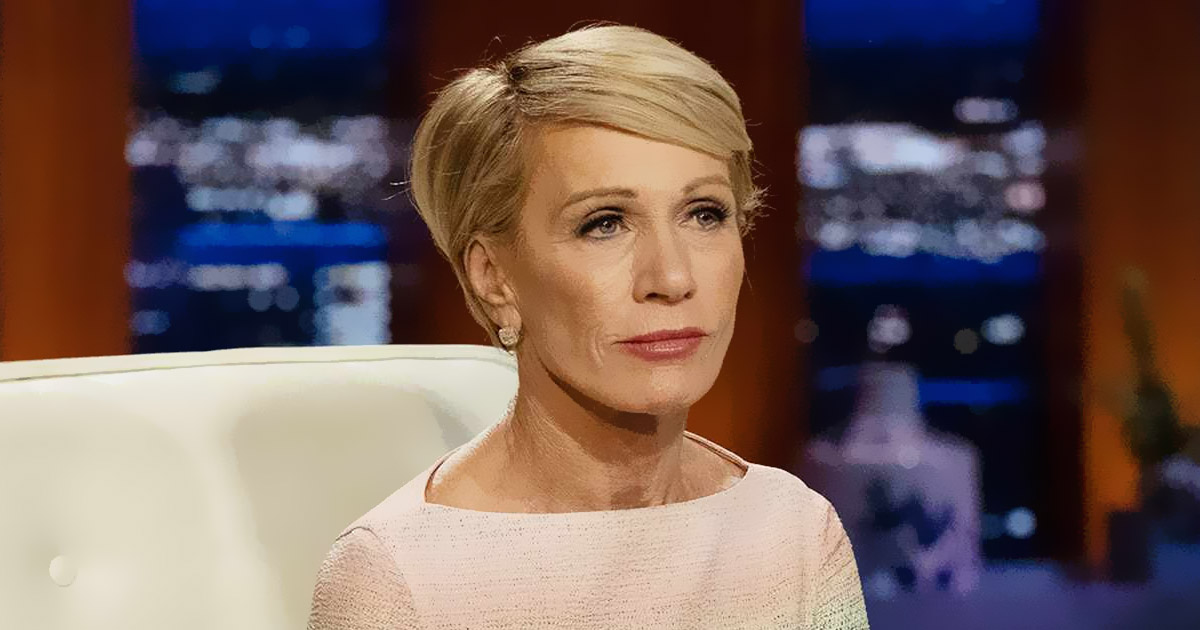

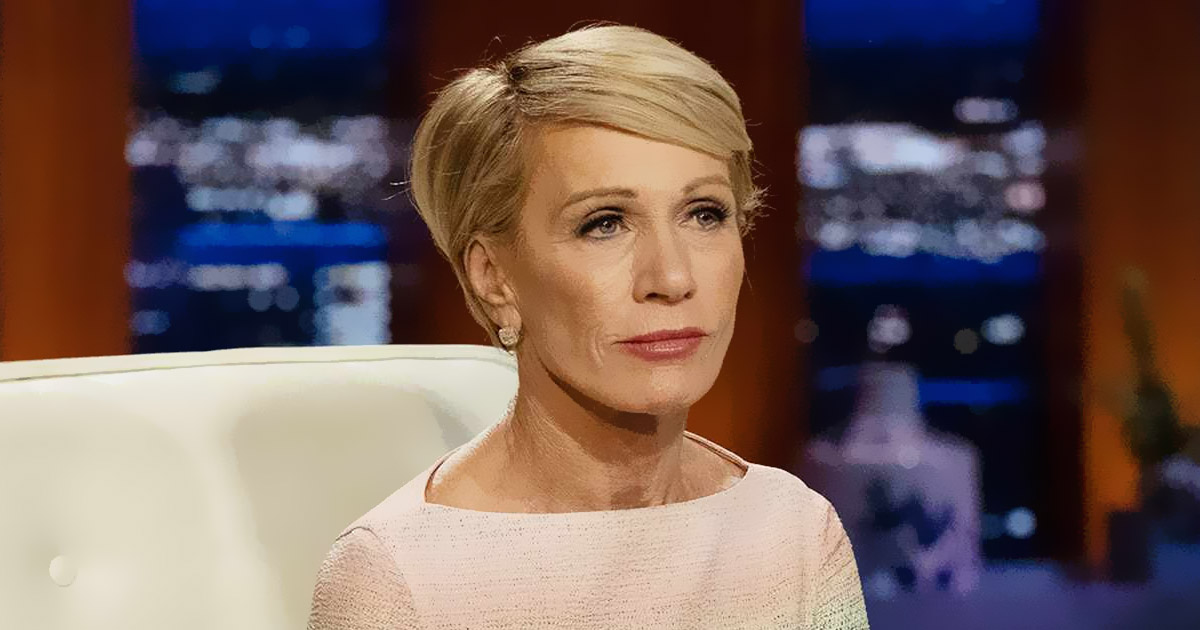

Barbara Corcoran is a successful entrepreneur and investor who is best known for her role as a "shark" on the hit television show Shark Tank. Here are some of the factors that have contributed to her success:

Entrepreneurial spirit

Corcoran has always had an entrepreneurial spirit, starting her first business at the age of 23 with a $1,000 loan from her boyfriend. She has a natural ability to identify opportunities and take risks, which has helped her build a successful career.

Marketing expertise

Corcoran is a master of marketing and branding, having built her real estate company into one of the most successful in New York City. She knows how to create a compelling message and connect with customers, which has helped her succeed in multiple ventures.

Resilience

Corcoran has faced numerous setbacks and failures throughout her career, but she has always bounced back with renewed determination. She sees failure as a learning opportunity and is not afraid to take risks and try new things.

Strategic partnerships

Corcoran has built strategic partnerships throughout her career, including with her ex-husband who helped her grow her real estate business. She also has a strong network of contacts in the business world, which has helped her succeed in a variety of ventures.

Positive attitude

Corcoran has a positive and energetic attitude that inspires others and helps her overcome challenges. She is always looking for ways to improve and grow, and she encourages others to do the same.

Overall, Barbara Corcoran's success story is a testament to her entrepreneurial spirit, marketing expertise, resilience, strategic partnerships, and positive attitude. She has built a successful career by taking risks, learning from failure, and always striving to improve.

READ MORE

Curious how your savings stack up? This article compares average savings in the U.S. and Canada, revealing surprising gaps, reasons behind them, and shocking stats about American savings.

A growing number of people are suddenly hearing about a $600 rule connected to Venmo and other cash apps, usually in the form of warnings, screenshots, or half-explained posts. There’s rarely context—just the implication that a normal year of payments may have crossed an invisible line with real consequences.

Do your sneakers cost more than your dinner payment? That's cute. Some of these kicks could pay your whole house’s mortgage.

Your cousins got their inheritance, but your mom is keeping yours—at age 40. Learn what rights you have and how to challenge unfair inheritance issues when a parent blocks your share.

When you posted a negative online review of a company's service, they published your contact information online and sent a cease-and-desist letter. We look at how you can protect yourself.

Car insurance has a funny way of becoming invisible. You sign up, set the payment to auto-draft, and then forget about it—until your bank account reminds you every month. The problem is that many drivers end up overpaying not because they’re reckless or unlucky, but because their policy hasn’t kept up with their life. If you’ve ever wondered whether your premium feels a little too spicy for what you’re getting, these signs will help you figure it out.

Disclaimer

The information on MoneyMade.com is intended to support financial literacy and should not be considered tax or legal advice. It is not meant to serve as a forecast, research report, or investment recommendation, nor should it be taken as an offer or solicitation to buy or sell any securities or adopt any particular investment strategy. All financial, tax, and legal decisions should be made with the help of a qualified professional. We do not guarantee the accuracy, timeliness, or outcomes associated with the use of this content.

Dear reader,

It’s true what they say: money makes the world go round. In order to succeed in this life, you need to have a good grasp of key financial concepts. That’s where Moneymade comes in. Our mission is to provide you with the best financial advice and information to help you navigate this ever-changing world. Sometimes, generating wealth just requires common sense. Don’t max out your credit card if you can’t afford the interest payments. Don’t overspend on Christmas shopping. When ordering gifts on Amazon, make sure you factor in taxes and shipping costs. If you need a new car, consider a model that’s easy to repair instead of an expensive BMW or Mercedes. Sometimes you dream vacation to Hawaii or the Bahamas just isn’t in the budget, but there may be more affordable all-inclusive hotels if you know where to look.

Looking for a new home? Make sure you get a mortgage rate that works for you. That means understanding the difference between fixed and variable interest rates. Whether you’re looking to learn how to make money, save money, or invest your money, our well-researched and insightful content will set you on the path to financial success. Passionate about mortgage rates, real estate, investing, saving, or anything money-related? Looking to learn how to generate wealth? Improve your life today with Moneymade. If you have any feedback for the MoneyMade team, please reach out to [email protected]. Thanks for your help!

Warmest regards,

The Moneymade team