Child Self-Made Millionaires

LIGHTFIELD STUDIOS, Adobe Stock

LIGHTFIELD STUDIOS, Adobe Stock

In a world where success is often measured by financial milestones, some extraordinary children have defied the odds to become self-made millionaires.

These young entrepreneurs and talents have achieved what many adults only dream of, and they've done it through their ingenuity, skills, and relentless dedication.

This article celebrates the top 12 child self-made millionaires who have earned their fortunes without relying on generational wealth.

1. Fraser Doherty - SuperJam

Fraser Doherty started his journey at the age of 14 using his grandmother's recipes to make homemade jam, which he named SuperJam.

He began selling his jams at farmers' markets and to local customers in Scotland. By 16, he had refined the recipes, making them 100% fruit.

His big break came when a major UK supermarket chain started stocking his products, turning him into a millionaire by the age of 19.

SuperJam has since become a global brand, renowned for its health benefits and natural ingredients.

2. Leanna Archer - Leanna Inc.

Leanna Archer began her entrepreneurial journey at just 9 years old by launching a haircare line based on her Haitian great-grandmother's natural recipes.

Her business, Leanna Inc., took off rapidly, and by the age of 17, she was earning over $100,000 annually, making her a self-made millionaire.

Her products, known for their natural ingredients and effectiveness, have gained a loyal customer base, and she has been recognized for her impressive business acumen at a young age.

3. Alina Morse - Zollipops Creator

At just 9 years old, Alina Morse invented Zollipops, a sugar-free, tooth-friendly lollipop.

Her company took off, and by the time she was 13, she had turned her sweet idea into a million-dollar business, being sold in thousands of stores across America.

4. Isabella Barrett - Entrepreneur and Reality TV Star

Isabella Barrett, a former reality TV star from 'Toddlers & Tiaras,' became a millionaire at 6 years old. She started her own jewelry and clothing lines, earning her millions in revenue and solidifying her place in the young entrepreneurial world.

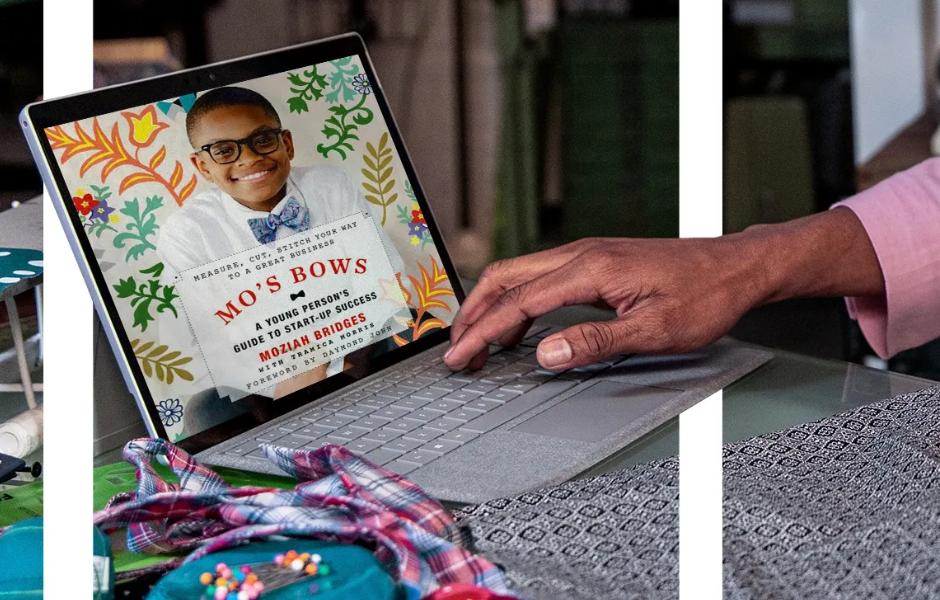

5. Moziah Bridges - Mo's Bows

Moziah Bridges started Mo's Bows at the age of 9, a company selling handcrafted bow ties.

His charming personality and business acumen landed him a spot on Shark Tank, and by age 15, Moziah had brought in over $1 million in sales.

6. Mikaila Ulmer - Me & the Bees Lemonade

At just 4 years old, Mikaila Ulmer started her lemonade business, Me & the Bees Lemonade, using her great-grandmother's recipe.

By the age of 13, she had secured a deal with Whole Foods worth $11 million, turning her lemonade stand into a thriving business.

7. Cory Nieves - Mr. Cory's Cookies

Cory Nieves founded Mr. Cory's Cookies at just 6 years old. His mission to make the world better with all-natural cookie recipes quickly turned into a profitable business, earning him widespread acclaim and substantial revenue by the time he was a teenager.

8. Ashley Qualls - WhateverLife .com

Ashley Qualls started her website, WhateverLife.com, at the age of 14 to provide free MySpace layouts. She quickly turned it into a lucrative business, drawing millions of visitors and generating substantial advertising revenue, making her a millionaire before she turned 18.

9. Benjamin Kickz - Sneaker Reseller

Benjamin Kickz, also known as Benjamin Kapelushnik, made a name for himself in the sneaker world by reselling limited-edition sneakers.

By the age of 16, he had turned his passion into a multi-million dollar business, dealing with celebrities and high-end clients.

10. Robert Nay - Bubble Ball App Creator

At just 14 years old, Robert Nay created the mobile game Bubble Ball, which quickly rose to the top of the Apple App Store charts.

With over 16 million downloads, his free app, developed in his bedroom, turned him into a millionaire.

11. Evan of EvanTubeHD

Evan, the young star behind EvanTubeHD, turned his love for toys and games into a YouTube empire.

By reviewing toys and games on his channel, he has amassed millions in revenue. At just 9 years old, Evan was reportedly earning $1.3 million a year.

12. Ryan Kaji of Ryan's World

Ryan Kaji started his YouTube channel at the age of 3, reviewing toys. His channel, formerly known as Ryan ToysReview, has grown into a multi-million-dollar enterprise, including TV shows, merchandise, and partnerships.

At 8 years old, Ryan reportedly earned $26 million in 2019 alone.

Final Thoughts

These inspiring stories of young millionaires prove that age is just a number when it comes to entrepreneurship and success. Their journeys are not only about financial gains but also about passion, innovation, and the courage to pursue dreams.

They serve as role models, showing that with creativity, hard work, and a bit of ingenuity, anyone, regardless of age, can achieve remarkable success.